Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Aug, 2023

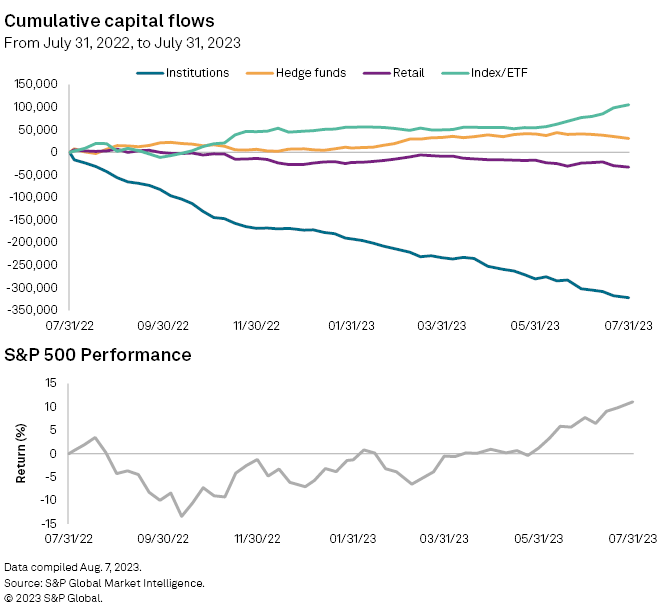

Institutional investors slowed their sell-off of US stocks in July, signaling a potential turn to buying into the rally in US equity markets.

Institutions sold a net $19.79 billion of stocks in July, down from the $21.74 billion of outflows in June and the average of $26.85 billion over the past 12 months, according to the latest data from S&P Global Market Intelligence. Institutional investors have shed a net of about $332.14 billion in stocks over the past 12 months.

The slowing of outflows shows that institutional investors are becoming more bullish and believe that the rise in the stock market will likely be sustained, said Christopher Blake, executive director of S&P Global Issuer Solutions. It may also be a signal of some fear of missing out on the rally in US equity markets. The S&P 500 increased just over 3% in July and rallied 20% from the start of the year to the end of July.

Shifting course

While institutions slowed their selling, hedge funds appeared to reverse course in July and retail investors increased their outflows.

Hedge funds sold off $10.15 billion in stocks in July, after buying an average of $2.56 billion each month over the past 12 months.

Retail investors, meanwhile, sold off $9.25 billion, up from $6.45 billion in June and the $2.75 billion average over the past 12 months.

"Hedge funds were bullish much earlier in the market rally and now are locking in some profits while also being cautious of the potential for a pullback given mixed fundamental and economic data behind the market rally," Blake said. "Retail investors also seem to be more focused on locking in some profits at this stage, suggesting less belief the rally will continue near-term."

Retail investors have sold off $32.95 billion of stocks over the past 12 months while hedge funds have bought $30.73 billion.

Changing exposure levels

Retail investors in July reduced their exposure in nearly every sector, except healthcare and communication services. Retail investors did not change their exposure to consumer staples.

Hedge funds similarly reduced their exposure to communication services by 4.9% as did institutions, which cut exposure by 0.6%, the most of any sector in July.

The move out of communication services, as well as information technology stocks, is likely a reflection of the rally in stocks expanding outside of the handful of mega cap stocks that carried the rally for much of the year, Blake said.

"Recent months have shown the rally broadening out a bit into other sectors, suggesting the selling in communication services has been a rotation play for institutional investors out of higher performing names in order to invest in some weaker sectors as the rally broadens," Blake said.

This article highlights capital flows data available from S&P Global Issuer Solutions. Data and insights for this article were compiled by Matthew Albert, Mark Buckles and Christopher Blake.

For more information on this product, please contact Christopher Blake, executive director, at christopher.blake@spglobal.com.