Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Jul, 2022

By Nephele Kirong and Gaurang Dholakia

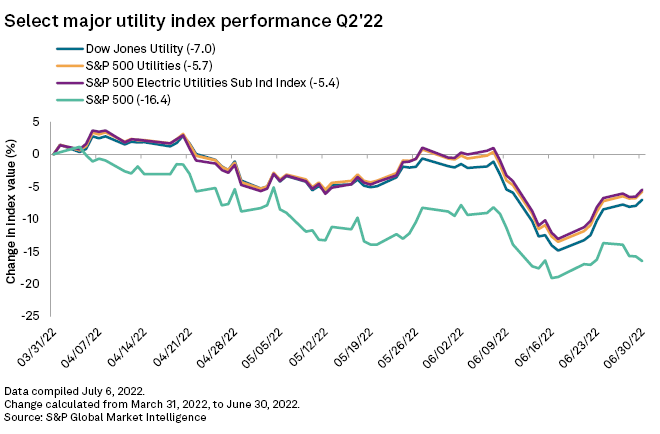

The S&P 500 declined by 16.4% during the second quarter of 2022 amid inflation concerns, geopolitical uncertainty, and fears of a potential recession.

Spooked investors did not spare U.S. electric and multi-utility stocks during the period. Despite outperforming the broader market, the S&P 500 Utilities Index dropped 5.7% from March 31 to June 30, the S&P 500 Electric Utilities Sub Ind Index fell 5.4% and the Dow Jones Utility Index slid 7%.

Top-performing stocks

Unlike in the first quarter, none of the public U.S. utilities covered by S&P Global Market Intelligence experienced a double-digit percentage gain in share price.

Out of the 10 top-performing stocks, half — NRG Energy Inc., Avangrid Inc., Southern Co., Xcel Energy Inc. and MGE Energy Inc. — registered declines in share price.

Among those closing the quarter in the green, Otter Tail Corp. led the pack, logging a 7.4% increase in share price to $67.13.

Constellation Energy Corp. followed at a distant second, gaining 1.8% to $57.26 per share. Executives said the company is benefiting from its nuclear fleet and the opportunity to accelerate its hedging plan in a high-fuel-price environment.

Bottom-performing stocks

PG&E Corp.'s share price fell 16.4% to $9.98. During the quarter, the California utility was hit with millions of dollars in fines over power cuts and pipeline safety violations. PG&E is also exploring the possibility of extending the life of its Diablo Canyon power station, California's single-largest source of electricity, through federal funding.

Other bottom-performing stocks include FirstEnergy Corp., Sempra, Public Service Enterprise Group Inc. and NextEra Energy Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.