Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Mar, 2023

The Federal Reserve is expected to raise interest rates by another 25 basis points on March 22 as it looks for ways to both fight persistently high inflation and mitigate the fallout from recent bank failures.

But even as a small increase is likely at the next meeting, the central bank's path forward has never been more uncertain since it began hiking rates a year ago.

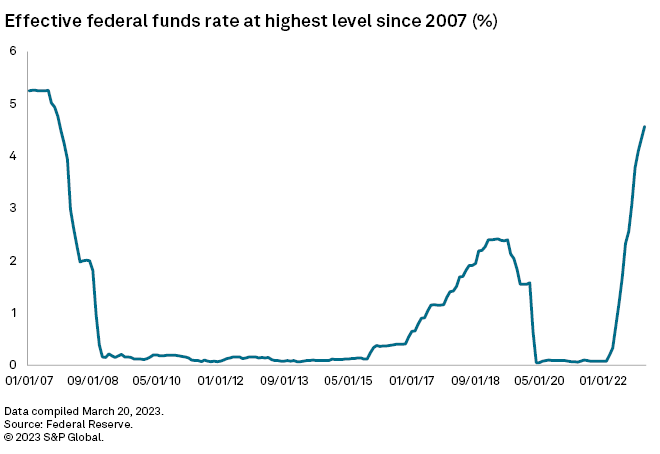

The Fed has boosted the benchmark federal funds rate by 450 basis points since March 2022. Just two weeks ago, many forecasters believed it would accelerate its efforts and hike by 50 basis points as inflation remained well above its 2% target and the labor market refused to cool. Recent bank failures have changed all of that, causing some to suggest that the rate-setting Federal Open Market Committee (FOMC) may pause its rate hike plans or even cut rates in the near future to calm markets.

"This will be a tough FOMC meeting that will probably have some dissenters," said Edward Moya, a market analyst with OANDA.

Fed officials may be confident they are stabilizing the banking sector, freeing them up to implement a 25-basis-point hike. If the banking sector needs additional help in the very near term, however, the Fed will likely feel forced to pause, Moya said.

Hike or pause?

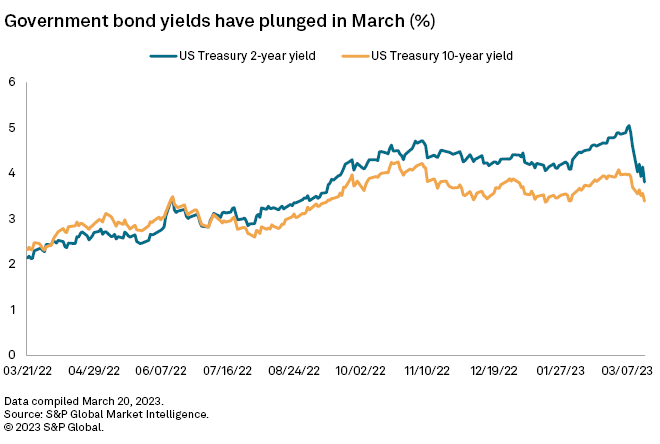

The odds of a 25-basis-point hike were close to 75% as of March 20, up from about 65% a week earlier, according to the CME FedWatch Tool, which measures investor sentiment in the federal funds futures market. Roughly 60% of the futures market sees the Fed cutting rates by July. A month ago, no one in the market saw rate cuts that soon, according to the tool.

The Fed will likely push for a modest increase as curbing inflation remains its top priority, and Fed officials may believe the recent bank failures do not pose a systemic risk to the banking sector or overall economy, said Oren Klachkin, lead U.S. economist at Oxford Economics.

Both the policy statement and Chairman Jerome Powell's post-meeting press conference are poised to signal that the central bank will take stabilizing action if market conditions warrant, rather than pausing rate hikes, which Klachkin said could cause more market turbulence than a small increase.

"We think policymakers would have a hard time clearly explaining the pause," Klachkin said. "Does the pause mean they aren't confident their actions to contain the fallout from [Silicon Valley Bank] are adequate? What might they know that markets don't? It can be easy to see a scenario where worries snowball."

Ultimately, prioritizing the stability of the banking sector may warrant a pause in the hiking cycle, said Kathy Jones, managing director and chief fixed-income strategist with the Schwab Center for Financial Research.

"Credit conditions have already tightened significantly anyway and now the fallout in the banking sector has the potential to trip us into a credit crunch that will exacerbate the slowdown in the economy and decline in inflation," Jones said.

Jones saw three options for this week's meeting: a 25-basis-point hike and an indication by the Fed they plan to use "other tools" to address bank liquidity; a rate increase with an indication that policy is sufficiently restrictive and no more hikes are likely; or a pause, where the Fed will not push rates up further until volatility declines.

"A pause … would leave the door open to adjusting policy down the road," Jones said.

Fed forecast

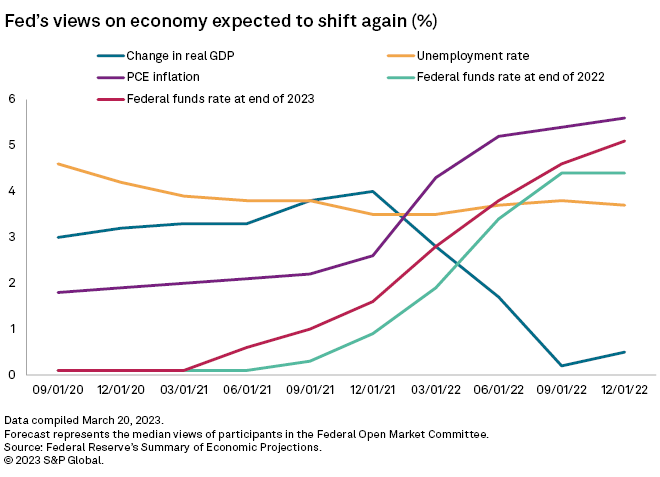

Following the FOMC meeting, Fed officials are expected to release their latest quarterly Summary of Economic Projections, which provides their views on where inflation, unemployment, GDP and the federal funds rate are headed in coming years.

In the last summary, released in December 2022, the median view among Fed officials was that the federal funds rate would be 5.1% at the end of 2023, up from its current range of 4.5% to 4.75%.

The median estimate will likely still be in the range of 5% to 5.25%, Jones said, but some Fed officials may forecast higher rates later this year in order to combat inflation.

The Fed outlook on growth will likely be reduced, and inflation projections could be boosted as high prices, particularly in services, have proved stickier than expected, said Gregory Daco, chief economist for EY-Parthenon.

"I think the GDP forecast and unemployment rate might be tweaked to show a dent from the banking sector stress," Daco said.