Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Aug, 2023

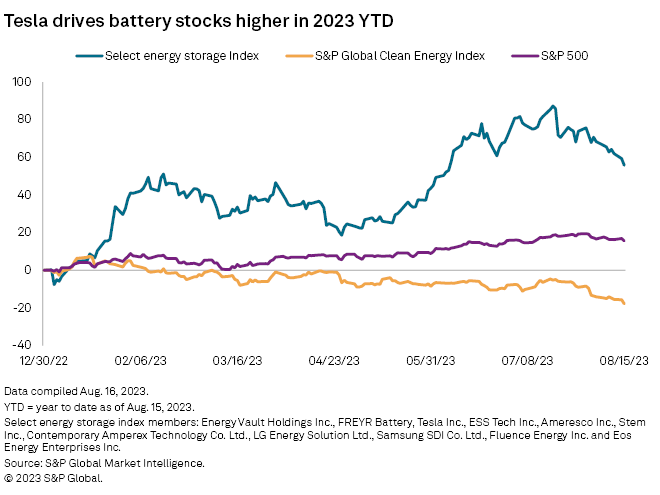

A select index of companies across the global energy storage industry is outperforming the S&P 500 by a wide margin in 2023, propelled largely by Tesla Inc. But the vertically integrated electric vehicle and battery storage powerhouse, one of the world's 10 largest publicly traded companies by market capitalization, is not the sector's only high flyer.

Five of the 11 companies selected by S&P Global Commodity Insights, ranging from makers of lithium-ion and alternative batteries and their components to suppliers of energy storage systems and electric vehicles, have posted double- to triple-digit gains so far this year. Overall, the select energy storage index was up roughly 56% as of Aug. 15, compared with the S&P 500's 15.6% rise, reflecting broad investor enthusiasm for companies seeking to fuel the next phase of the energy transition.

All of the companies stand to benefit from substantial US government support, including lucrative battery manufacturing and market incentives in the Inflation Reduction Act, signed by President Joe Biden one year ago. The law has improved the outlook for mobile and stationary storage markets and has unleashed at least $63 billion in private- and public-sector investment commitments into the country's underdeveloped battery supply chain since it was enacted in August 2022.

'Biggest winner'

Tesla's Nasdaq-listed stock, by far the heaviest-weighted company in the select energy storage index, was up roughly 91% this year by mid-August after beating the S&P Capital IQ estimate for normalized EPS by 11% in the second quarter of 2023. The company, which posted GAAP net income of $2.7 billion in the quarter, is rapidly expanding its energy business to complement its electric vehicle empire, both of which stand to accelerate their growth thanks to the US climate law.

Tesla is "the biggest winner from the Inflation Reduction Act," CFRA Equity Research analyst Garrett Nelson said in an Aug. 12 note to clients.

At the other end of the commercialization spectrum is Eos Energy Enterprises Inc., an upstart developer of zinc-based batteries that had gained nearly 138% as of Aug. 15, albeit rising from almost penny-stock territory. The company posted an adjusted net loss of 42 cents per share for the second quarter, missing the S&P Capital IQ estimate by approximately 56%.

Energy storage system integrator Fluence Energy Inc.'s share price has risen about 43% in 2023. The company, launched in 2018 by independent power producer AES Corp. and engineering giant Siemens AG, posted a GAAP net loss of 20 cents per share in its fiscal third quarter ended June 30.

Although Fluence's GAAP loss and revenues both beat the S&P Capital IQ consensus by about 13%, and the company boosted its guidance, analysts at Roth Capital Partners flagged concerns over the company's gross profit margins in an Aug. 11 client note. Roth Capital raised its revenue estimates for Fluence to $2.05 billion for 2023 and $2.79 billion for 2024 but lowered its 12-month stock price target to $27 per share from $31 per share on "more conservative" gross margins.

Shares in Contemporary Amperex Technology Co. Ltd. (CATL), the world's largest battery-maker, were up about 6% as of mid-August. The China-based company, which has a licensing partnership with Ford Motor Co. to provide know-how for the automaker's planned $3.5 billion battery factory in Michigan, missed the S&P Capital IQ consensus estimate for adjusted net earnings in the second quarter by 65%.

Jian Xiong Lim, an equity analyst at CFRA, in an Aug. 12 note projected stabilizing margins despite recent battery price discounts for customers, pointing to lower battery material prices.

"We are positive on CATL's strong cost management and increasing scale efficiency," the analyst said, rating the company's stock, listed in Shenzhen, China, as a "strong buy."

Shares of South Korean rival LG Energy Solution Ltd., a subsidiary of LG Chem Ltd. that is spending several billion dollars on a fleet of new stationary and EV battery factories in the US, gained 24% in 2023 as of Aug. 15. Samsung SDI Co. Ltd., another South Korean battery-maker whose largest shareholder is Samsung Electronics Co. Ltd., was up just over 1%.

All but two of the 11 select energy storage index constituents were ahead of the S&P Global Clean Energy Index, composed largely of solar and wind companies, which was down 17.8% this year through mid-August. ESS Tech Inc., an Oregon-headquartered startup listed on the NYSE that develops iron-based flow batteries, shed 43%. California-based Stem Inc., an energy storage system technology provider, was down about 31%.

Ameresco Inc., an integrator of renewable energy and battery storage systems, and European battery startup Freyr Battery were both down roughly 15% as of mid-August.

Post 'SPAC-apalooza'

Energy Vault Holdings Inc., a developer of gravity-based energy storage systems that has expanded into lithium-ion battery systems, has advanced approximately 15% this year. The company was part of a wave of energy storage upstarts that went public through special purpose acquisition company transactions in 2021 and 2022, which included Eos, ESS, Freyr and Stem.

All five of those companies have share prices well below their market debuts, and most remain in the starting blocks. But they all have high hopes of near- to mid-term earnings and revenue breakthroughs.

"The important thing for us is to continue to differentiate ourselves by delivering on what we say we're going to do," said Jeremy Bezdek, executive vice president of global corporate development at Freyr and president of the company's US business. Bezdek referred to that period as "SPAC-apalooza" when he was managing director at Koch Strategic Platforms LLC, the investment arm of Koch Industries Inc., which funded Freyr, ESS, Eos and a host of other battery startups.

So far, the company appears to be doing that. Freyr started a demonstration plant in Norway in June ahead of its aspired ramp-up on both sides of the Atlantic Ocean by 2025.

"That's when we start to see a shift on the income statement and start to see some real top-line numbers," Bezdek said in an interview.

The company recently unveiled plans to move its headquarters to the US and raise an additional $1 billion in equity for a major planned battery factory in Georgia.

Post "SPAC-apalooza," such early-stage companies are under the same close scrutiny from equity analysts as the sector heavyweights.

"It did put, I think, companies in a position to raise public capital probably earlier than they would have if the SPAC market wasn't as aggressive," Bezdek said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.