Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 May, 2023

France's largest listed lenders expect significant improvement in income from domestic lending in 2024 after a particularly weak first-quarter performance.

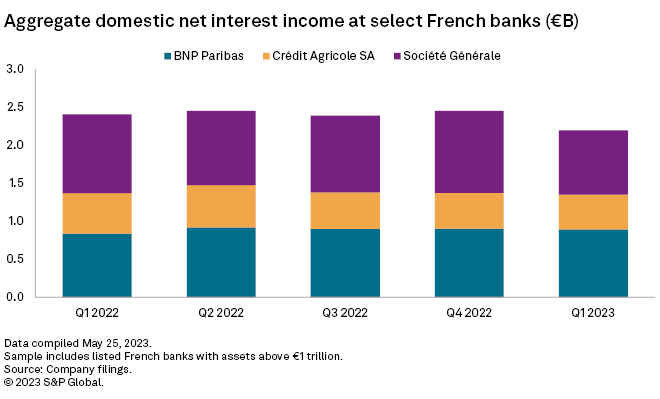

Aggregate domestic net interest income (NII) — the difference between interest revenues and interest expenses — at BNP Paribas SA, Crédit Agricole SA (CASA) and Société Générale SA fell more than 10% quarter on quarter to €2.19 billion in the first three months of 2023, according to company filings. The drop was the most severe quarterly decline since the European Central Bank began hiking rates in July 2022 and pushed aggregate domestic NII at the banks to its lowest level in the last five quarters.

Each of the three banks saw domestic NII fall in the first quarter despite most other European banks enjoying a surge in revenues from rising interest rates.

"As you've seen with all the large [banks] in this market, there are specificities in France that mean we will have, until the beginning of next year, a decrease in net interest margin, but with a rebound in 2024," SocGen CEO Frédéric Oudéa said during a first-quarter earnings call. "We are confident with the trajectory of our French retail business."

Banks in France are facing NII headwinds from a combination of factors, including rising deposit costs due to increases in the rates of regulated savings schemes, largely long-term fixed-rate loan books and other regulations limiting the pace at which banks can offer higher rates.

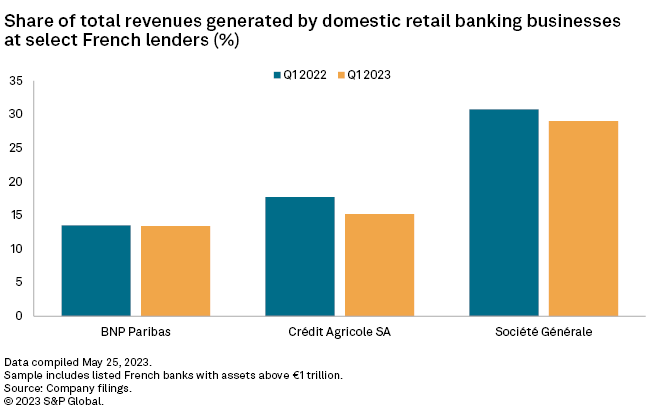

SocGen, which relies more heavily on income from French retail banking than its two listed peers,

Beyond NII pressures specific to the French market, SocGen's NII is also suffering from hedges it placed on its net interest margin in early 2022 before interest rates began to rise rapidly. Furthermore, it and other eurozone banks are losing hundreds of millions in additional NII from the premature end of an ultra-cheap European Central Bank funding program.

"The decrease in NII in the first quarter comes from a fall in loan origination and the [end of the targeted longer-term refinancing operations], which is a series of negative impacts that will not be further replicated going forward," said Oudéa.

CASA and BNP experienced a less severe quarterly decline in domestic NII in the first three months of the year, at negative 3.2% and negative 1%, respectively. BNP's performance was helped by its "low relative exposure to regulated savings" accounts such as Livret A, CFO Lars Machenil said.

The ongoing squeeze on NII saw the share of total revenues generated by the three lenders' French retail banking businesses fall year over year, company filings data shows. CASA experienced the largest decline, of 250 basis points to 15.2%, in the 12 months to the end of March, while SocGen fell 180 bps to 29% and BNP 10 bps to 13.4%.

Still, CASA's retail banking operations in other markets, which are enjoying the benefits of higher interest rates, meant that it could offset the decline from its domestic business.

"The pressure on net interest income at [our French retail bank] is more than compensated by the dynamics that we see in Italy, Poland and in Egypt," said Deputy CEO Jérôme Grivet.