Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Mar, 2023

By Allison Good

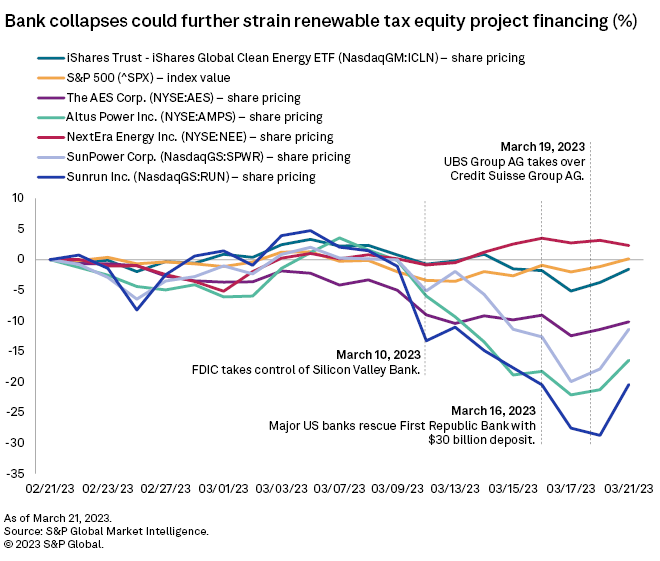

As renewable energy companies assess the impact of recent bank failures on tax equity financing, industry experts see certain equipment manufacturers, project developers and alternative fuels providers as better positioned to remain insulated from capital scarcity.

After Silicon Valley Bank (SVB) collapsed, residential solar installers Sunrun Inc., Sunnova Energy International Inc. and Spruce Power Holding Corp., as well as intelligent energy storage provider Stem Inc., all disclosed "immaterial" impacts from the second-largest bank failure in US history.

Plenty of other lenders should step in to fill any financing gaps for SVB as well as for First Republic Bank and Credit Suisse Group AG, but that may not be enough to stem the already decreasing availability of tax equity for financing projects, Morgan Stanley analysts said.

"In 2008-09, the tax equity market did contract significantly — and this could pose risks" to developers such as AES Corp., Altus Power Inc., NextEra Energy Inc., SunPower Corp. and Sunrun, Morgan Stanley wrote March 20.

Guggenheim analysts said in a March 13 report that residential solar companies have the most exposure to any banking system uncertainty because they rely on several different sources of capital, including tax equity. Also, "increased risk premia drive debt costs up" for those firms, the analysts said.

Residential solar financing company Sunlight Financial Holdings Inc. disclosed March 10 that SVB is the only lender under a revolving credit facility maturing April 26 that Sunlight Financial hoped to extend.

"The ability of the company to amend and extend (or to replace) this revolving credit facility [is] uncertain, which could have a material impact on the company's liquidity, cash and ability to attract new capital if not resolved on a timely basis," Sunlight said in the filing.

Credit Suisse did not necessarily play a major role in renewable energy financing or tax equity in recent years, but Latham & Watkins LLP attorney Eli Katz, who specializes in clean energy financing and tax subsidies, said in an email that "they did have a big franchise in the residential and distributed solar securitization sectors, so that is an area worth watching."

Keith Martin, a renewable energy tax expert and co-head of projects at Norton Rose Fulbright, wrote in an email that banking instability more broadly "could affect liquidity in the renewable energy sector and lead to an economic slowdown," which "would affect corporate profits. Corporate profits affect the supply of tax equity."

Investor opportunities, risks

Sector investors looking for more stable renewables balance sheets should consider "equipment manufacturers, especially those with high barriers to entry, a large backlog of contracted orders and especially strong demand for their products; and project developers with strong pricing power and access to capital," Morgan Stanley wrote.

Those stocks include Sunrun, AES, NextEra, Altus Power, Bloom Energy Corp. and Stem, the analysts said, with First Solar Inc. and Maxeon Solar Technologies Ltd. also strong in customer contracts and Fluence Energy Inc. benefitting from high demand for energy storage.

Regarding rising equity and debt costs, Morgan Stanley emphasized that risk could be higher for "companies whose business models are centered on a positive spread between project returns and financing costs" and smaller companies with private equity or venture capital funding.

When it comes to renewable fuels, analysts at energy investment bank Tudor Pickering Holt & Co. said March 16 that they have concerns about how the growth-oriented, mostly small-capitalization sector "will hold up," but that Neste Oyj and Opal Fuels Inc. shares are less volatile than the market.

Clean Energy Fuels Corp. and Montauk Renewables Inc. have solid balance sheets with "more cash than debt," the analysts said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.