Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Sep, 2022

By Vanya Damyanova and Marissa Ramos

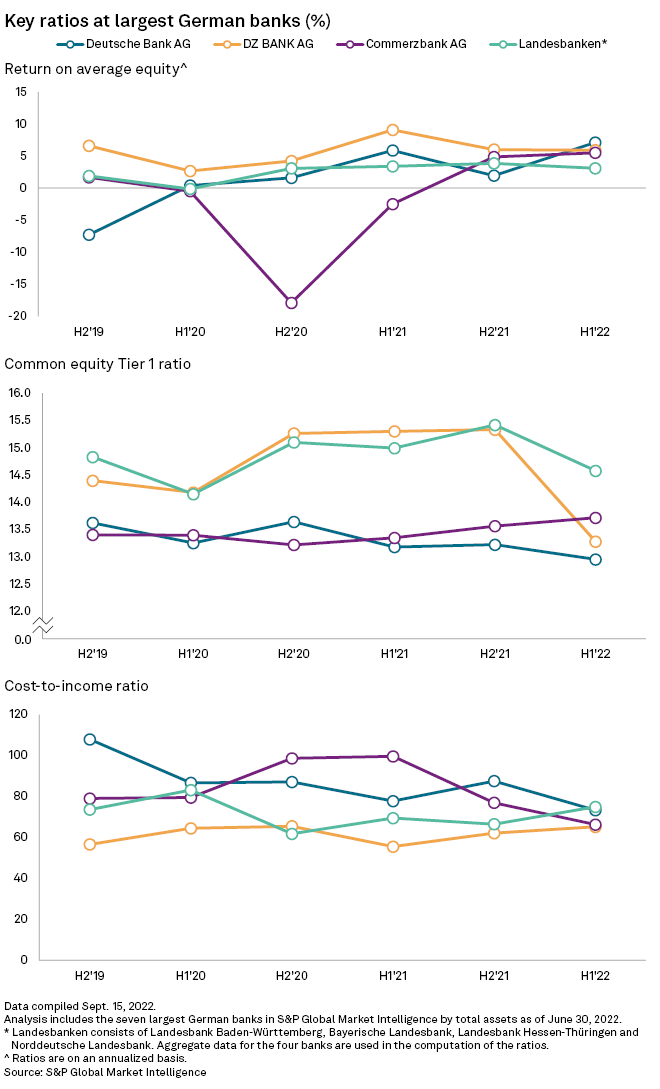

Germany's largest banks expect to hit profit and revenue targets for full year 2022 despite setting more money aside in the first six months of the year to account for future losses.

Commerzbank AG remains "cautiously optimistic" about achieving its annual consolidated profit target of more than €1 billion despite a worsening macro environment, CEO Manfred Knof said at the Handelsblatt Banking Summit on Sept. 8. Deutsche Bank AG has retained its 2022 revenue guidance of €26 billion to €27 billion, while DZ BANK AG and federal state banks Landesbank Baden-Württemberg, or LBBW, and Bayerische Landesbank, or BayernLB, reiterated pretax profit targets.

Deutsche Bank and the wider German banking sector have made conservative risk provisions this year and will be able to manage an expected increase in credit losses in late 2022, Christian Sewing, CEO of Deutsche Bank and president of the Association of German Banks, said at the same summit Sept. 7.

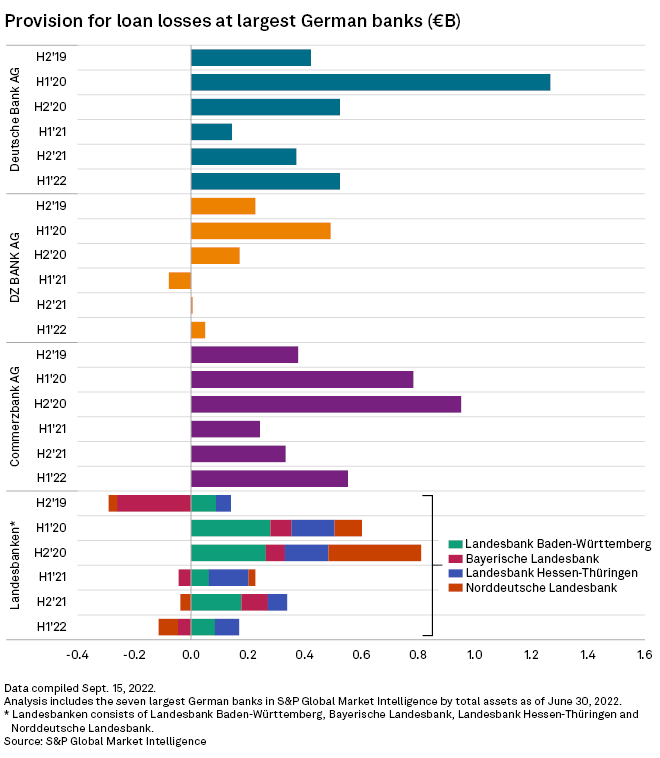

Risk provisions

First-half loan loss provisions increased year over year at Deutsche Bank, Commerzbank, DZ Bank and LBBW, S&P Global Market Intelligence data shows. Direct exposure to Russia dominated first-quarter provisioning, while the economic aftermath of the war in Ukraine was the focus in the second. DZ Bank serves as the central institution for German cooperative banks.

Federal state banks Landesbank Hessen-Thüringen Girozentrale, or Helaba; Norddeutsche Landesbank Girozentrale, or NordLB; and BayernLB all booked lower provisions or made reversals in the first half. But they also made sizable "provision overlays" — adjustments that are made when regular risk models are deemed insufficient.

In addition to its €85 million of risk provisions, Helaba set aside nearly the same amount through model adjustments and management overlays.

"It is clear that geopolitical tensions, energy shortages, soaring inflation, supply chain bottlenecks and rising interest rates are putting the brakes on the economy and unsettling the markets," the bank's CEO, Thomas Groß, said in August.

BayernLB and NordLB booked provision reversals but reported overlays of more than €300 million for future risks. LBBW and Commerzbank announced provision overlays of €90 million and €564 million, respectively, exceeding their first-half risk provisions. Commerzbank assumes it will need to use part of its overlay this year with 2022 risk provisions expected to reach roughly €700 million, CFO Bettina Orlopp said on an earnings call in August.

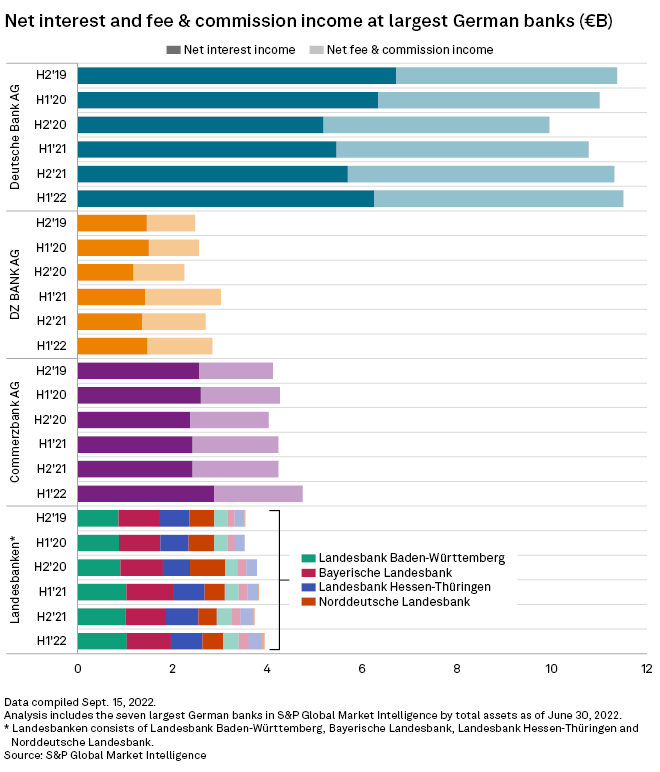

Higher rates drive profits

Despite the challenging environment, LBBW expects its 2022 consolidated pretax profit to surpass its original target and be somewhere in the mid-triple-digit million euro range, it said in late August. DZ Bank and BayernLB flagged the growing economic and market uncertainties but also reiterated previous guidance of 2022 pretax profits of about €1.5 billion and €500 million, respectively.

Higher interest rates were a key driver of profitability in the first half, with all banks except BayernLB booking higher net interest income than a year ago. Net fee and commission income rose year over year at all banks except for DZ Bank.

The ECB has indicated that it will continue raising interest rates in order to tame inflation.