Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Nov, 2023

US voters signaled a decided willingness to fund new local infrastructure and other projects during the Nov. 7 elections.

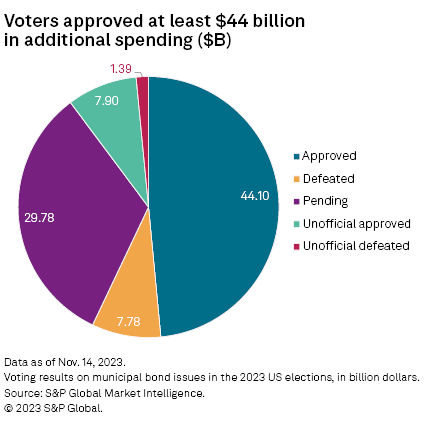

Relatively high interest rates failed to curb taxpayers' spending appetite, as voters approved more than $44 billion in municipal bonds designated for schools, roads and other public infrastructure uses. A further $29.78 billion is still pending as of Nov. 14, according to data compiled by S&P Global Market Intelligence.

The data shows that 55% of all proposed bond measures were approved by voters, while nearly a quarter were defeated.

In addition to electing candidates for state and local offices, voters in some jurisdictions were asked to weigh in on municipal bond measures in the off-year election, most of which go toward financing public infrastructure proposals. Certain jurisdictions require voter approval before they can issue these types of bonds.

Largest bond measures

Most of the largest municipal bond issues were approved in Texas, with nine of the top 10 originating from the state. At $2.5 billion, the two largest bond measures were authorized by Houston voters for local hospitals and by Charlotte, NC, voters for school-related projects.

Texas was also represented among the largest defeated bond measures, though the largest defeated proposal originated from Mesa, Ariz. The bond of $500 million was designated for capital improvements and issued by Mesa's public school district.

State results

Barring pending and unofficial bond election results, Texas recorded the highest number of ballot measures, with 199 approved and 61 denied across the state. Steady population growth in the state likely contributed to the significant number of proposals, as local governments aim to address the public resource needs of a growing number of residents.

Voters in Minnesota, Michigan and Iowa were more divided on spending going toward proposed municipal bonds, according to Market Intelligence data. Minnesota voters approved 25 proposals but denied 22, while Michigan voters approved 25 and denied 23.