Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Sep, 2023

By Joyce Guevarra and Annie Sabater

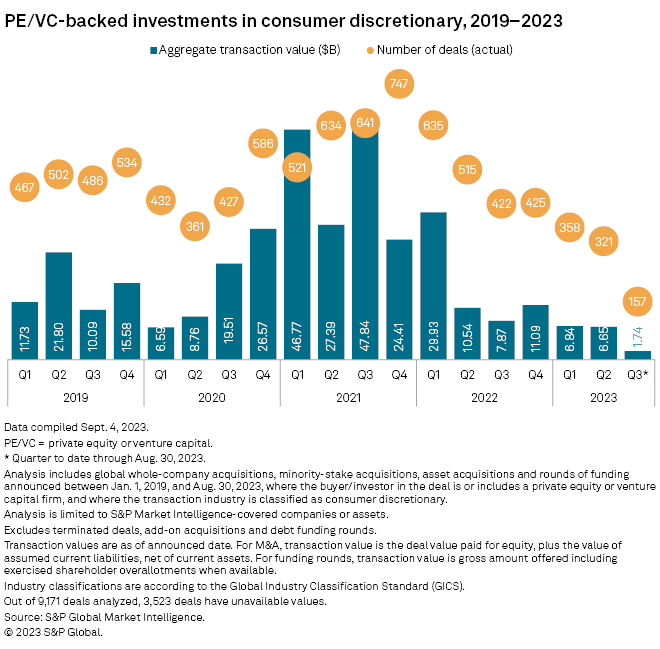

Global private equity and venture capital interest in the consumer discretionary sector fell sharply in the first half of 2023 with total deal value plunging 67% year over year to $13.49 billion, according to data from S&P Global Market Intelligence.

Transactions in the space totaled 679, down 41% from the first half of 2022.

Consumer discretionary remains the most-shorted sector on all major US stock exchanges, reflecting an unfavorable outlook for consumer demand due to persistent inflation, rising interest rates and the possibility of a recession. In the second quarter, consumer discretionary also topped all sectors for lowered corporate guidance.

Biggest deals

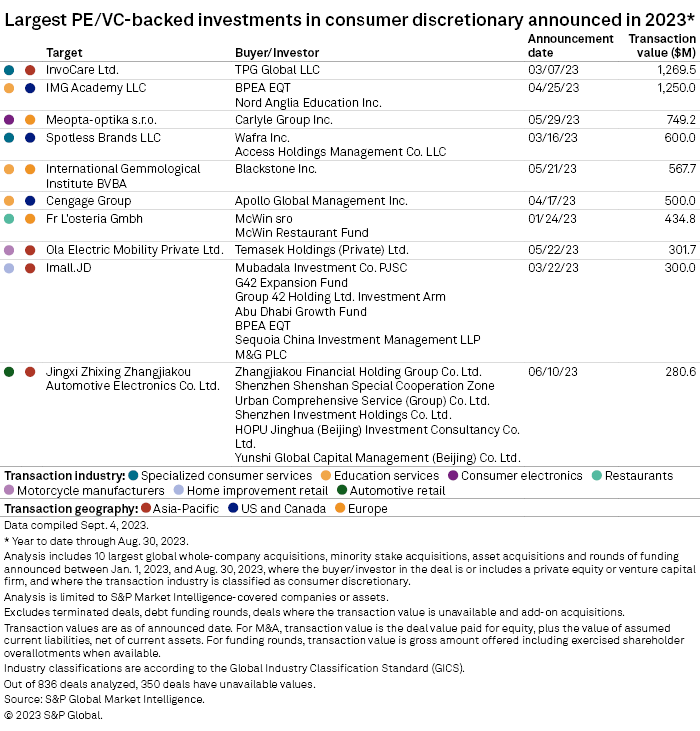

Through Aug. 30, the largest private equity transaction in the consumer space thus far in 2023 is TPG Global LLC's proposed acquisition of InvoCare Ltd., an Australia-listed provider of funeral services, for roughly $1.27 billion.

Deals involving educational services accounted for three of the top 10 consumer discretionary private equity deals so far this year.

The first was an investor group including BPEA EQT and Nord Anglia Education Inc., which acquiring sports academy IMG Academy LLC from Endeavor Group Holdings Inc. The other two were Blackstone Inc.'s acquisition of the International Gemological Institute from a subsidiary of Fosun International Holdings Ltd. in a deal valued nearly $568 million and Apollo Global Management Inc.'s participation in a $500 million funding round for Cengage Learning Inc.

Top subsectors

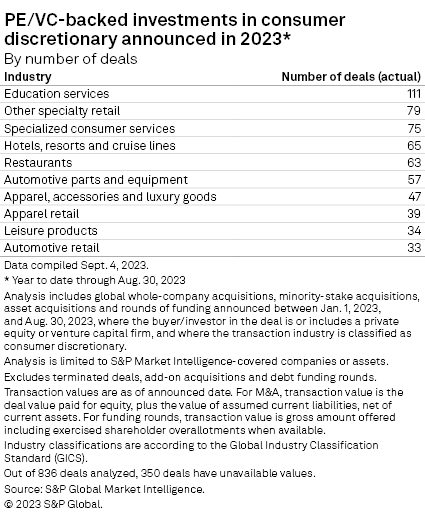

Private equity was involved in 111 announced deals in the consumer discretionary sector year to date through Aug. 30. The education services subsector was the standout in the second quarter with the value of private equity-backed deals in that space globally jumping roughly 47% year over year.