Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Jan, 2025

By Karl Angelo Vidal and Joyce Guevarra

S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

The release of Chinese AI model DeepSeek may have provided additional long-term risk to datacenter REITs, although a sudden moderation in hyperscale investments is unlikely, BMO Capital Markets said in a report.

"While there are reasons to be skeptical of the claims, the risk spectrum has widened, though we are hesitant to overreact and there are scenarios where investment increases," BMO analysts Ari Klein and John Kim said.

The analysts added that the data points around datacenter demand have been positive, such as record leasing in the fourth quarter of 2024 as well as increased capital expenditures for datacenters.

"Markets like Northern Virginia also have diverse demand drivers with virtually no availability (0.4%) and speculative development has been kept to a minimum, including Digital Realty Trust Inc.'s pipeline in North America that is 97% leased."

A chatbot made by DeepSeek may have burst the Big Tech bubble after the company appeared to prove that AI models could be created as effectively as western models at a fraction of the cost, according to an S&P Global Market Intelligence analysis.

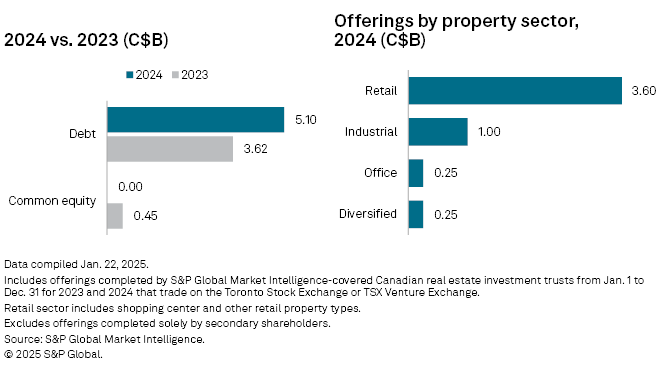

CHART OF THE WEEK: Canadian REIT capital offerings up in 2024

⮞ Capital offerings of public Canadian real estate investment trusts grew 25% year-over-year in 2024 to C$5.10 billion.

⮞ Retail REITs accounted for almost 71% of all the capital raised, at C$3.60 billion.

⮞ Industrial REIT Granite REIT offered C$550 million worth of unsecured debentures in October 2024, the single largest debt offering during the year.

TOP DEALS

– An affiliate of healthcare real estate investment trust Welltower Inc. is acquiring NorthStar Healthcare Income Inc. in a deal valuing the enterprise at about $900 million. Shareholders of NorthStar will receive $3.03 per share in cash. The transaction involves a portfolio of 40 senior housing communities. The deal is expected to close in the first half of 2025, subject to customary closing conditions, including approval by NorthStar's stockholders. CS Capital Advisors is the financial adviser and Morrison & Foerster LLP is serving as the legal adviser to NorthStar.

– The alternative investment arm of Goldman Sachs Group Inc. partnered with Dalfen Industrial LLC for the acquisition of a logistics portfolio from private equity giant Blackstone Inc. for nearly $300 million, Bloomberg News reported. The portfolio comprises 21 buildings totaling roughly 2.1 million square feet spanning Las Vegas, Dallas, Cincinnati and Pennsylvania. Amazon and Red Bull are among the tenants at the 92% leased portfolio, according to the report.

– Canadian healthcare REIT Chartwell Retirement Residences will acquire care retirement residence Rosemont Les Quartiers in the Rosemont–La Petite-Patrie neighborhood of Montreal for C$136 million. The property contains 632 rental suites. The acquisition is expected to close in the first quarter.

– Dream Office REIT is selling the property at 438 University Ave. in Toronto, Ontario, for gross proceeds of roughly C$105.6 million or approximately C$327 per square foot. The transaction is expected to close in the first quarter, subject to customary closing conditions.

US HOTEL PERFORMANCE

The average daily rate (ADR) of US hotels was up 3.4% year over year to $154.21 during the week ended Jan. 25, STR reported, citing data from CoStar, which provides information and analytics on property markets.

Occupancy was 54.3%, down 3.4% from the comparable week in 2024. Revenue per available room was down 0.2% to $83.74.

Among the top 25 markets, Los Angeles reported the largest occupancy gain. Washington, DC, saw the highest increases in ADR and RevPAR.

For 2025, CoStar and Tourism Economics maintained their forecast growth for ADR and RevPAR of +1.6% and +1.8%, respectively. Occupancy is expected to gain 0.1 percentage points to 63.1%

Explore key people moves in North American real estate.

Green bond issuance by US REITs picks up in 2024

REIT Replay: REIT share prices continue to grow during week ended Jan. 24