Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Dec, 2024

By Nushin Huq

Datacenters, cryptocurrency mining facilities and other large sources of new electricity demand present a generational growth opportunity and an enormous risk, according to utility executives in the Midwestern US.

"In terms of inquiries we're seeing, the numbers are staggering compared to what we've seen historically even across our 15, 16 years of experience," Arick Sears, MidAmerican Energy Co.'s senior vice president of regulation, said Nov. 26 during a daylong meeting on large loads at the South Dakota Public Utilities Commission. The Berkshire Hathaway Energy affiliate, which operates in Illinois, Iowa, Nebraska and South Dakota, has spoken with companies seeking to add "multiple gigawatts of demand."

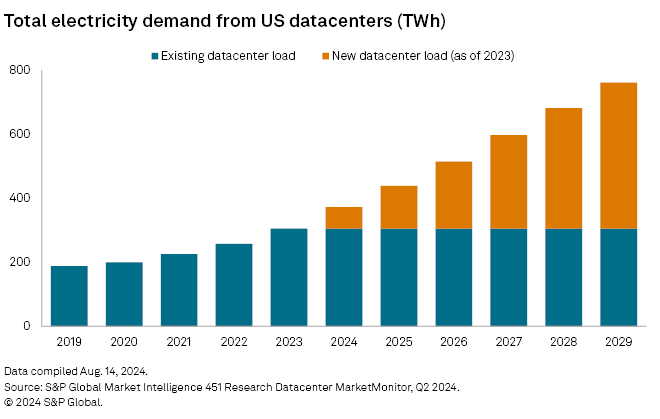

Rising industrial demand for electricity — including from hyperscale cloud service providers like Amazon.com Inc., Apple Inc., Google LLC, Meta Platforms Inc. and Microsoft Corp. — has shifted the narrative across the broader US power sector from weak growth and excess capacity to an urgent need for new investments and fast interconnections. Large loads can benefit power systems, for instance by relieving transmission congestion, but renewed growth comes with questions over the pace of the buildout, costs and potential overinvestments.

"No longer are we talking about discounted rates or tax incentives or all manner of other incentives to attract customers to our region," said Ryan Long, president of Minnesota, North Dakota and South Dakota at Minneapolis-based Xcel Energy Inc., which serves customers in eight states in the Midwest and West. "We now have north of 7 GW of requests across the Xcel Energy footprint. I'll be very frank that there's no way that we're going to be able to serve all of that in a reasonable amount of time."

In Minnesota, because of the lengthy resource planning process, Xcel incorporated about 500 MW of generic datacenter load growth into a recent forecast. But utilities mostly develop their systems based on actual signed agreements, knowing that large customers shop around and some requests are speculative. Doing so prevents double-counting of loads — a risk that a Google official recently flagged for US utility regulators.

MidAmerican, through years of working with datacenter operators, has learned that the "ramp schedules" they provide for coming online typically do not materialize as quickly as predicted, according to Sears.

"We really can't work with nonbinding ramp schedules anymore," Sears said. "We're working on agreements with the customers that would involve binding ramp schedules."

MidAmerican has been focused on how to improve demand forecasts for the Midcontinent ISO and its own resource planning purposes.

Concern over 'stranded costs'

In addition, utilities want to ensure they are not left with stranded assets in case a large-load customer goes out of business.

Montana-Dakota Utilities Co., a subsidiary of MDU Resources Group Inc., assesses what additional facilities are needed to bring large loads online and often makes arrangements with large customers so they pay for those facilities.

"So, in the case those loads would go away, our other customers aren't covering some sort of an investment recovery for us around those facilities," said Darcy Neigum, the utility's vice president of electric supply.

"This is not business as usual," said Tim Rogelstad, president of Otter Tail Power Co., an affiliate of Otter Tail Corp. that operates in Minnesota, North Dakota and South Dakota. "Our core objective is to protect existing customers through the life of this [large-load] customer. Second is protecting the company to make sure that we are not stuck with any stranded costs or other unrecoverable costs as part of this."

Otter Tail likes to direct large industrial customers to specific locations that do not require new transmission and distribution infrastructure. If the utility needs to invest in the grid, it will require financial assurance from the customer.

"In the environment that we're operating in today, we would expect a pretty good probability that there would be another customer to come in, but to the extent that it didn't, the financial backstop will be very high," Rogelstad said.

Utilities are also considering termination provisions, including buyout of assets added to the system, if a large load leaves suddenly.

Utilities are turning to flexible tariff structures to help handle their projected load growth.

"One thing we've learned from talking to datacenter customers is that they are not all the same," said Eric Egge, director of electric strategy, policy and planning at South Dakota-headquartered Black Hills Power Inc. "They have different objectives."

Black Hills Power designed its tariff for traditional datacenters based on one it created for Microsoft. Since then, other datacenters in Cheyenne, Wyoming, where Black Hills' parent company owns Cheyenne Light Fuel and Power Co., have used the same tariff structure — sometimes with slight modifications.

In anticipation of cryptocurrency customers, the company also designed a special blockchain tariff.

In Iowa, MidAmerican developed an individual customer rate, which Sears called a "game changer." The rate is for datacenters and other hyperscalers and is based on the actual cost to serve that particular customer.

"That has been very successful in protecting customers," Sears said.

At Xcel, the approach is that datacenters should cover all the costs that they bring to the system as well as their fair share of the fixed costs of running the business.

"I just want to be very clear that it is that fair share of the fixed cost that really is the affordability aspect of bringing on large loads like this," Long said.

Flexible demand

Another way utilities are managing load growth is using large loads as demand-side management tools. For example, Montana-Dakota Utilities hosts a datacenter in Ellendale, North Dakota, that is uniquely situated because of excess generation in the area.

"It's actually more reliable to the system if you could add load in those areas," Neigum said. "It minimizes then the potential need for transmission buildout as well to be able to get that generation to market. It ends up being a win-win situation for everyone."

Crypto mining facilities offer a unique opportunity because they typically are smaller than datacenters, at about 10 MW to 100 MW, and can handle interruption, added Egge of Black Hills Power.

While datacenters require firm load, they can be interruptible through behind-the-meter generation.

"We prefer them to be interruptible just because we feel that that's a better service we can provide to them, a more economic service versus the traditional datacenters that want extremely high reliability," Egge said.

Otter Tail has one large blockchain customer in North Dakota, which it can interrupt for up to about 5% of peak usage. The company has a trigger for capacity reasons and one for economic reasons, if the price reaches a certain point.

"We've had really good experience with them being a load-modifying resource," Rogelstad said.

NorthWestern Corp., a utility subsidiary of NorthWestern Energy Group Inc. that serves customers in Montana, Nebraska and South Dakota, is working with its regional transmission operator, Southwest Power Pool, on how it can leverage datacenters' ability to run their own generation during an emergency.

"They have the ability to take that load offline during a moment of an emergency," said Bleau LaFave, the utility's vice president of asset management and business. "We need to make sure we understand the value of that."

Most datacenters, however, use diesel as the backup generation fuel source, subjecting them to federal restrictions and permits that limit how long they can run, LaFave added.