Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Feb, 2025

By Zia Khan and Beenish Bashir

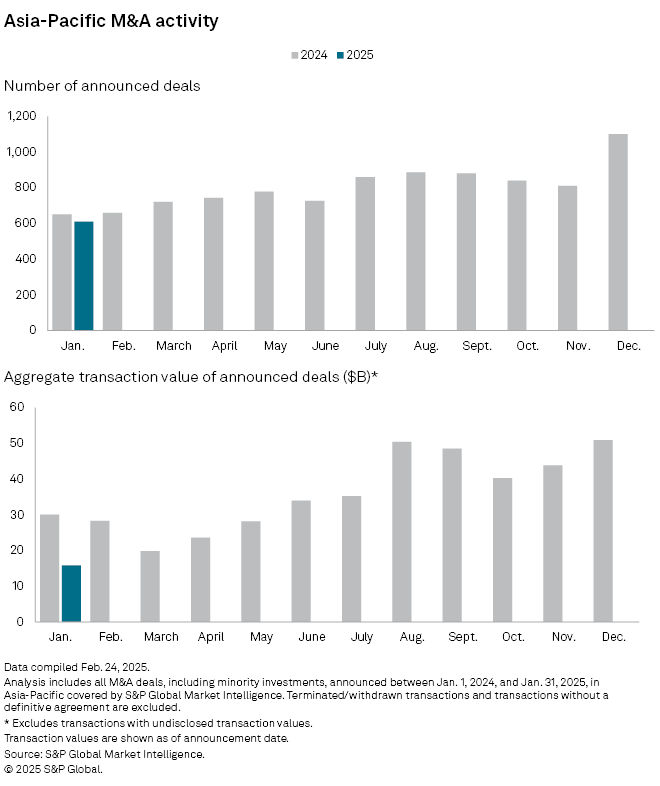

Mergers and acquisitions in the Asia-Pacific region fell to a one-year low in January, dragged by a slowdown in activity across sectors.

Companies completed 610 deals during the month, down 6.2% from 650 a year earlier, S&P Global Market Intelligence data show. The aggregate transaction value of all deals nearly halved to $15.85 billion from $30.08 billion in January 2024.

The slowdown in M&A activity was more evident in the industrials sector, where the deal count plunged to 76 from 120 a year ago. Deals in the technology, media and telecommunications sectors decreased to 93 from 127, while consumer sector deals dropped to 73 from 103, and materials sector deals fell to 42 from 65.

Deal activity in the financials sector also declined, with the number of transactions falling to 35 from 41 a year ago, the data shows.

Still, analysts are optimistic about dealmaking in the coming months amid benign global inflation and anticipated interest rate cuts. "Whilst geopolitical tensions continue, easing of inflation and cheaper financing coupled with pent-up demand and the need for investment in key sectors are expected to lead to increases in dealmaking activity," Norton Rose Fulbright said in its outlook report on Jan. 29.

"We expect to see the significant growth in dealmaking activity we saw in the final few months of 2024 continue into 2025," the law firm said.

Global M&A volumes jumped in the fourth quarter of 2024, with 9,765 deals announced, the highest number since the first quarter of 2023, Market Intelligence said in a report.

Regional breakdown

Mainland China and India recorded year-over-year growth in deals in January, though the gains were not enough to offset declines seen in other markets. Deal count in mainland China increased 32% to 165 in January from 125 a year ago, while India posted a nearly 21% year-over-year increase in the number of deals, to 104 from 86, according to the data.

The mainland Chinese companies also accounted for seven of the 10 largest M&A deals by transaction value in January, with Zijin International Holdings Co. Ltd.'s $1.87 billion acquisition of a 24.82% stake in Zangge Mining Co. Ltd. being the largest. It was also the only billion-dollar-plus deal announced by an Asia-Pacific company in January, the data shows.

Other notable deals in January included Anhui Expressway Co. Ltd.'s acquisition of Anhui Fuzhou Expressway Co. Ltd. and Anhui Sixu Expressway Co. Ltd. for $653.6 million and Chongqing Yufu Holding Group Co. Ltd.'s purchase of a 49% stake in Chongqing Pharmaceutical Health Industry Co. Ltd. for $621.5 million.

Two other major economies in the region, Japan and Australia, saw declines in deal activity in January, dragging total volumes. Japanese companies clinched 139 deals during the month, versus 156 in the same month in 2024, while the deal count in Australia dropped to 59 from 90.