Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Jul, 2022

Shares of major Italian banks have tumbled since early June amid domestic political upheavals and renewed concerns about the lenders' large holdings of local sovereign bonds.

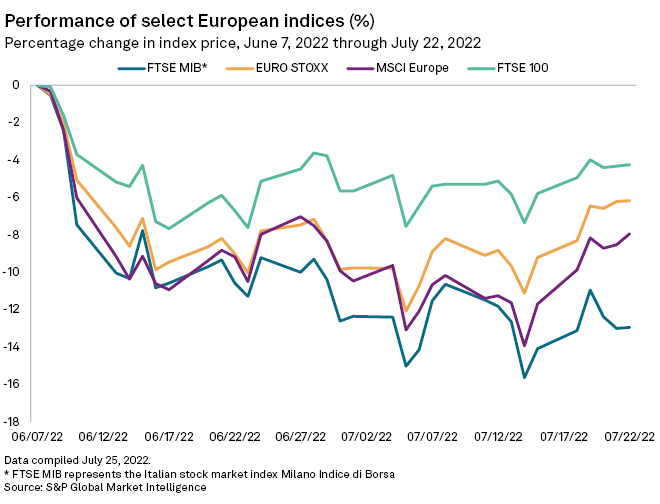

Banca Monte dei Paschi di Siena SpA has led the rout, plunging 46% since June 7 — the day before the European Central Bank indicated it would raise interest rates — as the worsening economic backdrop has complicated plans for a €2.5 billion capital raise. Intesa Sanpaolo SpA, UniCredit SpA, Banco BPM SpA and BPER Banca SpA also fell more than the EURO STOXX Banks index's about 15% decline through July 22 amid Mario Draghi's resignation as prime minister and political uncertainty ahead of snap elections in September.

The widening spread between Italian and German debt has revived fears of a so-called doom loop in which Italian banks' holdings of local sovereign bonds lose value amid a sell-off, stirring concerns about potential state bailouts, which in turn further depresses Italian government bonds. The ECB has sought to fend off this scenario by rolling out a special monetary policy tool that aims to cap borrowing costs for weaker eurozone nations.

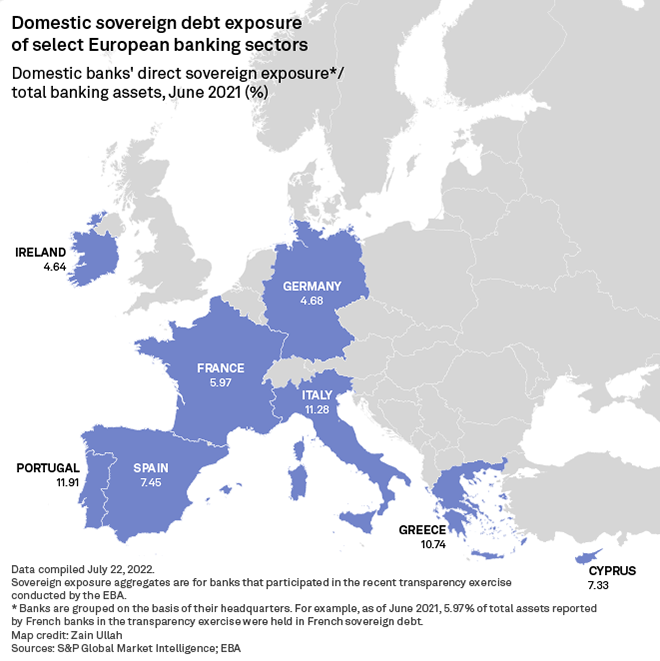

The doom loop is a particular concern in Italy because local sovereign bonds make up 11.3% of bank assets, versus 7.5% on average in other major eurozone countries, based on June 2021 data from the European Banking Authority. Concerns about Italian debt already caused the cost of insuring the nation's sovereign bonds using credit default swaps to jump to 167 basis points on July 22 from 128 bps on June 7.

The ECB on July 21 announced the Transmission Protection Instrument, or TPI, which will allow the eurosystem to buy securities in jurisdictions experiencing "a deterioration in financing conditions." Policymakers also raised interest rates by a larger-than-expected 50 bps to tame rising inflation the same day. Banks in Italy will likely be among the main beneficiaries of the TPI, Moody's wrote in a July 20 note.

Banks in Italy will likely be among the main beneficiaries of the TPI, Moody's wrote in a July 20 note.

Italy's FTSE MIB stock index has also fallen significantly more than other major European benchmarks since June 7.

|

* Access key financial highlights for Italian banks * Access key bank indexes. |