Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Jan, 2025

By Yuvraj Singh and Cheska Lozano

Indian banks face slowing credit growth in 2025 amid sticky high interest rates and cooling economic growth.

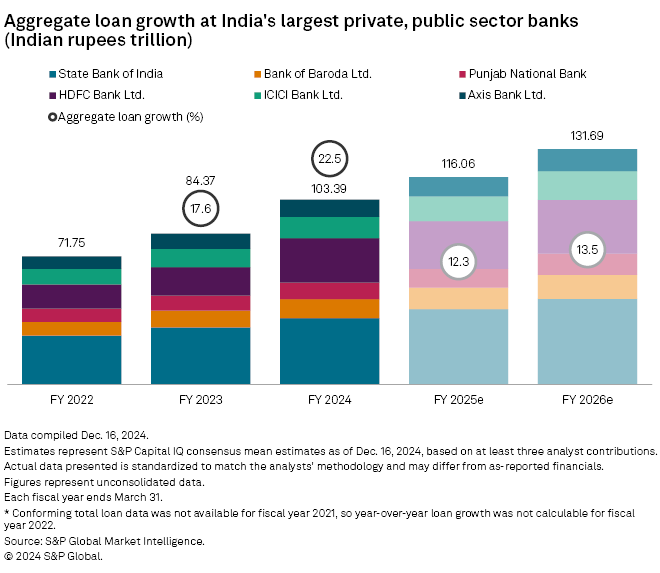

Aggregate loan growth at six of India's biggest private and state-owned banks by assets is expected to slow to 12.3% for the fiscal year ending March 31, down from 22.5% in the previous year, according to S&P Capital IQ mean estimates based on at least three analyst contributions.

"System credit growth has slipped mainly due to a sharp slowdown in unsecured retail loans as well as corporates, as per the Reserve Bank of India target," said Anand Dama, senior research analyst at Emkay Global in a note. The central bank increased the risk weights for unsecured lending in November 2024 by 25 percentage points to curb excessive lending to riskier customers. This included personal loans, credit card loans and credit to nonbanking financial companies.

Many banks have adjusted their strategy in recent quarters to better manage their balance sheets by reducing consumer loans and focusing on mobilizing retail deposits. HDFC Bank Ltd., India's largest lender by market capitalization, reported a 3% year-over-year growth in gross advances in the quarter that ended Dec. 31, 2024. The bank's deposit rate grew by 16% year over year.

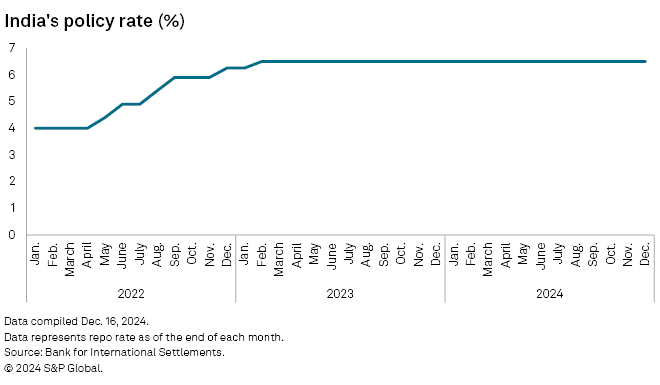

The Reserve Bank of India has maintained its benchmark interest rate at a higher level, even as central banks in the US and Europe eased monetary policy in 2024. The Indian central bank has kept its focus on inflation control, though analysts believe it has allowed the local currency to depreciate in recent weeks: a de-facto easing measure. The rupee is down 2.8% since Nov. 1, 2024. The Indian currency touched an all-time low of 86.65 to the US dollar on Jan. 14.

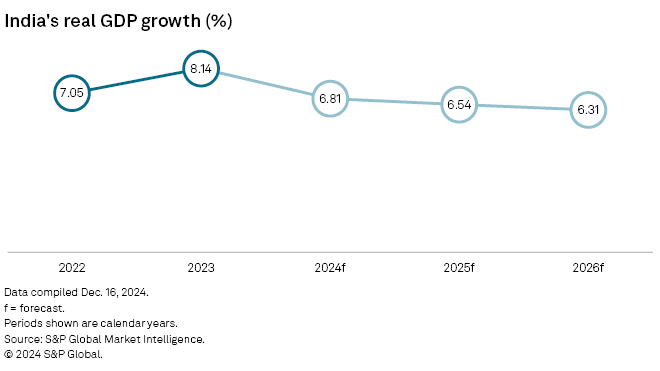

India's GDP growth slipped to a seven-quarter low of 5.4% year over year in the July-to-September quarter, from 8.1% a year ago, according to a news release by the National Statistics Office on Nov. 29, 2024. The government announced Jan. 7 that it expects the economy to grow 6.4% in the fiscal year ending March 31, down from 8.2% in the year ended March 31, 2024.

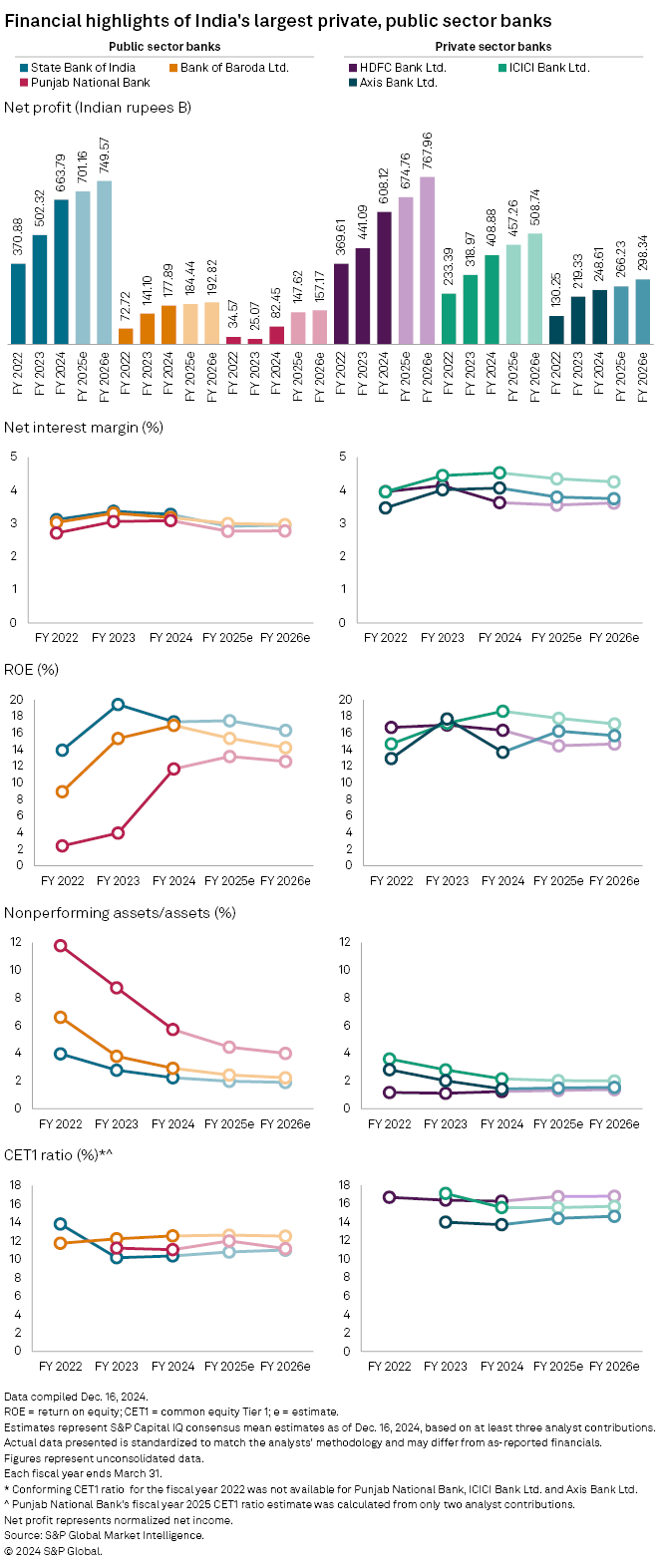

The net profit of Indian banks have continued to grow, though the pace has slowed in recent quarters. HDFC Bank reported a stand-alone net profit of 2.2% year over year in the quarter ended December 2024, down from 6% in the previous quarter. HDFC Bank is expected to post a net profit of 674.76 billion rupees in the year ending March 31, compared to 608.12 billion rupees in the previous fiscal year.

State Bank of India, the country's largest lender by assets, is projected to post a profit of 701.16 billion rupees for the fiscal year ending March 31, a 5.6% increase from 663.79 billion rupees in the previous year, according to S&P Global Market Intelligence estimates.

Net interest margins at most lenders are expected to edge lower, the estimates show. Weaker NIMs are expected as deposit rates catch up and monetary easing looms.

Bad loans have declined to a multiyear low as the Reserve Bank of India focused on asset quality and systemic risks in Indian banking.

"Buoyed by falling slippages, higher write-offs and steady credit demand, the [gross nonperforming assets] ratio of scheduled commercial banks fell to a multiyear low of 2.6% [in September 2024]," the Reserve Bank of India noted in its December 2024 financial stability report. Still, the aggregate gross nonperforming loans ratio of India's 46 largest banks is likely to increase to 3.0% by March 31, 2026, from 2.6% in September 2024, the central bank said in the report.

As of Jan. 28, US$1 was equivalent to 86.55 Indian rupees.