Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Aug, 2023

By Ben Meggeson and Cheska Lozano

Asset quality at large Spanish, Italian and Austrian banks is forecast to

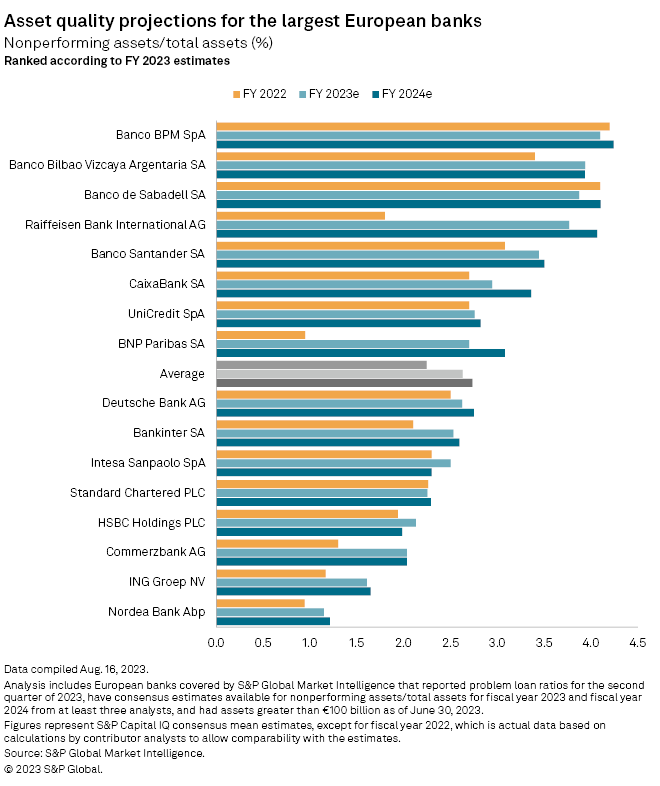

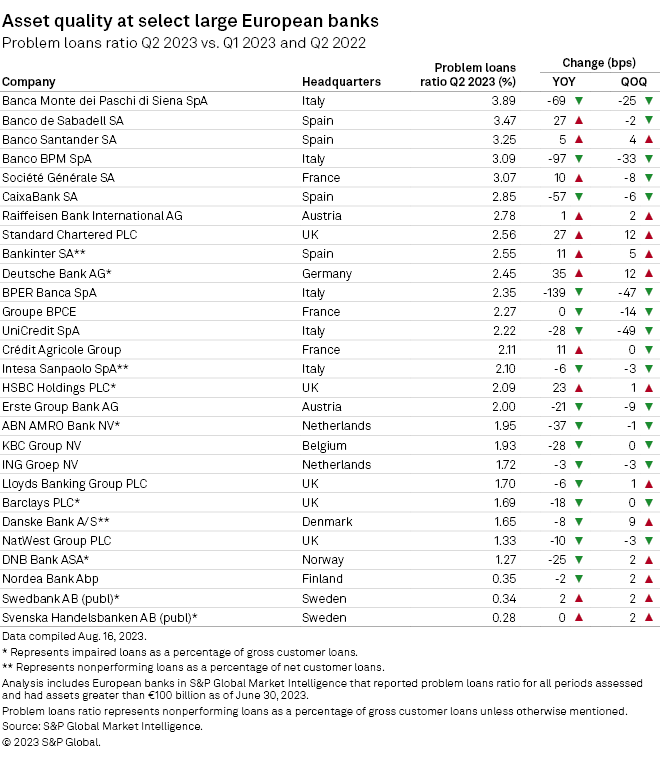

In a sample of the biggest banks in the continent, Spain-based Banco Santander SA, Banco Bilbao Vizcaya Argentaria SA, Banco de Sabadell SA and CaixaBank SA, Italy-based UniCredit SpA and Banco BPM SpA, and Austria-based Raiffeisen Bank International AG (RBI) are expected to have the highest nonperforming asset (NPA) ratios for full year 2023, ranging from 2.76% to 4.10%.

All are forecast to report a worsening of asset quality in 2024, with ratios of between 2.82% and 4.24%, except BBVA, the ratio of which is set to stay the same, according to S&P Global Market Intelligence mean consensus estimates.

The average NPA ratio for all banks in the sample is forecast to be 2.63% for 2023 and 2.73% for 2024.

Most banks expect asset quality to deteriorate as an uncertain economic outlook and tighter monetary policy in the face of high inflation dampen consumer and business confidence, the European Banking Authority (EBA) said in July.

Spanish banks face the greatest risk from leveraged corporate debt and consumer finance portfolios in the current environment, according to analysts at Scope Ratings. A decline in nonperforming loan (NPL) ratios since 2019 "seems to have reached the bottom," they wrote in an Aug. 10 report.

That said, the buildup of provisions is seen as "an adequate shield against materially higher impairments," and there have been positive signs, with some Spanish banks revising their cost-of-risk guidance slightly downward for the year.

Italy's banks remain cautious about future asset quality due to high inflation and a sluggish economy as well as increased loan-loss provisions in the first half of 2023, analysts at DBRS Morningstar wrote in an Aug. 8 report. However, new NPLs were "manageable" and high levels of net interest income and tight cost management would cushion against worsening asset quality, they said.

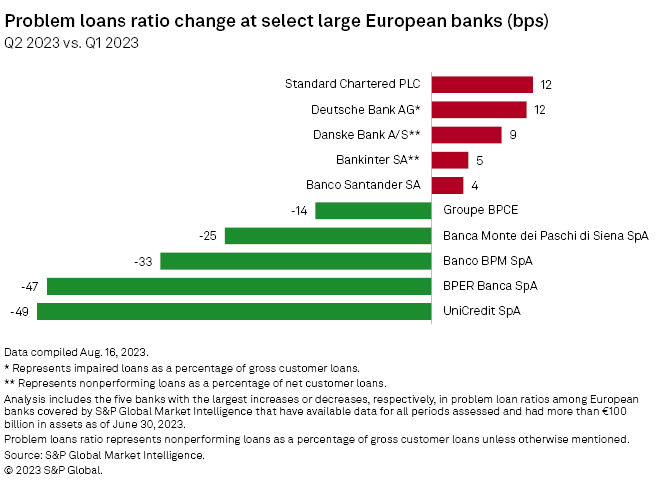

Italian lenders in the sample showed the greatest improvement in their problem loans ratio over the course of the second quarter, Market Intelligence data shows.

In an adverse economic scenario, European banks' exposure to the hospitality and construction sectors would pose the biggest threat to their asset quality, according to the EBA's latest stress test. The results of the test, published in late July, suggested banks were well positioned overall to cope with challenging conditions. They entered the 2023 test with an average nonperforming exposure ratio of 1.6%, compared with 2.1% at the outset of the 2021 test.

Spanish banks were among the best performers in the stress test, which demonstrated their strong capital ratios and resilience to downturns, Scope Ratings said. Italian banks were also shown to be more resilient than the European average, with liquidity remaining sound in spite of recent sizable paydowns of borrowings under the ECB's targeted longer-term financing operation III cheap money program, according to DBRS Morningstar.

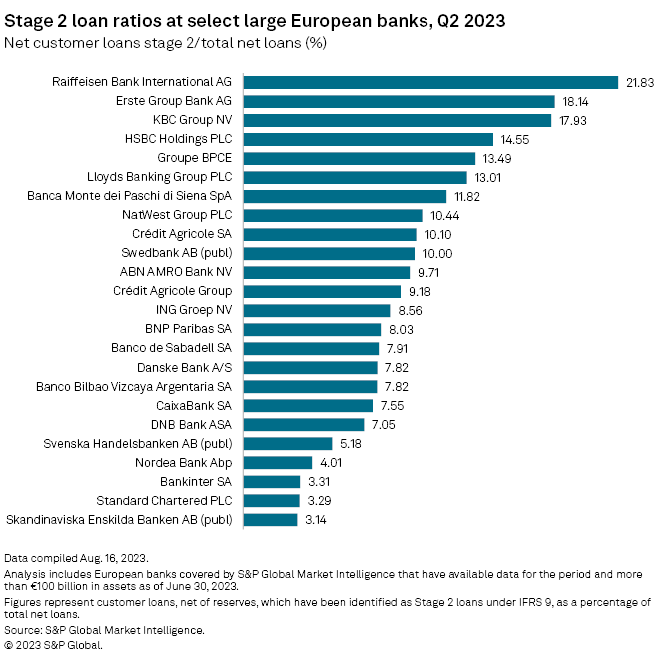

RBI, which has the largest exposure to Russia among Europe's banks, recorded the highest ratio of loans threatening to go bad. Loans classified under IFRS 9 accounting as stage 2 — those for which credit risk has increased significantly since origination — totaled 21.83% of total net loans at the end of June, Market Intelligence data shows.