Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Sep, 2023

The Federal Reserve may not have raised interest rates this week, but Fed officials clearly see rates staying much higher and remaining there for much longer than they did just a few months ago.

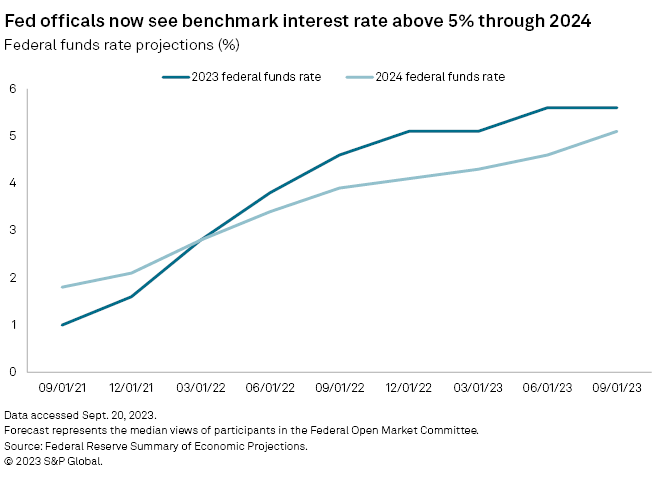

Ten of the 19 members of the rate-setting Federal Open Market Committee now see the benchmark federal funds rate remaining above 5% through 2024, according to the quarterly summary of economic projections released Sept. 20. Back in June, just six members projected rates above 5% next year. In September 2022, no FOMC member was forecasting rates above 5% and only six members saw rates above even 4% in 2024.

The median view among Fed officials is now for the federal funds rate to be 5.6% at the end of 2023 and 5.1% at the end of 2024, up from 4.6% and 3.9%, respectively, from a year earlier.

These shifting projections, known as the Fed's "dot plots," indicate that the central bank's aggressive rate hike push since March 2022 has yet to have its desired effect, and that monetary policy will remain tighter for much longer than once anticipated.

"The Fed's forecasts suggest a more durable expansion that is slowing very, very gradually," said Thomas Simons, US economist with Jefferies. "I think these dots suggest that the current rate is going to be maintained for about six months longer than the last edition."

Wait-and-see approach

The Fed on Sept. 20 decided to hold rates steady in their current range of between 5.25% and 5.5%, where they have been since July. Fed Chairman Jerome Powell told reporters that the Fed could hike rates by another 25 basis points at one of the next two FOMC meetings before the end of the year, but gave no indication whether that was likely. Twelve of the FOMC's 19 members see rates above 5.5% at the end of 2023, according to the dot plots, suggesting that one more 25 basis-point hike is expected to be approved at either the November or December Fed meetings.

"This was a wait-and-see meeting," said Patrick Leary, managing director with Loop Capital Markets. "Its not a victory on inflation, its not saying we're done raising rates, its saying 'We've come a long way and now we're going to see what happens.'"

Fed officials have said they will not move to cut rates until year-over-year growth in the personal consumption expenditures index, excluding food and energy, also known as core PCE, starts to move meaningfully toward 2%.

"The process of getting inflation sustainably down to 2% has a long way to go," Powell said.

Fed officials do not see much movement toward that 2% goal yet. According to the September meeting projections, the median view among FOMC members is for core PCE to end 2024 at 2.6%, up 30 basis points from expectations a year earlier, and even see it at 2.3% at the end of 2025. Core PCE was 4.2% in July, according to the latest government data.

It remains unclear how close inflation will need to get to 2% before the Fed starts even considering rate cuts.

"I'm not sure what progress will be sufficient enough for the Fed to lower rates, but we'll probably need to see it show up in services inflation," said Callie Cox, a US investment analyst at eToro. "The Fed may also be willing to cut rates if we see enough weakness in the job market. From here on out, rate decisions could require a lot of context since the risk-reward equation is so much more balanced now."

Significant uncertainty

The odds of rate cuts within the year are tumbling. As of Sept. 21, just under 40% of the futures market was betting that the Fed would start to cut rates by at least 25 basis points by their June 2024 meeting, according to the CME FedWatch Tool, which measures investor sentiment in the Fed funds futures market. A month earlier, nearly 80% of the market was betting on rate cuts by that meeting.

Rather than a substantial move to 2% inflation growth, rate cuts could be triggered by another event, particularly as the economy is facing a number of potential headwinds, including a possible government shutdown, an auto workers strike, resumption of student loan payments and rising energy prices.

"There's so much uncertainty around these things," Powell told reporters.

Rate cuts could arrive far earlier than the futures market and many Fed officials expect, said Simons with Jefferies. Simons expects that economic growth will likely slow late this year and into early 2024 and the US will ultimately fall into a recession forcing the Fed to begin to lower rates.

"The higher for longer approach will keep them at current levels until March, but they will see enough accumulated weakness in the economy by then that they will be forced to cut," Simons said.