Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Aug, 2023

By Hailey Ross

Kemper Corp. failed to impress investors this week after reporting weak second-quarter earnings and announcing plans to exit its preferred auto and home business.

The Chicago-based property and casualty company struggled in the quarter, in part due to a large amount of catastrophes.

Kemper reported a net loss of $97.1 million, or $1.52 per share, for the second quarter, compared to the net loss of $72.2 million, or $1.13 per share, a year ago. The 2023 second-quarter net loss also included a $45.5 million after-tax charge due to the impairment of the goodwill asset related to the preferred property and casualty insurance segment.

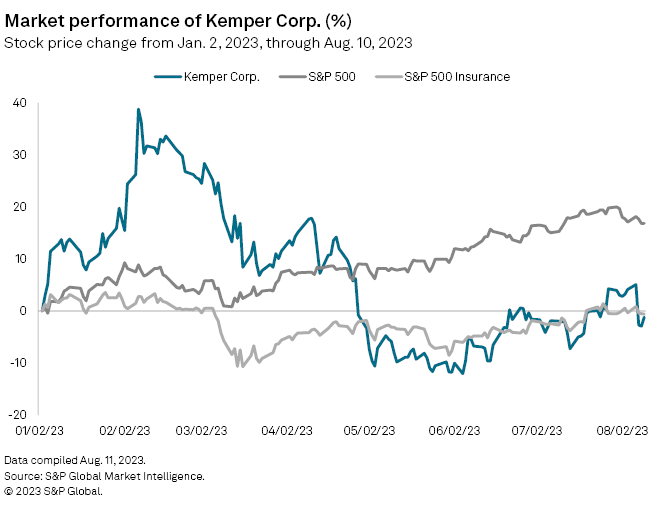

Kemper's stock was down 5.4% to $48.29 for the week as of midafternoon Aug. 11. While relatively flat year to date, the stock is down considerably from its year-to-date high of $68.05.

In an interview, Piper Sandler analyst Paul Newsome said although the company lost a significant amount of money in the quarter, there are signs that its underlying business is stabilizing.

'Right' decision to exit

Kemper made the "right decision" to shut down its preferred auto and home business, Newsome said, although some investors were likely hoping the company would have been able to sell it instead.

"It's been a very long time since the business delivered consistent profitability," Newsome said. "I think there were some investors that were a little disappointed that they weren't able to find a buyer and realize some return on the business."

The move fits in with the industrywide trend of trying to contend with the enormous claims inflation that has come out of the COVID-19 pandemic, the Piper Sandler analyst said, adding that it is a business in which it is "difficult" to make money right now.

JMP Securities analyst Matthew Carletti said in a note that Kemper's management team has a "firmer grasp than most" on the economics of its business.

"We have a high degree of confidence in management's ability to guide the business through the current inflationary time period and ultimately put the company in a much stronger position to take advantage of market dislocations," he said.

Kemper's specialty auto book outside of California is near rate adequacy, the JMP analyst said. In the Golden State, Kemper has taken "significant' non-rate action to go with a recently approved rate increase of about 30%.

"Over time, Kemper expects California to become a smaller part of the company as newer geographies gain scale," Carletti said.

Kemper did not respond to requests for comment before publication.

Devastation in Hawaii

This week also brought news of a historic catastrophe in Hawaii where wildfires are wreaking havoc across the island of Maui and claiming dozens of lives.

The Allstate Corp. is the top public US-based insurer that provides homeowners coverage in Hawaii, with an 8% market share.

Insurers are projected to field a variety of claims in the coming months, including claims for auto, boat, business property, homeowners and travel insurance, according to the American Property Casualty Association.

Allstate's stock was flat for the week around midafternoon on Aug. 11.

The S&P 500 fell 0.24% to 4,467.20 for the week ending Aug. 11 as of midafternoon on the final day of trading. The S&P 500 US Insurance index was up 0.3% to 595.09.