Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Jan, 2025

By Allison Good

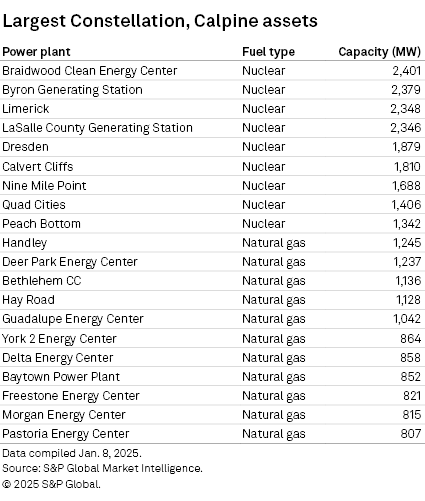

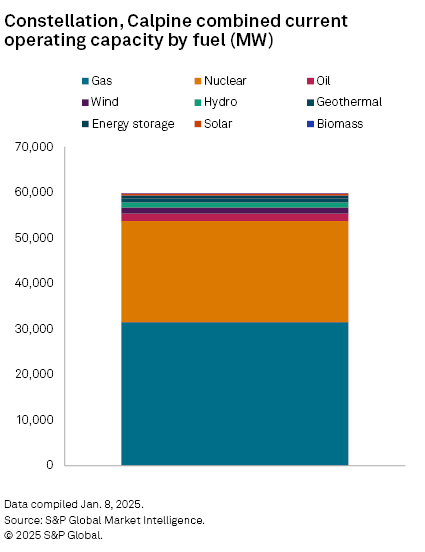

A potential deal to combine Constellation Energy Corp. and Calpine Corp. would create a merchant nuclear and natural gas behemoth in the US that would own 60,000 MW of operating capacity, according to S&P Global Market Intelligence data.

Constellation is reportedly in advanced talks to purchase privately owned Calpine in a cash-and-stock transaction that would value the power company at close to $30 billion, including debt, and form an entity owning 31,478 MW of gas generation and 22,238 MW of nuclear generation.

"The impetus for the acquisition is clearly Constellation's bullish view on power demand from datacenters, and they must have significant insight into Big Tech's power needs given they own the largest nuclear fleet and are fielding calls on supply agreements," analysts at CreditSights wrote Jan. 8.

|

Constellation shares dropped nearly 5% on Jan. 8 to close at $243.84.

Germany's RWE AG was also interested in buying the independent power producer (IPP) to cement an integrated position in the US, but deliberations with Energy Capital Partners LLC, which leads the investor consortium that owns Calpine, reportedly ended in 2024.

In May 2024, reports emerged that the consortium, which also includes Access Industries Inc. and the Canada Pension Plan Investment Board, was considering a sale, stake divestment or initial public offering for Calpine.

The Energy Capital Partners-led consortium in 2018 closed a $5.6 billion private buyout of Calpine, in a deal including the assumption of about $11.2 billion in net debt. At the time, the deal was driven by a strategy on the part of Calpine's management team that the power producer's value could fetch premiums going private, relative to its equity price in public markets. The buyout price, announced in August 2017, represented a roughly 51% premium to Calpine's unaffected share price in May of that year.

IPPs began to see a financial resurgence in 2024 ahead of expected windfalls from tightening electricity markets, with datacenters' projected energy needs fueling much of that surging demand.

"CreditSights in no way, shape or form saw a [Constellation] acquisition coming but we did speculate these private portfolios would file to IPO in 2025 and that would lead to upside in all their bonds," CreditSights added.

Buying Calpine would also expand Constellation's core asset base beyond nuclear plants and the PJM Interconnection LLC market.

"Calpine's generation fleet is concentrated in California, Texas, the mid-Atlantic and Northeastern US, thus providing [Constellation] a broader geographic exposure to attractive energy markets," BofA Securities analysts wrote Jan. 8. "Further, Calpine has significant experience and expertise in both building and operating gas, geothermal and renewable generation facilities, which adds considerable fuel diversity value to [Constellation's] existing nuclear fleet."

Calpine was one of the first merchant generators to signal that it will ramp up development in the PJM market following the grid operator's record-breaking auction results in July 2024.

That year also saw Constellation and Talen Energy Corp. sign high-priced contracts to provide electricity to Microsoft Corp. and Amazon.com Inc. for their datacenters.