Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 May, 2023

Spain's largest banks are confident of earning more income from domestic lending in 2023 than originally expected following a strong first-quarter performance.

Further rises in interest rates since the beginning of the year, and expectations of more hikes to come, are improving the banks' outlooks for domestic net interest income (NII). Slower-than-expected increases in interest expenses, known as the deposit beta, are also boosting NII — the difference between interest revenues and interest expenses.

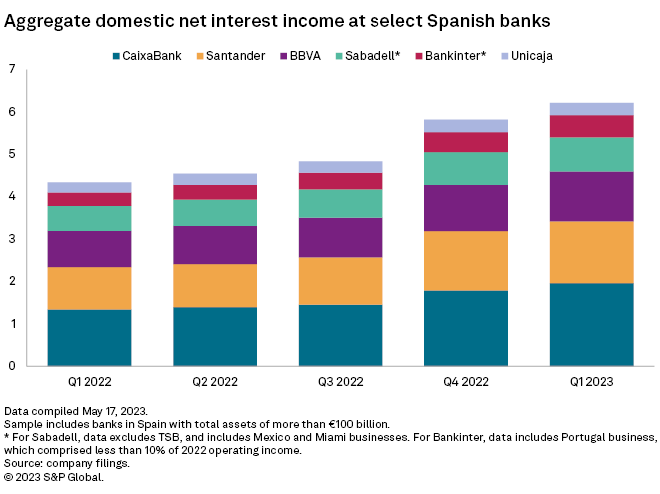

Aggregate domestic NII at Spain's six largest lenders — CaixaBank SA, Banco Santander SA, Banco Bilbao Vizcaya Argentaria SA, Banco de Sabadell SA, Bankinter SA and Unicaja Banco SA — increased almost 7% quarter on quarter in the first three months of 2023 to €6.21 billion, according to company filings.

"We have a good combination of resilience in the [loan] portfolio and, at the same time, upside in NII going forward," CaixaBank CEO Gonzalo Gortázar said during a first-quarter earnings call.

CaixaBank, Spain's largest domestic lender, saw NII in its home market increase almost 10% quarter-on-quarter to €1.96 billion in the first three months of the year.

"At the [fourth-quarter 2022] results presentation, our NII guidance for 2023 was a repeat of the same growth in 2022, which was 20% to 21%," Bankinter CFO Jacobo Diaz said. "We are now upgrading our NII growth guidance a little bit to close to 25%."

Bankinter operates in Spain, Portugal and Ireland. Spain accounted for more than 90% of the bank's revenues in 2022.

Not all positive

Unicaja was the only one of Spain's six largest lenders to register a decrease in NII in the quarter. The bank, which is also the only one of the six to operate exclusively in Spain, saw NII fall by 0.3% quarter on quarter to €293 million.

The higher proportion of mortgage lending in Unicaja's loan book compared to its domestic peers accounted for its relatively weak NII performance, CFO Pablo González said during an earnings call.

"Obviously, [our NII growth] takes longer than peers' to realize because the mortgage portfolio is not like the working capital lending or the short-term lending or corporate lending other peers have," said González. "But it will show up in the numbers, as we have started to see in this quarter."

Deposit beta boost

A slower-than-expected pass-on of rising interest rates to depositors is also boosting Spanish banks' NII growth prospects.

"We expect the deposit beta to increase over time — it's quite low," Sabadell CEO César González-Bueno said during a first-quarter earnings call. "The first quarter [deposit beta] has behaved very well."

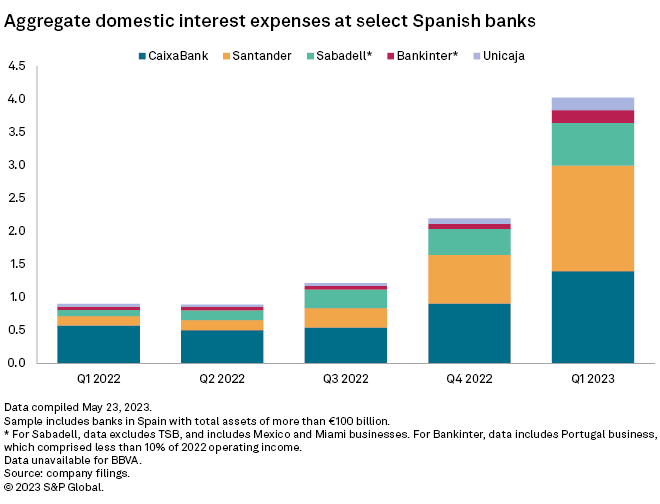

Aggregate domestic interest expenses at five of Spain's six largest banks — data for BBVA is unavailable — grew more than 83% quarter on quarter in the first three months of 2023 to €4.02 billion.

Bankinter saw the largest increase, up more than 170% quarter on quarter to nearly €194 million. Unicaja and Santander also saw interest expenses more than double from the previous quarter.

CaixaBank enjoyed the lowest increase in interest expenses in the first three months of the year at about 54% quarter on quarter to almost €1.4 billion.

"So far, the [deposit beta] situation is evolving for us better than our initial expectation," CaixaBank CFO Javier Pano said during a first-quarter earnings call. "Let's see if we can sustain that, which we think we'll do."