Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Sep, 2022

Retailer Bed Bath & Beyond Inc. recently announced some strategic changes it plans to implement to help drive profitability and improve its balance sheet and cash flows. Included in the plan is the closure of about 150 lower-producing stores under the Bed Bath & Beyond banner.

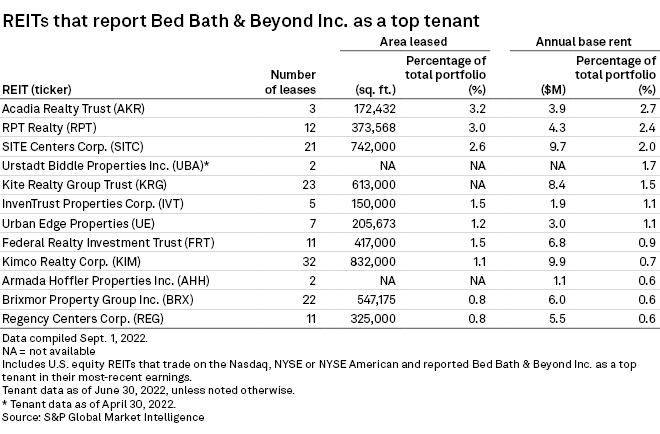

Twelve publicly traded real estate investment trusts reported Bed Bath & Beyond as a top tenant in their latest quarterly filings, according to an S&P Global Market Intelligence analysis.

Kimco reports the most leases with Bed Bath & Beyond

Kimco Realty Corp. leased the most stores to Bed Bath & Beyond, at 32. The stores totaled about 832,000 square feet and represented $9.9 million in annual base rent.

Kite Realty Group Trust had 23 locations leased to the retailer for $8.4 million in annual base rent, while Brixmor Property Group Inc. had 22 leases for $6.0 million in annual base rent.

SITE Centers Corp. leased 21 stores to Bed Bath & Beyond for $9.7 million in annual base rent.

Acadia Realty Trust reported three leases with Bed Bath & Beyond as of June 30, totaling $3.9 million in annual base rent, approximately 2.7% of its total portfolio base rents.

RPT Realty's leases with Bed Bath & Beyond represented $4.3 million in annual base rent, or 2.4% of its total portfolio base rents.

According to Bed Bath & Beyond's latest earnings release, the retailer had 955 stores in total as of May 28, including 769 Bed Bath & Beyond stores, 135 under the buybuy BABY brand and 51 stores under the names Harmon, Harmon Face Values or Face Values.

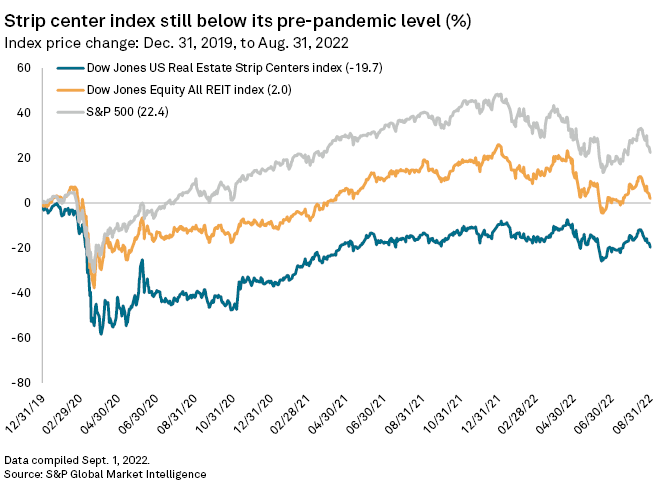

Strip center index yet to recover to pre-COVID-19 level

The vast majority of REITs with exposure to Bed Bath & Beyond stem from the shopping center sector.

The Dow Jones U.S. Real Estate Strip Center index is still down 19.7% compared to its value at the end of 2019 prior to the COVID-19 pandemic.

The more broad Dow Jones Equity All REIT index is up a slight 2.0%, while the S&P 500 is 22.4% above its value at the end of 2019.