Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 May, 2023

By Dylan Thomas and Muhammad Hammad Asif

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

When TPG Inc. announced May 15 that it agreed to a $3 billion deal to acquire investment firm Angelo Gordon & Co. LP, the listed private equity firm touted the addition of a $55 billion credit business to its portfolio, increasing its exposure to a strategy currently in demand with institutional investors.

But there was more to the deal for TPG, including the addition of new products targeting retail investors, CEO Jon Winkelried explained on the firm's first-quarter earnings call that same day.

"Our ability to deliver product to our retail channel partners is greatly enhanced by this transaction," Winkelried said.

The potentially massive individual investor market was a hot topic on first-quarter earnings calls, with Blackstone Inc. President Jonathan Gray reiterating his estimate that wealthy individuals hold $85 trillion in investable assets globally. Compared to private equity's typical partners, institutional investors who have 25%-30% of their portfolios in alternative assets, those individual investors have just 1%-2% of their portfolios in alternatives, Gray said.

The conversation around further opening alternative investments to individual investors has been going on for some time, but it has taken on a new urgency as fundraising slows. Institutional investors have shown a reduced appetite for alternatives, particularly for the firm's private equity strategies.

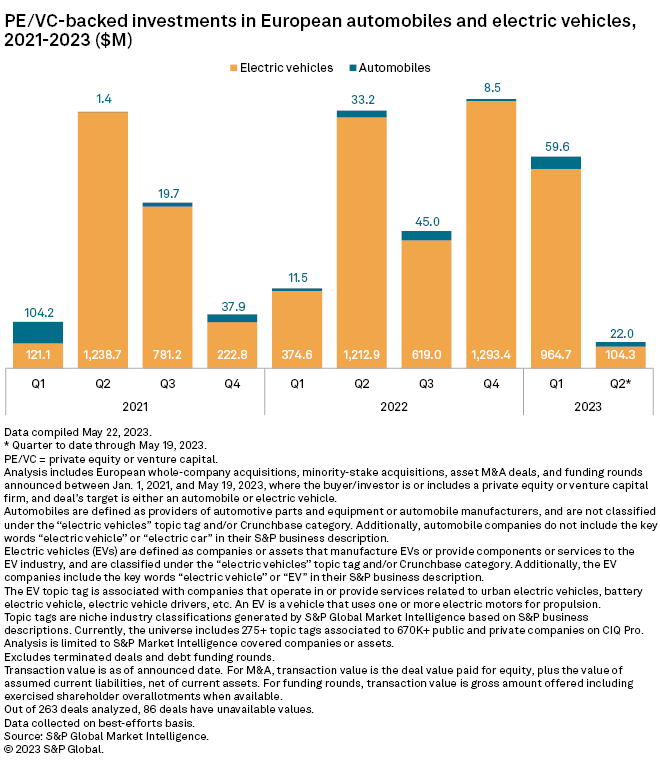

CHART SECTION: Pending combustion engine ban draws PE investment to European EV sector

⮞ Private equity and venture capital investment in Europe's electric vehicle sector totaled $964.7 million in the first quarter, more than 2.5 times the total from the same period a year earlier.

⮞ Private equity investment in the European automobile sector totaled just $59.6 million in the first quarter by comparison.

⮞ Europe's electric vehicle sector is drawing investors' attention ahead of a European Union ban on the sale of new combustion engine automobiles slated to take effect in 2035.

TOP DEALS AND FUNDRAISING

– Funds managed by private equity giant Blackstone Inc. acquired International Gemological Institute, a Belgian provider of independent certification of diamonds, gemstones and jewelry, from Shanghai Yuyuan Tourist Mart (Group) Co. Ltd.

– Silver Lake Technology Management LLC agreed to buy a minority stake in TeamSystem Holding SpA from Hellman & Friedman LLC for €600 million. The seller will retain a majority stake in the Italian cloud software provider.

– GTCR LLC raised $11.5 billion at the close of its GTCR Fund XIV. The vehicle includes $11 billion in limited partner commitments and about $500 million from the private equity firm.

– QED Investors LLC, a financial technology venture capital firm, garnered a total of $925 million in capital commitments, across two newly closed funds. The vehicles are Fund VIII, an oversubscribed $650 million early-stage fund, and Growth II, a $275 million early growth-stage fund.

MIDDLE-MARKET HIGHLIGHTS

– Amulet Capital Partners LP added Alliance Clinical Network Inc., a clinical site platform, to its portfolio.

– Baird Capital provided growth capital to London-based financial technology platform Freemarket through its Global Private Equity Fund.

– First Israel Mezzanine Investors Ltd. agreed to buy about 12.6 million ordinary shares of Israel-based biopharmaceutical company Kamada Ltd. in an approximately $60 million private placement.

FOCUS ON: FOOD

– Arbor Investments agreed to sell DPI Specialty Foods Inc., which distributes chilled and frozen specialty products, to KeHE Distributors LLC.

– An investor group sold plant-based seafood startup Current Foods Inc. to Wicked Foods Inc., doing business as Wicked Kitchen. Greatpoint Investment Management LLC, UGVP Management LLC, Astanor Ventures, Electric Feel Ventures and Tenacity Venture Capital were among the sellers, according to S&P Global Market Intelligence data.

– AirTree Ventures Pty. Ltd., Grok Ventures Pty. Ltd. and Skip Capital Pty. Ltd. sold Milkrun AU Pty. Ltd. to Woolworths Group Ltd., which will fold the Australian online grocer into its Metro60 existing grocery delivery service, Market Intelligence data shows.

For further private equity deals, read our latest In Play report, which looks at potential private equity-backed M&A, including rumored transactions, each week.