Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Feb, 2025

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Surging revenue from asset management businesses appeared to lift the spirits of private equity's Big Four firms, which all set quarterly or annual records for fourth-quarter 2024 fee-related earnings.

The average sentiment score for the most recent batch of earnings calls by Blackstone Inc., Apollo Global Management Inc., KKR & Co. Inc. and The Carlyle Group Inc. nudged to its highest level in several years, according to an S&P Global Market Intelligence analysis of the language used by executives and analysts on the call. Another likely factor in the brighter tone was a broadly shared expectation of more M&A and IPO activity in 2025, which would give a boost to their private equity strategies.

Exits, in particular, are a top priority across the private equity industry. The middle market drove the increase in the monetization of portfolio company investments in 2024. Could the Big Four be more active in 2025?

Blackstone President Jonathan Gray said the outlook looks good.

"The environment is clearly here getting better," Gray said on the firm's Jan. 30 earnings call, citing a strong economy and healthy equity markets. "We think large, profitable companies can go public."

Read more about the most recent earnings season for private equity's Big Four.

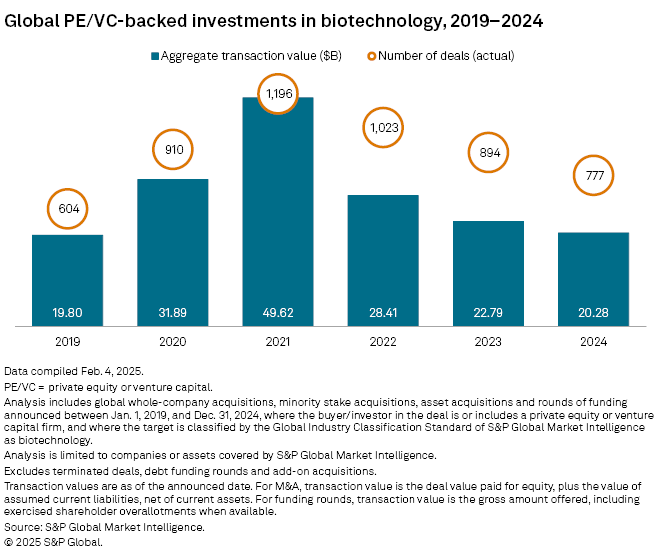

CHART OF THE WEEK: Biotech investments decline for 3rd consecutive year

⮞ Private equity- and venture capital-backed transactions in biotechnology declined for the third consecutive year in 2024 to $20.28 billion globally, down 11% from $22.79 billion in 2023, according to Market Intelligence data.

⮞ Deal values increased every quarter of 2024, indicating signs of a potential reversal.

⮞ Within the larger healthcare sector, biotechnology absorbed more private investment in 2024 than any other industry, except for pharmaceuticals.

TOP DEALS

– KKR & Co. Inc. completed the second stage of its two-tranche tender offer for the common shares and share options of Fuji Soft Inc. KKR now owns nearly 58% interest in Fuji Soft and will proceed to take the Japanese software company private.

– Funds managed by KKR will acquire a stake in Sydney-based employment management platform Employment Hero Pty. Ltd. from Seek Investments Pty. Ltd. The deal is expected to close by the first quarter.

– The Carlyle Group Inc. made an additional investment in distributed generation platform Aspen Power Partners LLC. Carlyle made its initial commitment to Aspen Power in 2022.

FUNDRAISING UPDATE

– GTCR LLC raised about $3.6 billion in total commitments for Strategic Growth Fund II at final close. The vehicle will invest in lower-middle-market and midmarket companies.

– Greenfield Partners LLC secured $400 million in capital commitments primarily for its Fund III. The vehicle will invest in early growth technology companies.

– Madison River Capital LLC raised more than $370 million in capital commitments at the final close of its inaugural fund. Madison River Capital Fund I will focus on control buyouts of lower-middle-market companies in the healthcare services, industrial and business services sectors.

– Invalda INVL raised €305 million at the first close of its second private equity fund. INVL Private Equity Fund II will invest in businesses across the Baltics, Poland, Romania and the broader EU.

MIDDLE-MARKET HIGHLIGHTS

– HealthEdge Investment Partners LLC closed the sale of patient-monitoring-device maker LifeSync Corp. The buyer was Amphenol Corp.

– Grovecourt Capital Partners purchased IMRIS Inc., which provides magnetic resonance imaging solutions. Trinity Capital Inc. sold the company.

– Kinzie Capital Partners LP added Fraser Steel, which makes steel tubular products, to its portfolio.

FOCUS ON: PRIVATE EQUITY FUNDRAISING

Private equity fundraising struggled in 2024, with total capital raised declining for the third consecutive year.

Private equity firms also took longer to close funds. Investment vehicles that closed in 2024 were open for a record 21.9 months versus 19.6 months in 2023 and 14.1 months in 2018, according to a report from McKinsey & Co.

Fundraising for buyout, growth equity and venture capital each fell as much as 25% compared with 2023. However, fundraising of midmarket vehicles — those ranging from $1 billion to $5 billion in size — remained flat year over year, according to McKinsey.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter