Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Dec, 2024

The US labor market has begun to weaken after months of soaring interest rates and recession warnings.

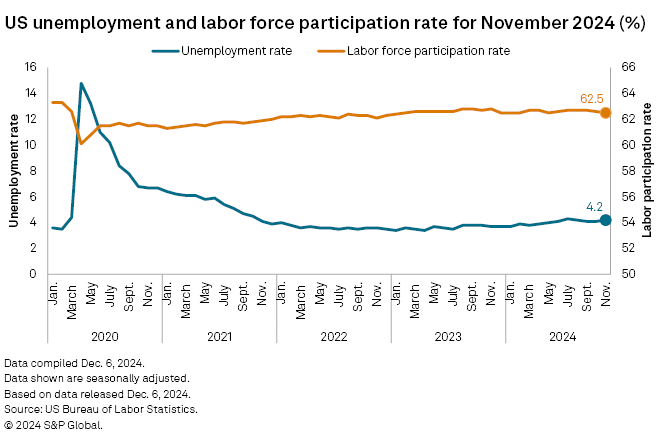

The US unemployment rate climbed to 4.2% in November, up from 3.7% in November 2023, indicating 883,000 more Americans are jobless than a year earlier, the US Bureau of Labor Statistics reported Dec. 6. Meanwhile, the labor force participation rate, which measures the share of the working age population with a job or looking for work, fell to 62.5%, its lowest level since May.

The size of the American workforce is in decline and unemployment is rising, with a growing share of Americans remaining jobless for extended stretches of time. Where job growth is occurring, it is concentrated in a select number of industries.

"The labor market has cooled substantially, and this is showing up in higher unemployment," said Guy Berger, director of economic research at the Burning Glass Institute. "It's not a bad labor market yet, but it's not a great one either."

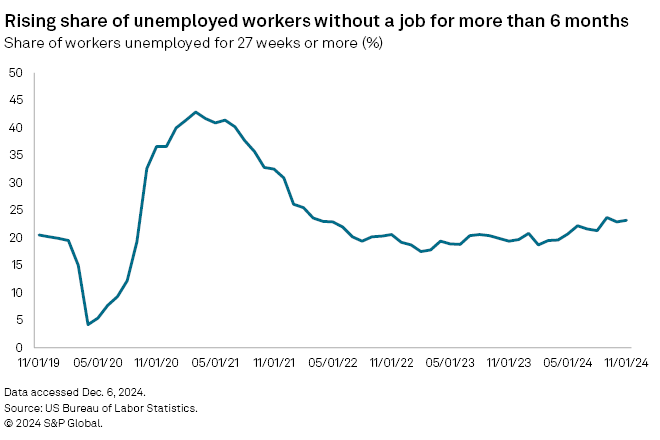

Unemployed workers are also staying without jobs longer, a signal that labor demand has cooled. The share of unemployed workers out of a job for more than six months has averaged 23.3% over the past three months, up from 19.9% over the same three-month stretch a year earlier.

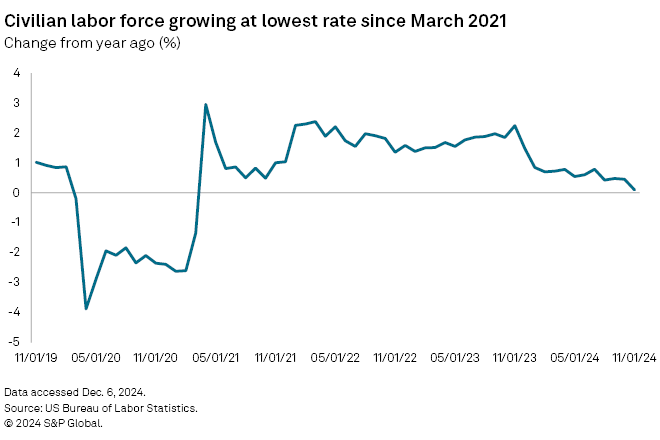

The size of the civilian labor force, which rose by 963,000 people from May to September, had fallen by 409,000 by the end of November. The labor force increased in size by less than 0.1% from November 2023 to November 2024, the smallest annual increase since March 2021, when the labor force fell 1.3%.

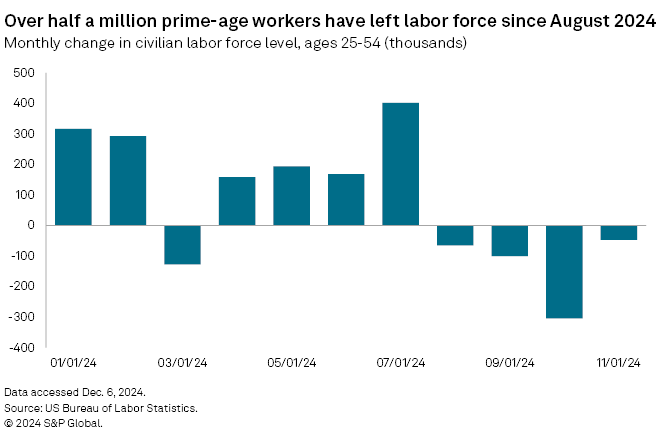

Prime-age workers, those between 24 and 54 years old, drove the slowdown. This portion of the labor force has declined by 514,000 since July.

Even so, the participation rate for prime-age workers, which was 83.5% in November, remains near highs last seen in the early 2000s. The rate appears to be leveling off or nearing a peak and is unlikely to rise much further, said Cory Stahle, an economist with Indeed Hiring Lab.

The rise in unemployment for prime-age workers was largely fueled by longer unemployment duration and more people entering or reentering the job market.

"This suggests that the labor market remains strong enough to attract people, but the pullback in job postings since March 2022 is impacting how quickly they can find work," Stahle said in an email.

There were still 7.7 million job openings in October, well below the March 2022 peak of 12.2 million but still 455,000 above pre-pandemic levels, according to the latest government data.

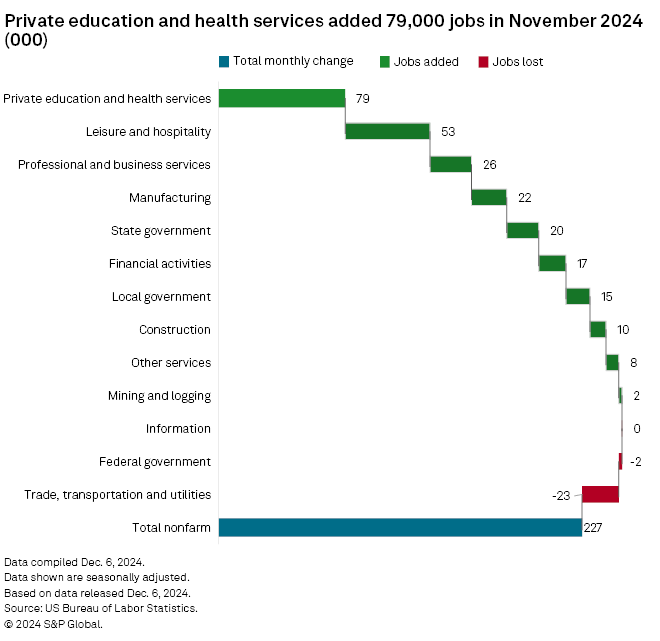

Much of the hiring is taking place in healthcare, leisure and hospitality, and state and local governments. Of the 227,000 jobs added in November, nearly 60% were in two sectors.

Still, the ongoing hiring is a signal that the jobs market may not deteriorate much more, said Thomas Simons, a US economist with Jefferies.

"They may not be indicative of broader strength, but they also show that demand for labor has a solid floor that is not going to give out even if the economy weakens from here," Simons said.

Overall weakness in the jobs data was enough to boost the odds of another 25-basis-point rate cut by the Federal Reserve this month to a near certainty. While the Fed wants to keep inflation in check, it also does not want signs of weakness in the labor market to lead to larger joblessness.

"These are not huge alarm bells, but they do give you a bit of caution," said Michael Pugliese, a senior economist with Wells Fargo. "This is the tightrope the Fed is trying to walk."