Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 May, 2023

By Alex Graf and Gaby Villaluz

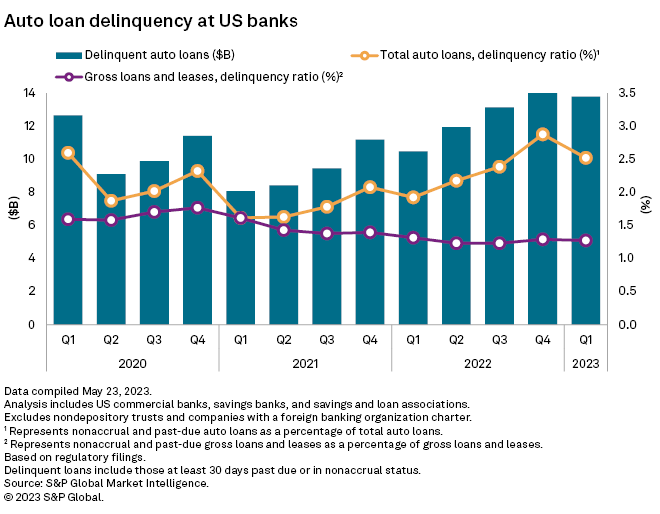

The auto loan delinquency ratio at US banks continued to rise on a year-over-year basis even though it decreased quarter over quarter for the first time since the first quarter of 2022.

The total auto loan delinquency ratio rose 60 basis points year over year to 2.52% in the first quarter, according to S&P Global Market Intelligence data. This marked the fifth straight quarter that the ratio rose when compared to the year-ago period.

The ratio did fall 36 basis points sequentially in the first quarter. It also fell quarter over quarter in each of the previous two first quarters.

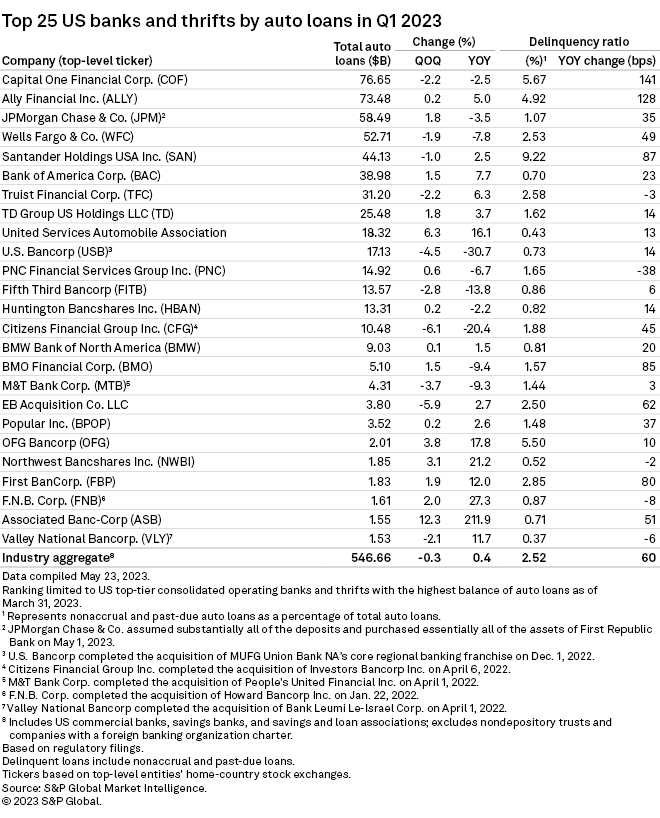

Among the top 25 banks by auto loans, Boston-based Santander Holdings USA Inc. had the highest auto loan delinquency ratio for the third straight quarter, up 87 basis points from the prior year to 9.22%.

Capital One Financial Corp. had the second-highest delinquency ratio, as it climbed 141 basis points year over year to 5.67% in the first quarter.

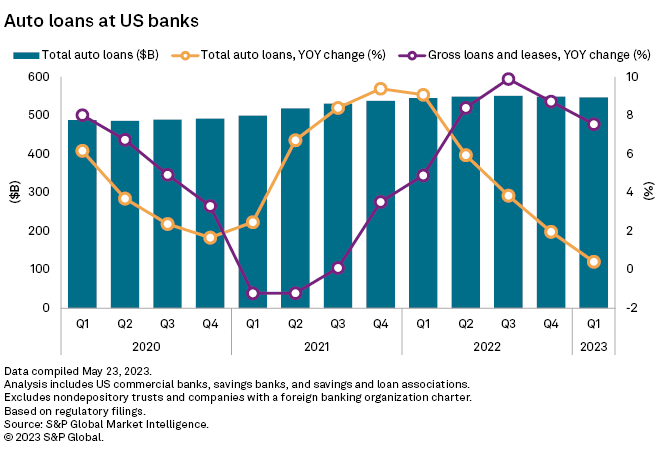

Total auto loans decrease for 2nd consecutive quarter

US banks' collective auto loans declined slightly again in the first quarter to $546.66 billion from $548.39 billion in the linked quarter. Even so, total auto loans were $2.2 billion more than in the first quarter of 2022.

Ally closing in on Capital One's top lender spot

Among the top 25 auto lenders, 15 posted sequential increases in their portfolios, while 10 recorded quarter-over-quarter decreases.

Capital One's auto loans declined 2.2% sequentially to $76.65 billion. The bank held on to its spot as the top auto lender in the country during the first quarter, but Ally Financial Inc. narrowed the gap, finishing the quarter with $73.48 billion in auto loans after a 0.2% sequential gain.

– Access an industry document detailing auto loan holdings.

– View US industry data for commercial banks, savings banks, and savings and loan associations.

A decline in auto originations of 47% year over year and 6% quarter over quarter drove Capital One's decrease in total loans, President and CEO Richard Fairbank said during the company's first-quarter earnings call.

"Our auto business has been in a striking pullback mode," Fairbank said.

Associated Banc-Corp reported the largest sequential increase in auto loans at 12.3% to $1.55 billion in the first quarter. The largest quarter-over-quarter decline among the top 25 auto lenders came from Citizens Financial Group Inc., which reported a 6.1% drop to $10.48 billion.