Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jul, 2022

By Jon Rees

Lloyds Banking Group PLC has set aside £377 million of loan loss provisions to cover potential defaults as rising inflation and a cost of living crisis hit borrowers. The bank also maintained significant COVID-19 provisions.

This is compared with an impairment release of £734 million in the same period last year, when the economy was expected to grow rapidly after pandemic restrictions eased.

Monitoring behavior

The bank is monitoring its customers' behavior closely for signs of stress and has already seen evidence that they were adapting their finances to adjust to the rising cost of living, CEO Charlie Nunn said at its first-half results presentation. Inflation is running at 9.4%.

"We can see customers spending less on white goods and taking actions, such as managing subscription services, to accommodate the increased costs of energy, food and fuel. On the other hand, we see no increase in our customers canceling insurance policies or opting out of auto enrolment pensions," he said.

Within its retail and commercial lending operations, the majority of the bank's lending is at historically low loan-to-value ratios of about 40%. Its unsecured lending, like credit cards, tends to be focused on prime customers, said Nunn.

Lloyds maintained £500 million of expected credit losses in relation to COVID-19, and its overall ECL charge stood at £4.5 billion, which was £300 million higher than at the end of 2019.

Hikes helped

The bank has benefited from the rapid rise in interest rates by the Bank of England, which has hiked the rate five times since last December to 1.25%. It is expected to raise it again next week.

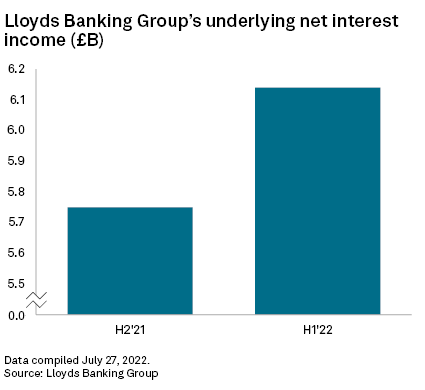

Lloyds saw its net interest income rise sharply to £6.1 billion from £5.7 billion in the second half of 2021 as the interest rate increases more than offset the effects of a competitive mortgage market, said Nunn.

Net interest margin, the difference between what the bank earns from loans and pays on deposits, stood at 277 basis points in the first half of 2022 compared with 256 bps in the second half of last year, prior to the rate rises. Lloyds expects it to reach about 280 bps by the end of this year, assuming interest rates of 2% at that point.

Under pressure

The Lloyds CEO was questioned by analysts during the investor presentation on whether the bank had come under pressure from regulators or politicians to pass on rate rises to savers more quickly.

"I can't predict what's in the future [...] We've not had any discussions with government or the Bank of England about any of those topics," said Nunn.

The majority of Lloyds' customers who are savers are within the highest income brackets and are not the customers struggling with the cost of living, said Nunn, while NIM is below pre-pandemic levels.

The bank said it would pay an interim dividend of 0.80 pence per share, up 20% on the first half of 2021, and said it had not had any indication that the BoE would be unhappy with its dividend proposals in light of the macroeconomic situation.