Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 May, 2023

By Karl Angelo Vidal and Ali Imran Naqvi

S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

Detroit, Philadelphia, Cleveland and Houston are the only four major metropolitan areas in the US where buying a home is cheaper than renting, according to real estate brokerage Redfin Corp.

The median estimated monthly mortgage payment for homebuyers in Detroit stood at $1,296, 24% cheaper than the estimated monthly rent of $1,697. Philadelphia came in second with a 7% ownership discount, followed by Cleveland and Houston with ownership discounts of 4% and 1%, respectively.

On average, the typical home costs 25% more to buy than rent across the 50 most populous metro areas in the US, according to the report.

Redfin said mortgage rates will likely fall below 6% by the end of the year, although it is unlikely rates will return to 3% levels anytime soon.

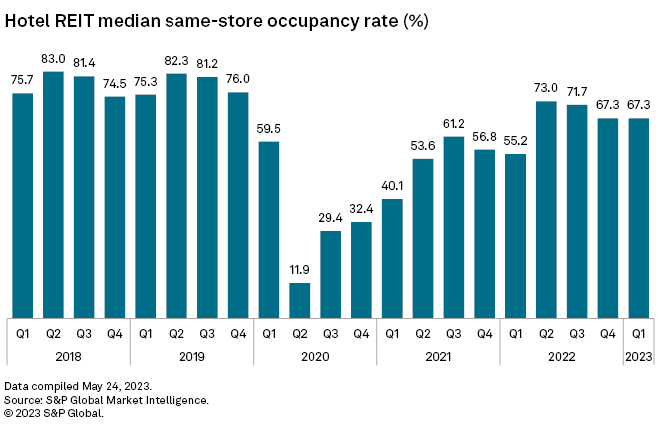

CHART OF THE WEEK: US hotel REITs earnings metrics in Q1 mostly flat QOQ

⮞ Median same-store occupancy of US hotel real estate investment trusts in the first quarter stood at 67.3%, in line with the quarter prior.

⮞ Same-store revenue per available room (RevPAR) followed a similar trend at $164.95 on a median basis, although it was up 20.7% on an annual basis.

⮞ Park Hotels & Resorts Inc. reported the highest same-store RevPAR growth for the quarter, up 36.5% year over year.

Property transactions

– Armada Hoffler Properties Inc. concluded the $215 million acquisition of The Interlock mixed-use development in Atlanta's West Midtown area from SJC Ventures LLC. Armada Hoffler's ownership comprises 311,000 square feet of commercial space and an 835-space garage.

– BKM Capital Partners LP paid more than $280 million to purchase 10 light industrial properties across Los Angeles; Las Vegas; and Portland, Ore. The 35-building portfolio spans more than 1.1 million square feet.

– KKR & Co. Inc. bought the three-building GO|99 South, an industrial park in Phoenix, from an entity linked to developer George Oliver for $165 million, the Phoenix Business Journal reported, citing county records and Vizzda database. The property spans nearly 1.3 million square feet.

Financing

– Joy Construction Corp. and Maddd Equities secured $143 million in financing for their residential project in Brooklyn, NY, The Real Deal reported. The residential development at 202 Tillary St. will comprise 465 units and is expected to be completed in the third quarter of 2025.

– An affiliate of Soho House & Co Inc. obtained a $140 million loan provided by JPMorgan Chase Bank NA and Citi Real Estate Funding Inc. to refinance the Soho Beach House hotel and club in Miami Beach, Fla. The financing was arranged by Walker & Dunlop Inc.

US REIT same-store net operating income growth slowed in Q1

REIT Replay: REIT share prices fall during week ended May 19; broader market up