Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Nov, 2023

For many economists, a deteriorating labor market is the key signal for central banks to feel confident their tightening of monetary policy is working. The November flash Purchasing Managers' Index surveys from S&P Global signaled such a weakening, as firms increasingly reported excess capacity relative to subdued demand.

Major developed economies contract as orders slump

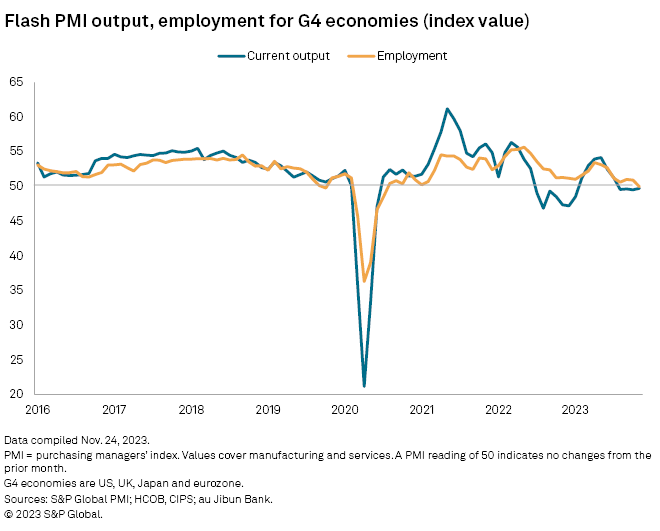

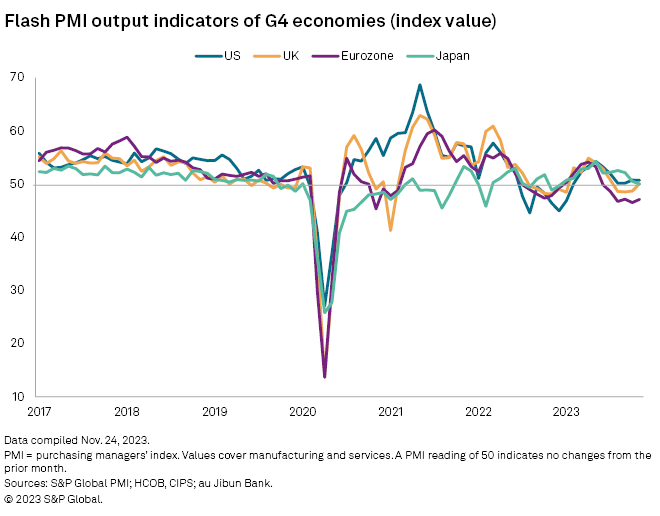

Business activity across the four largest developed economies — the US, UK Japan and the eurozone, also known as the G4 — fell for a fourth successive month in November. However, the rate of decline remained only marginal, easing fractionally in October, according to provisional Purchasing Managers' Index (PMI) survey data. The flash PMI output index for the G4 economies rose to 49.7, a four-month high, from 49.5 in October, but is still in contraction territory.

The decline was again led by the eurozone, though the downturn showed signs of bottoming out, with a steadying of output in the UK also bringing tentative welcome news of diminished recession risk. Growth in the US, meanwhile, continued to run much weaker than earlier in the year and Japan's upturn showed signs of stalling.

The surveys continue to indicate that service sector growth remains very subdued in the G4 on average relative to surge seen in spring and summer, while manufacturing remains in decline. A marginal rise in service sector output across the G4 improved on October's decline. Still, activity in the sector has now been largely stagnant for four months, contrasting with the solid growth spurt seen earlier in the year. Manufacturing output has now contracted across the G4 for a seventh successive month.

Developed world employment falls

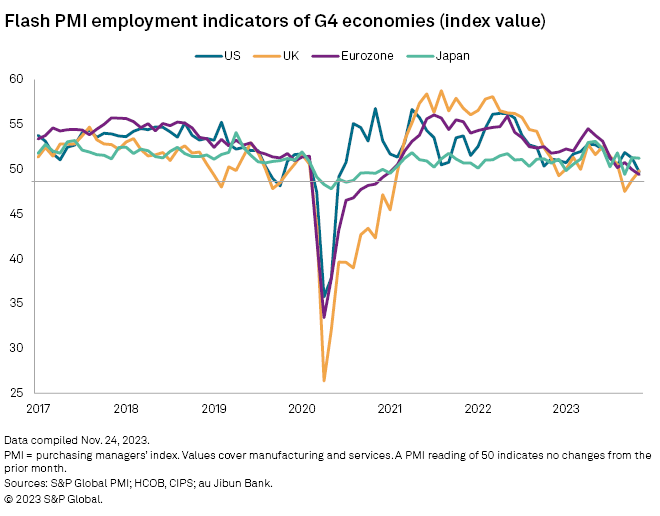

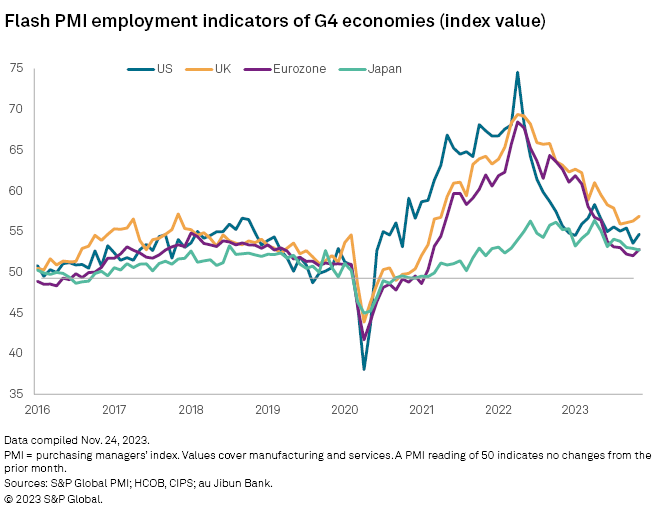

Survey employment data also pointed to weakening labor markets across the G4. Staffing levels across manufacturing and services declined — albeit only fractionally — for the first time since July 2020 during the early pandemic lockdowns. Among the G4, only Japan reported higher employment, with marginal declines reported elsewhere. The drop in US employment was particularly significant as the first since the early pandemic lockdowns. In the eurozone, the decline was the first since the lockdowns of early 2021. UK employment fell for a third month.

Factory jobs were cut in the G4 for a second successive month, dropping in all four economies. The eurozone factory payroll decline was especially marked and the sharpest since October 2012 if early pandemic months are excluded. UK job losses also remained steep, albeit easing. While the US factory jobs decline was far less severe than in Europe, payroll losses declined the most in past two months since the global financial crisis, if early pandemic months are excluded. A marginal decline was recorded in Japan.

Service sector employment came close to stalling on average across the G4. Resilient hiring in Japan was countered by the first drop in US services employment since the early pandemic months and only marginal gains in the eurozone and UK, albeit the latter representing an improvement on declines in the prior two months.

Selling price inflation ticks higher, but cost growth weakens

Average selling prices for goods and services rose at an increased rate across the G4, yet were still running at one of the lowest rates seen since early 2021. Input cost inflation moderated further, slipping to its lowest since November 2020, which adds some encouragement to the prospect of selling price inflation cooling again in coming months.

Selling price inflation picked up in the US, eurozone and UK, with the latter remaining especially elevated by historical standards. The eurozone reported the lowest rate of the three, reflecting the relatively weaker demand environment. The rate of increase in Japan eased to its lowest level since February 2022.

Manufacturing selling prices barely rose across the G4 on average, albeit with a robust increase in Japan and to a lesser extent in the US. A marked fall in goods prices was in the eurozone, with UK prices largely unchanged.

Service sector selling prices rose at a slightly increased rate compared to October, with input cost inflation softening slightly. Both rates remain elevated by historical standards, including in all G4 economies, and persist as the principal area of concern in relation to stubbornly high core consumer price inflation.

The employment data will be especially important to watch going forward, helping to assess wage bargaining power as labor costs typically represent the lion’s share of service sector input costs. New order inflows will be a key guide to demand-pull inflation pressure.

Purchasing Managers' Index data is compiled by S&P Global for more than 40 economies worldwide. The monthly data is derived from surveys of senior executives at private sector companies and is available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and subindexes, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data is used by financial and corporate professionals to better understand where economies and markets are headed and to uncover opportunities.

Full PMI data are available only via subscription. For more information or to express your interest, please contact your S&P Global relationship manager.

Data and insights for this article were compiled by Chris Williamson, chief business economist for S&P Global Market Intelligence.

30 Nov, 2023

For many economists, a deteriorating labor market is the key signal for central banks to feel confident their tightening of monetary policy is working. The November flash Purchasing Managers' Index surveys from S&P Global signaled such a weakening, as firms increasingly reported excess capacity relative to subdued demand.

Major developed economies contract as orders slump

Business activity across the four largest developed economies — the US, UK Japan and the eurozone, also known as the G4 — fell for a fourth successive month in November. However, the rate of decline remained only marginal, easing fractionally in October, according to provisional Purchasing Managers' Index (PMI) survey data. The flash PMI output index for the G4 economies rose to 49.7, a four-month high, from 49.5 in October, but is still in contraction territory.

The decline was again led by the eurozone, though the downturn showed signs of bottoming out, with a steadying of output in the UK also bringing tentative welcome news of diminished recession risk. Growth in the US, meanwhile, continued to run much weaker than earlier in the year and Japan's upturn showed signs of stalling.

– Set email alerts for future PMI articles.

– Read more PMI research on Capital IQ Pro.

The surveys continue to indicate that service sector growth remains very subdued in the G4 on average relative to surge seen in spring and summer, while manufacturing remains in decline. A marginal rise in service sector output across the G4 improved on October's decline. Still, activity in the sector has now been largely stagnant for four months, contrasting with the solid growth spurt seen earlier in the year. Manufacturing output has now contracted across the G4 for a seventh successive month.

Developed world employment falls

Survey employment data also pointed to weakening labor markets across the G4. Staffing levels across manufacturing and services declined — albeit only fractionally — for the first time since July 2020 during the early pandemic lockdowns. Among the G4, only Japan reported higher employment, with marginal declines reported elsewhere. The drop in US employment was particularly significant as the first since the early pandemic lockdowns. In the eurozone, the decline was the first since the lockdowns of early 2021. UK employment fell for a third month.

Factory jobs were cut in the G4 for a second successive month, dropping in all four economies. The eurozone factory payroll decline was especially marked and the sharpest since October 2012 if early pandemic months are excluded. UK job losses also remained steep, albeit easing. While the US factory jobs decline was far less severe than in Europe, payroll losses declined the most in past two months since the global financial crisis, if early pandemic months are excluded. A marginal decline was recorded in Japan.

Service sector employment came close to stalling on average across the G4. Resilient hiring in Japan was countered by the first drop in US services employment since the early pandemic months and only marginal gains in the eurozone and UK, albeit the latter representing an improvement on declines in the prior two months.

Selling price inflation ticks higher, but cost growth weakens

Average selling prices for goods and services rose at an increased rate across the G4, yet were still running at one of the lowest rates seen since early 2021. Input cost inflation moderated further, slipping to its lowest since November 2020, which adds some encouragement to the prospect of selling price inflation cooling again in coming months.

Selling price inflation picked up in the US, eurozone and UK, with the latter remaining especially elevated by historical standards. The eurozone reported the lowest rate of the three, reflecting the relatively weaker demand environment. The rate of increase in Japan eased to its lowest level since February 2022.

Manufacturing selling prices barely rose across the G4 on average, albeit with a robust increase in Japan and to a lesser extent in the US. A marked fall in goods prices was in the eurozone, with UK prices largely unchanged.

Service sector selling prices rose at a slightly increased rate compared to October, with input cost inflation softening slightly. Both rates remain elevated by historical standards, including in all G4 economies, and persist as the principal area of concern in relation to stubbornly high core consumer price inflation.

The employment data will be especially important to watch going forward, helping to assess wage bargaining power as labor costs typically represent the lion’s share of service sector input costs. New order inflows will be a key guide to demand-pull inflation pressure.

Purchasing Managers' Index data is compiled by S&P Global for more than 40 economies worldwide. The monthly data is derived from surveys of senior executives at private sector companies and is available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and subindexes, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data is used by financial and corporate professionals to better understand where economies and markets are headed and to uncover opportunities.

Full PMI data are available only via subscription. For more information or to express your interest, please contact your S&P Global relationship manager.

Data and insights for this article were compiled by Chris Williamson, chief business economist for S&P Global Market Intelligence.