Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Jul, 2023

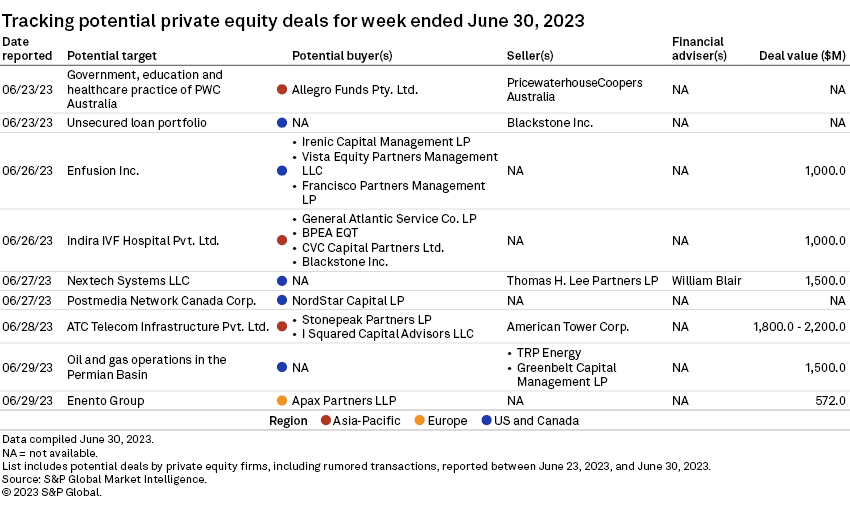

S&P Global Market Intelligence presents In Play Today, a periodic summary of potential private equity deal activity, including rumored transactions. This summary is based on information obtained on a best-efforts basis and may not be inclusive of all potential deal activity.

– Allegro Funds Pty. Ltd. is looking to buy PwC Australia's government, education and healthcare practice, Reuters reported, citing a person familiar with the matter.

– Blackstone Inc. is planning the sale of an unsecured Spanish loan portfolio with a face value of €2 billion, Reuters reported, citing two sources with knowledge of the process.

– Francisco Partners Management LP, Irenic Capital Management LP and Vista Equity Partners Management LLC are among the suitors interested in taking over Enfusion Inc., Reuters reported, citing people familiar with the matter. Enfusion, which provides cloud-based portfolio management and risk systems to investment funds, has a current valuation of nearly $1 billion.

– Blackstone, General Atlantic Service Co. LP, BPEA EQT and CVC Capital Partners Ltd. are in a race to take over Indira IVF Hospital Pvt. Ltd., Mint reported, citing two people close to the matter. The private equity firms are eyeing a majority stake in the India-based in-vitro fertilization treatment chain, which is asking for a valuation of more than $1 billion. The prospective buyers are expected to submit second-round bids in four to six weeks, according to one of the sources.

– Thomas H. Lee Partners LP. is looking to sell Nextech Systems LLC at a valuation of about $1.5 billion, Reuters reported, citing people familiar with the matter. The private equity firm, which has enlisted William Blair to run the sale process, may decide to keep a minority stake in the healthcare software company, according to the sources.

– NordStar Capital LP is discussing a potential merger of some operational assets of Canadian publishing companies Toronto Star Newspapers Ltd. and Metroland Media Group Ltd. with Postmedia Network Canada Corp., Reuters reported. The potential deal will see NordStar taking a 50% voting interest and 44% economic interest in the combined company and retaining a 65% interest in Toronto Star.

– I Squared Capital Advisors LLC is in pole position to acquire a roughly 90% stake in American Tower Corp.'s Indian unit, ATC Telecom Infrastructure Pvt. Ltd., The Economic Times reported, citing people aware of the matter. Stonepeak Partners LP is also interested in buying the stake, with bids expected in the range of $1.80 billion to $2.20 billion, according to the report.

– TRP Energy LLC is considering the possible sale of its oil and gas operations in the Permian basin for more than $1.50 billion, Reuters reported, citing people familiar with the matter. Greenbelt Capital Management LP owns a controlling stake in TRP.

– Finland-based digital business and consumer information services provider Enento Group Oyj is weighing options, including a possible sale, and Apax Partners LLP is evaluating the company, Bloomberg News reported, citing people with knowledge of the matter. Enento reportedly has a market valuation of approximately €526 million.