Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Feb, 2025

By John Wu and Uneeb Asim

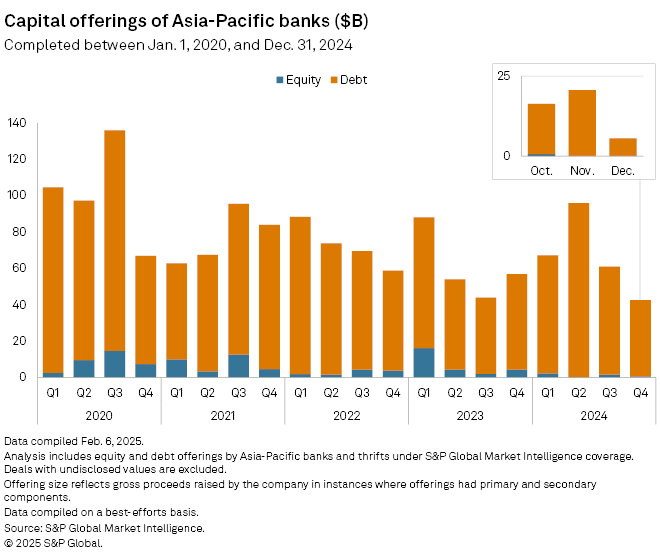

Asia-Pacific banks are set to increase debt issuance in 2025 to fund balance sheet expansion and meet regulatory capital requirements.

Banks in the region issued $261.83 billion in debt in 2024, up 21.2% from $216.06 billion in 2023, according to S&P Global Market Intelligence data. The growth was driven by Chinese banks, which issued $107.92 billion, or more than 41% of the total, up from $76.06 billion in 2023.

In contrast, Japanese banks' debt issuance fell to $32.60 billion in 2024 from $58.61 billion in 2023 and $35.35 billion in 2022.

Chinese banks are expected to issue more debt to expand their balance sheets, refinance maturing obligations and meet 2028 total loss-absorbing capacity targets, said Iris Tan, senior equity analyst at Morningstar.

Elsewhere in the region, bank debt issuance is likely to rise moderately, said Michael Makdad, senior equity analyst at Morningstar.

"Excluding China, Australia and India, I'd expect aggregate Asian bank debt issuance in 2025 to be up moderately versus 2024, reflecting normal balance sheet growth and continued phase-in of the final total loss-absorbing capacity [TLAC] requirements," Makdad said.

The rise in Asia-Pacific bank debt issuance aligned with global trends, as total bond issuance increased 20% to $9.266 trillion in 2024 from $7.699 trillion in 2023, S&P Global Ratings said Jan. 31. It expects a 3% increase in 2025, constrained by high interest rates and a potential US economic slowdown.

TLAC requirements

Regulatory capital needs, particularly TLAC requirements, will drive Chinese banks' debt issuance in 2025, analysts said.

The Financial Stability Board's TLAC standards require global systemically important banks to hold financial instruments that absorb losses and facilitate recapitalization in a crisis. China has five of the world's 29 global systemically important banks (G-SIBs), while Japan has three.

By 2028, four of China's G-SIBs — Industrial and Commercial Bank of China Ltd. (ICBC), China Construction Bank Corp., Agricultural Bank of China Ltd. and Bank of China Ltd. — must accumulate an estimated 1 trillion yuan to meet final TLAC requirements, according to S&P Global Ratings. Bank of Communications Co. Ltd., which joined the G-SIB list in 2023, has until 2027 to meet its initial requirement.

"China's mega four banks need to accumulate TLAC capital equal to 22% of each bank's [risk-weighted assets]," said Xi Cheng, director at S&P Global Ratings. The actual capital need will likely be higher as loan growth, coupled with profitability pressure, limits banks' ability to fund TLAC internally, Cheng said.

Morningstar's Tan expects China's five G-SIBs to issue TLAC bonds to meet the 2028 target. Issuance of Tier 2 and perpetual bonds in 2025 is also expected to continue, mainly to replace higher-interest debt.

Big issuers

Chinese banks, including the big four lenders, accounted for nine of the 10 largest debt offerings in 2024, according to Market Intelligence data. Commonwealth Bank of Australia was the only non-Chinese bank in the ranking, issuing $7.63 billion.

The big four — ICBC, China Construction Bank, Agricultural Bank of China and Bank of China — completed seven of the 10 largest offerings.

ANZ Group Holdings Ltd.'s $1.11 billion preferred security issuance in March was the largest bank equity offering of 2024. Indian banks — Punjab National Bank, Bank of Maharashtra, ICICI Bank Ltd. and Union Bank of India — followed, raising $596.8 million, $416.5 million, $383.3 million and $362 million, respectively.