Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Jan, 2025

By Hailey Ross and Jason Woleben

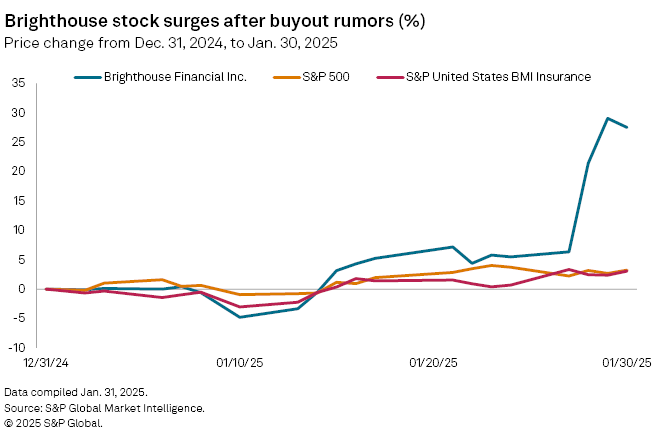

Shares of Brighthouse Financial Inc. spiked more than 20% this week after a press report said the life insurer is looking to sell itself.

The Financial Times reported Jan. 28 that Brighthouse is working with two banks to evaluate selling a minority stake or even the entire company. Sources in the article cautioned that talks were in early stages.

Increased enthusiasm for Brighthouse's prospects pushed its stock price up and it ended the week at $61.71, almost the exact same closing price on its first day of trading as an independent company after it was spun-off from MetLife, Inc. in 2017.

A spokesperson for Brighthouse said the insurer does "not comment on rumors and speculation."

Private equity interest

If a deal were to materialize, public companies would not likely be among the interested parties, according to Raymond James analyst Wilma Burdis.

"We think the most likely buyer – should a deal emerge – could be a new private equity-backed entrant into the private credit space, or an established PE player seeking distribution," Burdis said in a note to clients. "We see public life insurance companies as unlikely buyers as they could perceive Brighthouse's low multiple as a risk."

The timing of the Financial Times' report is a "bit curious" since Brighthouse's estimated risk-based capital in the third quarter of 2024 had returned to its "400-450% target range for normal markets" after some quarters of volatility, said Jefferies analyst Suneet Kamath.

"It feels to us that Brighthouse has already solved its capital problem, so why the need for a deal now?" Kamath said.

A deal could still make sense as Brighthouse's price-to-ratio multiple has "lagged" peers and has missed out on "sizeable re-rating" that others have benefited from amid strong annuity sales for the industry and the high interest rate environment, the Jefferies analyst said.

"It's possible that the board is looking at ways to catch up to the group more quickly than the time it might take management to restore credibility on capital," Kamath said. "Alternatively another explanation could be that Brighthouse is about to report another negative RBC development in its fourth-quarter of 2024 results."

Annuity leader

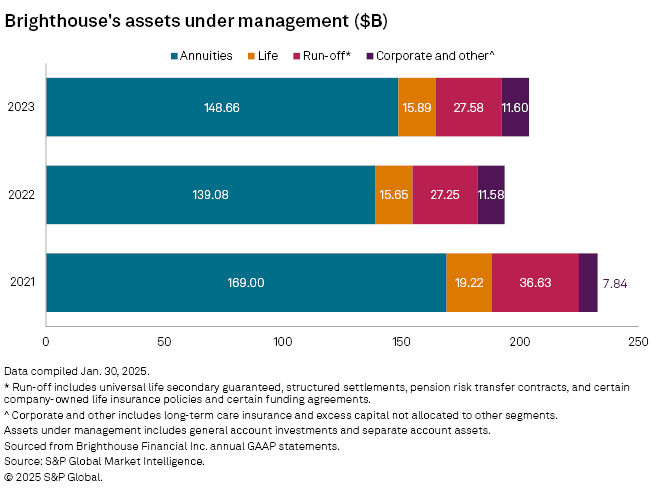

Brighthouse reported assets under management, which include general account investments and separate account assets, of roughly $204 billion as of year-end 2023. The company has a diverse array of active and run-off books annuity, life and long-term care businesses.

The bulk of Brighthouse's assets under management are tied to its annuity products, with $148.6 billion hosted in its portfolio. According to data from LIMRA, Brighthouse was the second-largest writer of Registered Index Linked Annuities (RILA) in 2023. Through the first nine months of 2024, LIMRA reports that Brighthouse was the fourth-largest RILA writer with $5.79 billion in sales.

Due to the makeup of its portfolio, Brighthouse might be attractive to asset managers such as Apollo Global Management Inc., KKR & Co. Inc., Sixth Street Partners LLC and

Several of these companies have completed major deals in the recent past, buying up blocks of annuities and life insurance businesses or outright acquiring companies. For example, Apollo-backed Athene Holding Ltd. and Venerable Holdings Inc. each acquired portions of Voya Insurance and Annuity Corp., in 2018. Sixth Street's Talcott Financial Group Ltd. assumed a range of fixed annuity, universal life and variable annuity blocks from the combination of Principal Financial Group Inc. and Guardian Insurance & Annuity in a series of transactions in 2022.