Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Mar, 2023

The US insurance industry has minimal investment exposure to banks that have recently collapsed or been placed under review for a potential ratings downgrades.

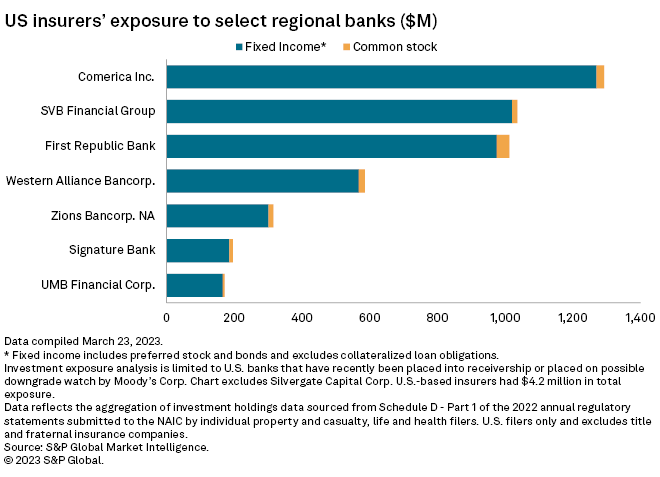

US-based insurers' total investment exposure to failed banks SVB Financial Group and Signature Bank and five banks that Moody's recently put on review for a potential downgrade — Comerica Inc., UMB Financial Corp., First Republic Bank, Western Alliance Bancorp. and Zions Bancorp. NA — was roughly $4.61 billion as of Dec. 31, 2022, according to a review of regulatory statements by S&P Global Market Intelligence.

The insurance industry overall holds trillions of dollars in cash and investable assets. The life industry had $4.87 trillion investable assets as of Sept. 30, 2022, while property and casualty insurers had $2.12 trillion.

In addition to the aforementioned regional banks, Moody's on March 13 placed Intrust Bank NA under review for a potential downgrade. The ratings agency subsequently downgraded First Republic's long-term issuer rating and local currency subordinate ratings to B2 from Baa1 and lowered its long-term local currency bank deposit rating to Baa3 from A1.

|

– This template allows you to track US insurers exposure to individual securities by imputing full or partial CUSIPs. – Read about how traditional banks will face greater scrutiny when trying to obtain directors and officers (D&O) cover. |

Silicon Valley bank exposure

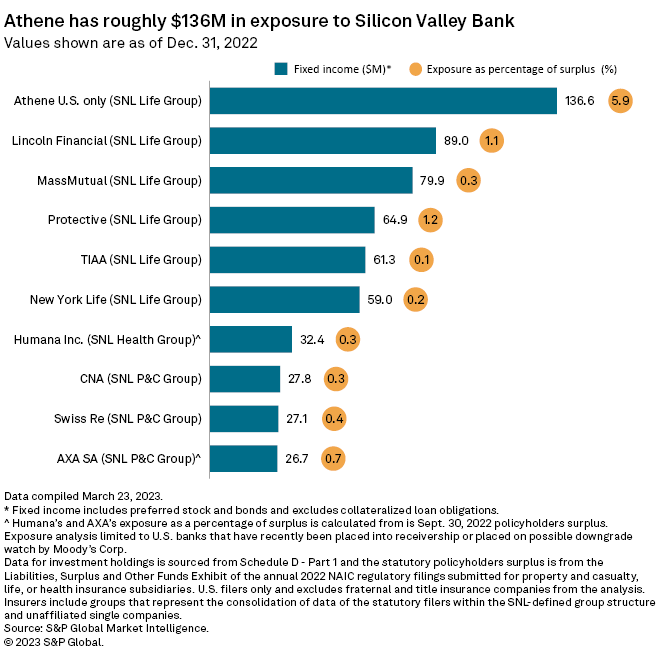

The US-domiciled units of Athene Holding Ltd. reported fixed-income exposure of $136.6 million to Silicon Valley Bank at the end of the 2022, with $112.5 million in senior unsecured debt and $24.1 million of preferred stock.

The insurer's total investment exposure in the failed bank is calculated to be 5.9% of its surplus within its US operating subsidiaries; however, this calculation is likely overstated when compared to total enterprise capital due to the existence of material operations within its Bermuda subsidiaries. Overall, Athene's US operations reported investable assets of $131.5 billion on Dec. 31, 2022.

Lincoln National Corp. held roughly $89 million of unsecured Silicon Valley Bank debt, which was roughly 1.1% of its total surplus at 2022-end.

Insurers' exposure to US banks under review

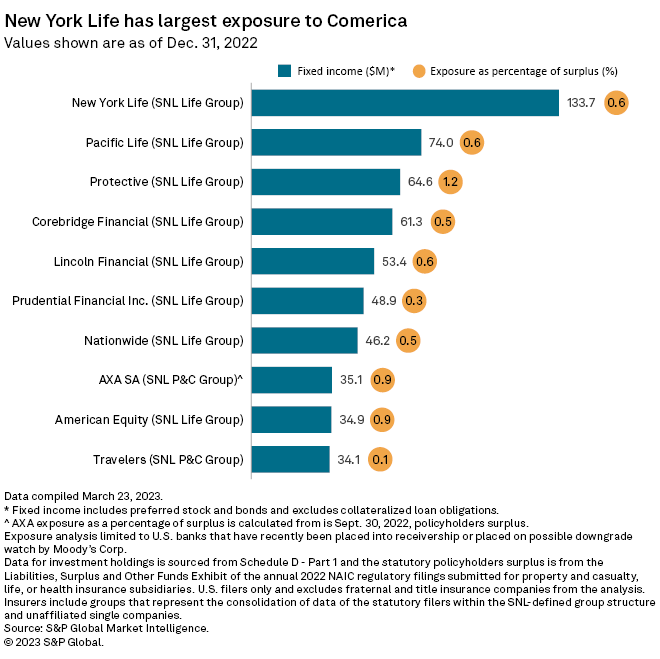

US insurers' largest fixed-income exposure to the banks in this analysis is to Comerica, with a carrying value of $1.29 billion. This is comprised of $1.27 billion in fixed-income obligations and roughly $22 million in common stock holdings as of Dec. 31, 2022.

Affiliates of New York Life Insurance Co. reported a carrying value for $133.7 million of Comerica debt at the end of 2022, a relatively small amount when compared to the insurer's total investable assets of $319.1 billion and less than 1% of its surplus.

Pacific Mutual Holding Co., Protective Life Corp. and Corebridge Financial Inc. had exposure of more than $60 million each to Comerica.

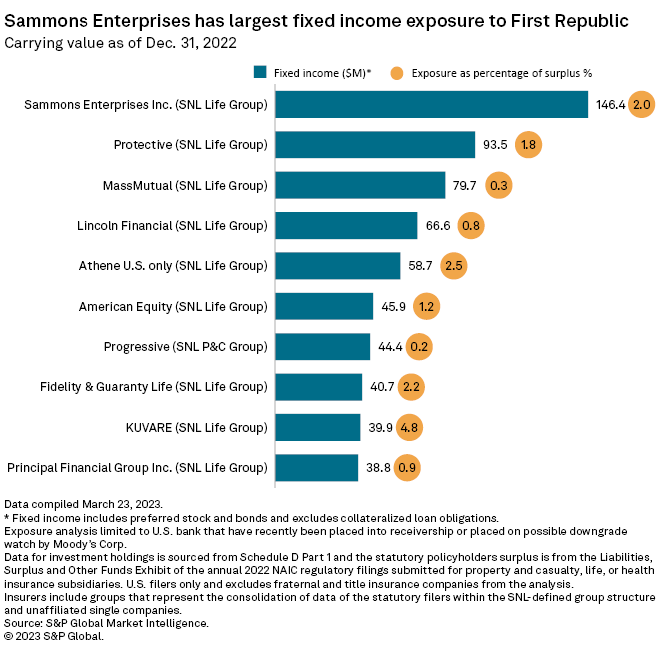

Industrywide fixed-income exposure to First Republic was approaching $1 billion at the end of last year. The largest holder of fixed-income securities were the insurance units of Sammons Enterprises Inc. — Midland National Life Insurance Co. and North American Co. for Life & Health Insurance — with an aggregate total $146.4 million in preferred stock.

This analysis was limited to US property and casualty, life and health insurers with direct investment exposure based on common stock, preferred stock, bond holdings of each respective bank. If the insurer sold or bought additional securities of the banks since the end of 2022 or has material insurance operations domiciled outside the US, the values reported may not accurately reflect the total exposure of the company.

The insurance industry's investment exposure may not be limited to their direct investment in the banks. Indirect exposure to SVB includes investments in collateralized debt obligations that are backed in part by trust preferred securities. Documents filed in connection with SVB Financial Group's Chapter 11 bankruptcy proceedings indicate that the company assumed obligations related to the subsidiary trust preferreds of Boston Private Holdings Inc. in connection with its 2021 acquisition of that entity.