Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Jan, 2025

By Arpita Banerjee and Ronamil Portes

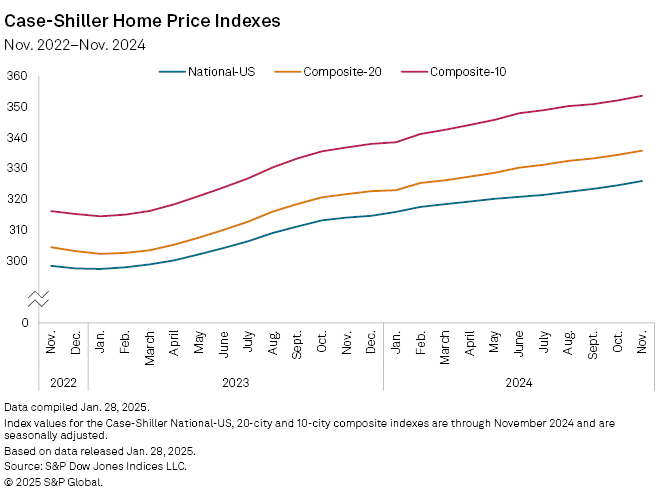

US home price gains picked up again in November 2024, following months of deceleration.

The S&P CoreLogic Case-Shiller US National Home Price NSA Index, which covers all nine US census divisions, posted a 3.8% year-over-year increase in November 2024, up from a 3.6% annual gain in October 2024.

The 10-City Composite saw an annual increase of 4.9%, unchanged from the previous month. The 20-City Composite posted a year-over-year increase of 4.3%, up from a 4.2% increase in the previous month.

"Despite below-trend growth, our National Index hit its 18th consecutive all-time high on a seasonally adjusted basis," Brian Luke, head of commodities, real and digital assets at S&P Dow Jones Indices, said in a Jan. 28 release. "Again, with the exception of Tampa, all markets rose monthly with seasonal adjustment."

On a monthly basis, the US national index rose 0.4% in November 2024 after seasonal adjustment, unchanged from the prior month. The 20-City and 10-City Composite indexes also reported month-over-month increases of 0.4% each.

New York again recorded the largest annual growth at 7.3% among 20 cities, while Chicago and Washington followed with increases of 6.2% and 5.9%, respectively. Tampa saw the lowest return, posting a decline of 0.4%.

"Tampa's decline is the first annual drop for any market in over a year. Returns for the Tampa market and entire Southern region rank in the bottom quartile of historical annual gains, with data going back to 1988," Luke said.

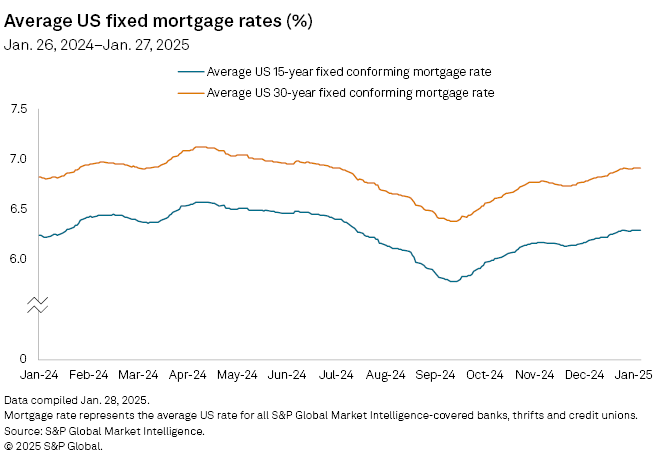

Mortgage rates near 7.0% in January

Rising mortgage rates remain a constraint for potential homebuyers.

The average US 30-year fixed-conforming mortgage rate increased from 6.82% on Jan. 1 to 6.91% on Jan. 27. The average US 15-year fixed-conforming mortgage rate was 6.29% on Jan. 27, up from 6.21% on Jan. 1.

US mortgage applications fell 2% week over week in the seven days ended Jan. 24 after seasonal adjustment, as reported by the Mortgage Bankers Association (MBA) in its Weekly Mortgage Applications Survey. On a seasonally adjusted basis, applications to refinance a mortgage declined 7%, while applications to purchase a new home fell 0.4%.

Rebound in home sales continue

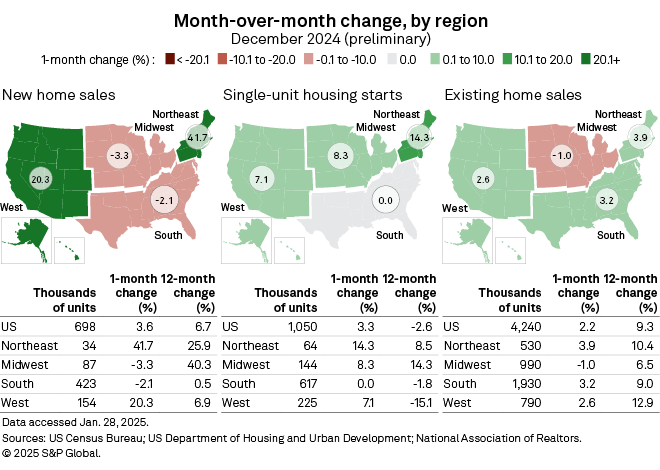

Existing and new home sales continued increasing in December 2024.

Nationwide, existing home sales rose 2.2% in December 2024 to a seasonally adjusted annual rate of 4.24 million units. Sales rose 9.3% year over year, the largest year-over-year gain since June 2021, according to a Jan. 24 release by the National Association of Realtors (NAR).

All four US regions registered sales growth year over year, with the West posting the highest annual growth at 12.9%. Sales increased in three US regions on a monthly basis but fell 1.0% in the Midwest. The Northeast recorded the highest month-over-month increase in existing home sales, at 3.9%.

"Home sales in the final months of the year showed solid recovery despite elevated mortgage rates," NAR Chief Economist Lawrence Yun said in the release. "Home sales during the winter are typically softer than the spring and summer, but momentum is rising with sales climbing year-over-year for three straight months."

New home sales rose 3.6% month over month and 6.7% year over year to a seasonally adjusted rate of 698,000 units, according to data from the US Census Bureau and the Department of Housing and Urban Development.

Year over year, new home sales rose in all four US regions. The Midwest posted the highest growth year over year, at 40.3%. Sales declined on a month-over-month basis in the Midwest and South.

The Northeast posted the highest month-over-month increase in new home sales, at 41.7%.

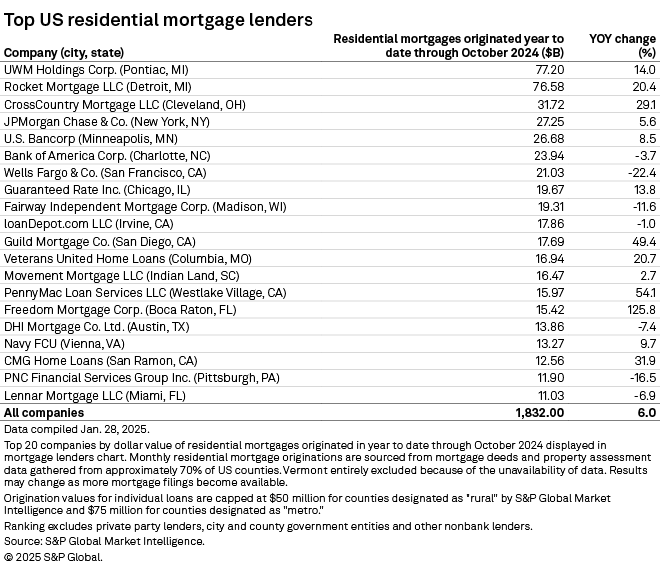

Top mortgage lenders

Pontiac, Michigan-based UWM Holdings Corp. continued to lead the list of US residential mortgage lenders for 2024, originating $77.20 billion in residential mortgages through October 2024.

S&P Dow Jones Indices and S&P Global Market Intelligence are divisions of S&P Global Inc.