Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Jun, 2023

The US Federal Reserve decided against raising interest rates on June 14 for the first time since its push to tame spiking inflation began more than a year ago. The pause is likely to be short-lived, however, as the central bank signaled that it will resume raising interest rates as soon as July and push them higher than previously expected.

The median forecast among Fed officials calls for the benchmark federal funds rate to hit 5.6% at the end of 2023, roughly 50 basis points higher than its current level. Fed officials unanimously voted June 14 to not raise rates in June, following 10 straight rate hikes since March 2022 that pushed the federal funds rate above 5% for the first time since 2007.

Fed Chairman Jerome Powell said the June pause will allow officials to assess inflation, jobs and other economic data before considering another hike at the July meeting of the rate-setting Federal Open Market Committee. The fresh projection, an increase from prior quarterly predictions released by the Fed, signals that one of the most aggressive monetary policy tightening cycles in Fed history still has room to run.

"You can bank on at least one more rate hike this year, maybe two and even three isn't impossible," said Joel Prakken, chief US economist at S&P Global Market Intelligence.

Rising forecasts

One year ago, the median forecast within the Fed was for the federal funds rate to top out at 3.8% by the end of 2023. The new forecasts show expectations of higher rates, with median predictions rising to 4.6% by the end of 2024 and settling at 3.4% at the end of 2025.

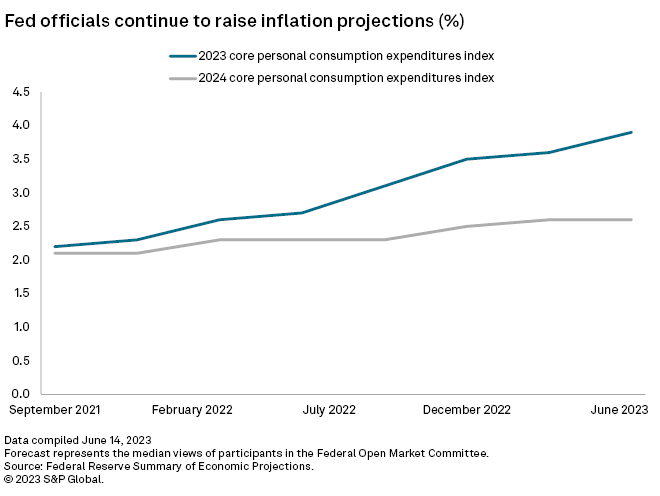

In addition, Fed officials upped their views for inflation this year, forecasting the personal consumption expenditures (PCE) index excluding food and energy prices, the "core" inflation measure the Fed is aiming to bring down to 2%, to increase to 3.9% by the end of 2023. A year ago, Fed officials projected that this measure would be 2.7% at the end of this year.

Market Intelligence economists predict May's core PCE reading to be 4.7% in May, roughly flat from April. That data will be released on June 30.

A separate measure of inflation, the core consumer price index, increased 5.3% from May 2022 to May 2023 after a seasonal adjustment, the US Bureau of Labor Statistics reported on June 13.

'Top priority'

Inflation remains well above target and the Fed is not easing up in its fight to bring it down, Powell said during a June 14 press conference detailing the Fed's decision to pause hiking rates.

"Getting price stability back and restored will benefit generations of people as long as it's sustained," Powell said. "It really is the bedrock of the economy and you should understand that is our top priority."

Core PCE year-over-year growth has been stalled at about 4.7% since late 2022 and the Fed is likely to keep considering hiking rates until this measure starts to move down "meaningfully," said Callie Cox, a US investment analyst at eToro.

Rate cuts, Cox said, are "out of the question" for now, echoing the point Powell made during his press conference.

'Worst possible scenario'

What the Fed does next hinges entirely on where prices go.

"Everything will depend on the inflation trajectory," said Ruslan Lienkha, chief of markets at financial technology platform YouHodler.

By boosting their interest rate and inflation forecasts, Fed officials are preparing financial markets for the "worst possible scenario," Lienkha said.

"After the previous Fed meeting, financial markets had strong expectations of rate cutting by the end of this year, which in our opinion, were over-optimistic expectations as a recovery of the world economy is slipping," Lienkha said. "So probably [a federal funds forecast of] 5.6% appeared in the rhetoric just to rebalance market expectations."

Still, with inflation showing some signs of cooling, the Fed may have enough evidence by September to slow the rate of tightening, James Knightley, chief international economist with ING, wrote in a June 14 note.

Student loan repayments are expected to restart in September after a three-year pause, giving Fed officials the motive to signal that its rate-hiking cycle is over.

"We also think that the ongoing effects of previous rate hikes and the hit from tighter lending conditions will be more apparent in the data, and that will be the catalyst for the Fed to signal rates aren't going any higher," Knightley wrote.