Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

4 Dec, 2024

US Sen. Jim Risch (R-Idaho) introduced legislation Dec. 4 that could provide as much as $3.6 billion in federal funds to offset cost overruns from the construction of qualifying new nuclear reactors.

The Accelerating Reliable Capacity (ARC) Act is intended to minimize nuclear development risk and comes months after the second of two new units entered commercial service at the Vogtle Nuclear Plant in Georgia, an expansion project dogged by years of delays and billions in cost overruns.

"We are at the cusp of unlocking a host of advanced reactor technologies, which are essential to meet growing domestic energy demands and strengthening our national security," said Risch, co-chair of the Senate Advanced Nuclear Caucus. "While the US has made significant investments in developing new nuclear reactors, the financial risk in moving from demonstration to commercialization is so significant, it impedes industry growth. The ARC Act aims to mitigate that risk and ensure the US remains the global leader in nuclear energy."

A history of hefty costs and long timelines often associated with new nuclear builds can make it "challenging to attract investments," Risch said. The ARC Act aims to establish a limited risk reduction program for building new commercial reactors by "providing a backstop for unforeseen costs through enhanced financing terms."

The proposed program would benefit three or more next-generation nuclear energy projects to "jumpstart commercialization," Risch said.

The 19-page legislation would establish a New Nuclear Investment Accelerator Program account at the US Energy Department's Loan Programs Office. Under the proposed bill, unused Inflation Reduction Act (IRA) funds for nuclear energy and other energy programs would be transferred into the account, totaling as much as $3.6 billion.

The maximum payment amount for any qualifying project cannot exceed $1.2 billion, according to the legislation.

To qualify, projects must have a reasonable expectation of being constructed "on time and on budget," must have expected costs equal to or greater than $2.5 billion and must have received loan guarantees through the DOE, among other criteria, according to text of the bill obtained by S&P Global Commodity Insights.

The ARC Act is a "pivotal step" in addressing "financial barriers that have hindered" nuclear deployment in the US, said Maria Korsnick, president and CEO of the Nuclear Energy Institute.

Providing more certainty for early adopters could help mitigate risks for nuclear projects and encourage investment in the broader industry to develop other new units, John Wagner, director of the Idaho National Laboratory, said in a statement.

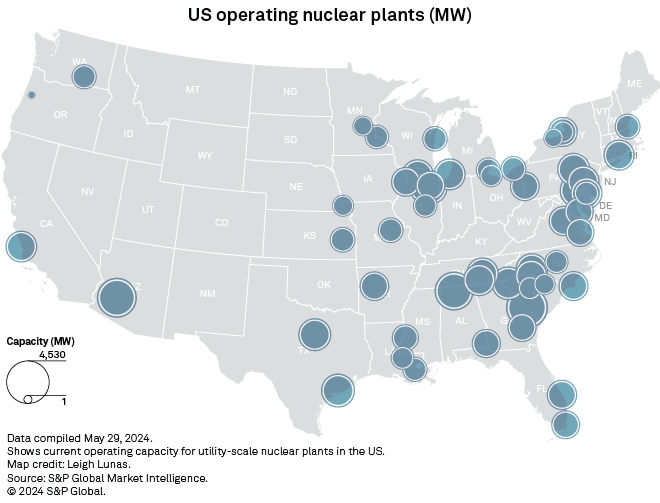

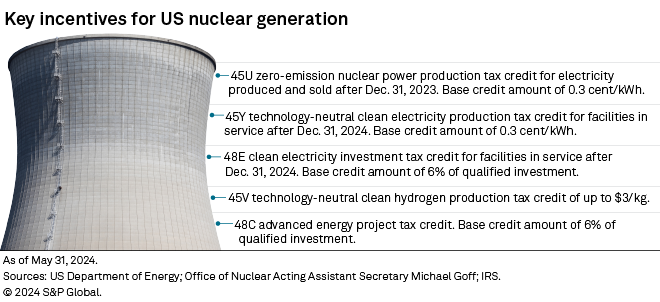

While nuclear advocates celebrated the completion of Southern Co.'s Vogtle over the summer, utilities sought more support for the next major US nuclear build. Cost overrun "insurance" topped the list, though DOE leaders said existing incentives, including key tax credits passed under the IRA in 2022, are already generous.

Those tax credits in some ways reversed the fortunes of nuclear operators, especially those in competitive power markets, prompting operators to seek uprates and license extensions for the existing fleet.

In July, President Joe Biden signed legislation to support development of advanced nuclear reactors by reducing licensing times and cutting processing fees. Biden characterized the ADVANCE Act at the time as a "win for American energy security, innovation and achieving economywide, net-zero emissions by 2050," adding that the law would help deliver clean power and union jobs.

Advanced nuclear has also seen increased interest from tech companies in 2024 looking for firm generation to support datacenter projects. Google LLC partnered with Kairos Power LLC to deploy 500 MW of advanced nuclear beginning in 2030; Amazon.com Inc. and X-energy and Dominion Energy Inc. have teamed up for advanced reactor projects; and Facebook parent company Meta Platforms Inc. is seeking proposals for up to 4 GW of nuclear power by the early 2030s.