Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Jul, 2022

By Tom Jacobs

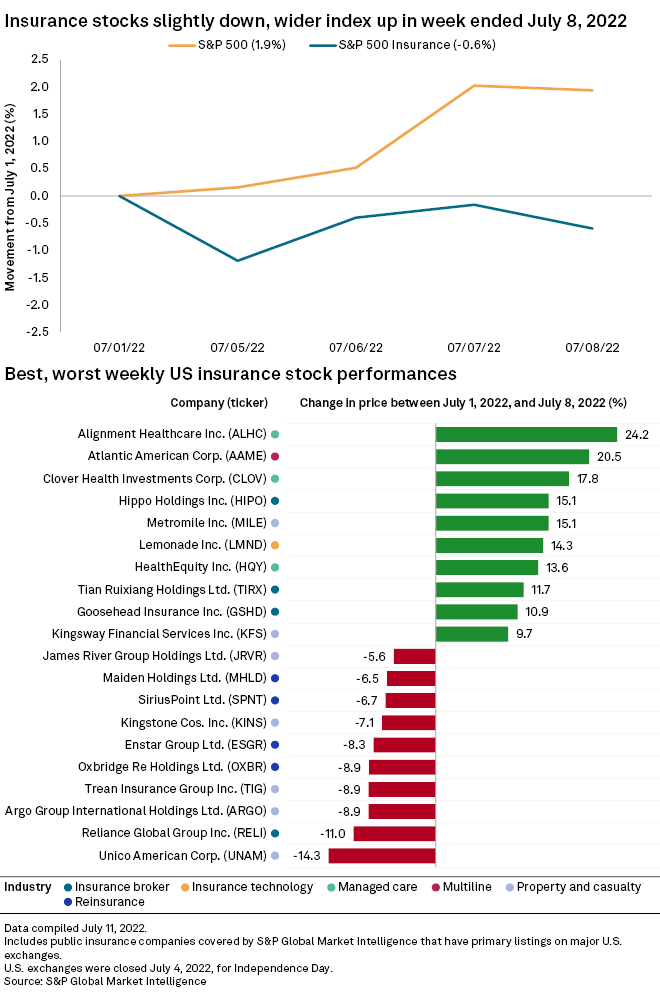

Insurance stocks were mixed this week as the industry prepares to report second-quarter earnings in the face of continued inflationary pressure, recession fears and a shaky broader market.

The S&P 500 rose 1.94% to 3,899.93 for the holiday-shortened week ending July 7.

While equity markets have mostly moved lower in the first half of the year, Piper Sandler analyst Paul Newsome noted that many insurance stocks have fared better. He anticipates a "normal" earnings season from the property-casualty companies he covers.

"Investors have hidden out in the property-casualty sector because it is relatively independent from the rest of the economy," Newsome said in an interview. "As a result, stocks are actually up a little bit year-to-date, where, obviously, the stock market is down a lot."

Insurers will probably continue to outperform if the macroeconomic environment remains the same, especially if the world has seen "peak" inflation, said Newsome, who added that the insurance market seems to fear the onset of recession rather than continued inflation.

That said, the insurance industry historically has proven itself to be resilient to a broader macroeconomic downturn.

"Recessions have fairly modest impacts on the industry, so that's why 'normal' is good for the insurance companies," the analyst said. Newsome's outlook is also based on the lack of catastrophic weather events in the quarter, which he called "the biggest quarter-by-quarter swing factor."

Newsome in a research note said the P&C market remains "reasonably hard" and pricing is rising at the same pace as last quarter. Prices for commercial insurers like Chubb Ltd., down 2.45%, American Financial Group Inc., down 3.26%, and The Hartford Financial Services Group Inc., down 0.86% this week, are rising faster than underlying claims inflation. That suggests most companies will see underwriting margin expansion in the second quarter.

Results from auto insurers such as The Allstate Corp., up 0.13%, The Progressive Corp., up 1.60%, and The Travelers Cos. Inc., down 1.27%, will be a focal point for this season, said Newsome. Inflation has had a negative effect on auto claims, as have used car prices and higher repair, wage and rental costs, which have led to "an enormous amount of margin compression."

"Those inflation pressures may have kind of flattened out but they're still very high," Newsome said. "So, you still have the potential for fairly difficult year-over-year comparisons with last year."

New leadership at Voya

Voya Financial Inc. on July 7 appointed Heather Lavallee president and CEO, effective at the start of 2023.

Lavallee, currently CEO of Voya's Wealth Solutions business, will replace Rodney Martin, who will become executive chairman of the board of directors. Lavallee was also appointed to the board of directors.

Lavallee, who joined Voya in 2008, previously was president of Voya's Tax-Exempt Markets and of its Employee Benefits business.

Voya's share price fell 2.62% for the week.

Top movers

Managed care carriers Alignment Healthcare Inc. and Atlantic American Corporation were the biggest gainers for the week, rising 24.20% and 20.47%, respectively. Clover Health Investments Corp. picked up 17.78%, while Metromile Inc. and Hippo Holdings Inc. rose 15.07%.

Insurers that had the steepest declines were Unico American Corporation, down 14.29%, Reliance Global Group Inc., down 10.95% and Argo Group International Holdings Ltd., down 8.94%