Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Mar, 2023

S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

The number of high-earning Americans opting to rent instead of owning a home are increasing, pushing up demand for rental properties, The Wall Street Journal reported.

Renter households making over $150,000 or more a year grew to over 3 million, or an 87% increase between 2016 and 2021, the report said, citing estimates from the U.S. Census Bureau. These affluent households are putting off buying homes due to high mortgage rates and elevated home prices, among other reasons.

Austin, Texas, topped the cities with a large jump in the number of high-earning renters over the five-year period, at 154%, according to an analysis by apartment-listing website RentCafé. Nashville, Tenn.; Atlanta; Phoenix; and other cities in the South and Southwest regions also saw large increases in these renters.

In a separate report, Redfin Corp. said the lack of listings is causing the housing affordability crisis to intensify, in addition to high rates and surging home prices. The number of affordable home listings plunged by 53% in 2022 from 2021, the largest annual decline in Redfin's record that started in 2013.

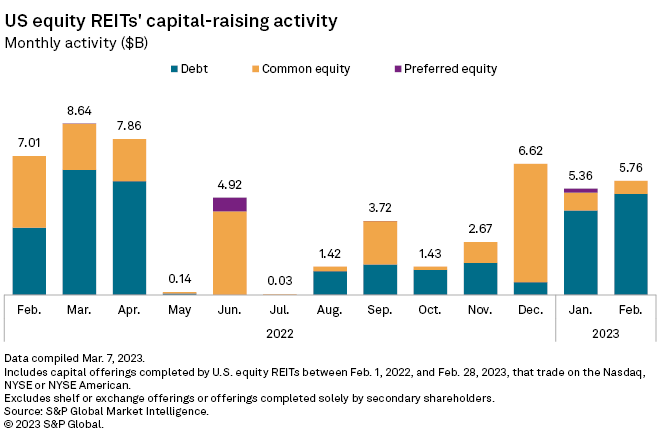

CHART OF THE WEEK: Capital offerings by US equity REITs increase in February

⮞

⮞

⮞

Office loans in focus

* Blackstone Inc.'s $325 million commercial mortgage-backed securities loan on the Hughes Center campus in Las Vegas has transferred to special servicer KeyBank, Commercial Observer reported. The private equity giant has issued a hardship letter stating it is unable to fund future monthly payments, the report said, citing sources. Hughes Center includes 10 office buildings spanning 1.5 million square feet.

* Starwood Capital and Artisan Realty are in discussions with lender Morgan Stanley for the debt related to their PCT office complex in El Segundo, Calif., Green Street's Real Estate Alert reported. According to the report, about half of the 1.6 million square-foot, three-building property is now vacant as tenants left during the pandemic. A Starwood spokesman told the news outlet that the company has not defaulted and is still the owner of the complex, while Morgan Stanley did not respond to a request for comment. The partnership acquired the property, then known as Pacific Corporate Towers, for $611.2 million in 2017.

Property trades

* Real estate investment manager Hines closed on a Whole Foods-anchored shopping center in White Plains, N.Y., for $112 million, WSJ reported. The property is spread across 262,000 square feet.

* Centerspace sold nine apartment communities in Minnesota and Nebraska for $144.3 million. The company will use the sale proceeds to pay down outstanding debt.

US REIT direct exposure to Silicon Valley Bank fairly limited

Data Dispatch: More than half of US REITs top Q4'22 FFO-per-share estimates

Data Dispatch: Average short interest in US REITs edges up in February