Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Jun, 2022

By Hailey Ross and Jason Woleben

Activists and investors are pushing companies to make net-zero commitments, which could have ramifications for the directors and officers insurance market as the potential for increased shareholder suits over environmental, social and governance issues grows.

At some point, companies will have to prove that they are actually making progress on their commitments to net-zero or potentially face lawsuits, something that is becoming increasingly concerning for at least one insurance executive.

Direct premiums edge up in Q1

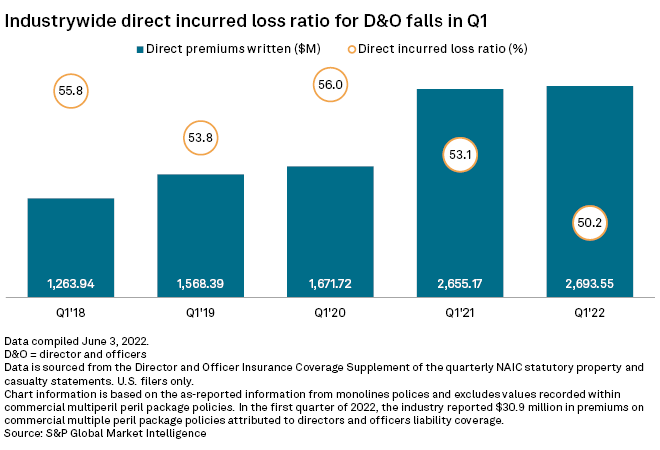

The U.S. D&O insurance market logged $2.69 billion in direct premiums written in the first quarter, a slight increase from $2.66 billion a year earlier, according to an S&P Global Market Intelligence data analysis.

D&O insurance is liability coverage that protects the directors and executive officers of a company, as well as the company itself, for losses and other costs stemming from lawsuits alleging wrongdoing against those entities.

D&O insurers also posted a first-quarter direct incurred loss ratio of 50.2%, an improvement from the 53.1% in the first quarter of 2021.

AXA remains the largest U.S. D&O writer

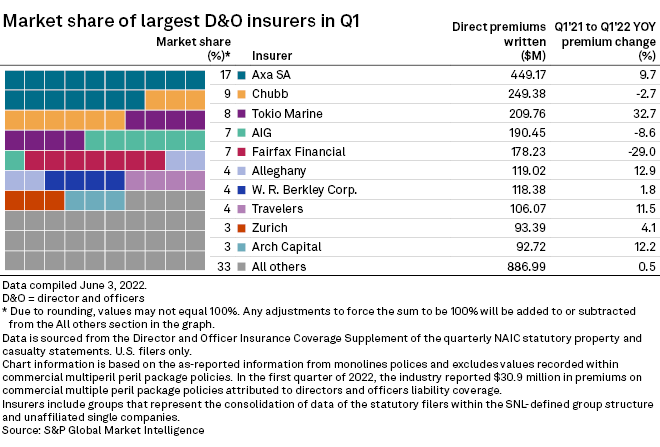

Seven of the top 10 U.S. D&O insurers saw year-over-year increases in direct written premium in the first quarter.

|

* Download a template that can generate market shares across annual or quarterly P&C exhibits. * Read an article about U.S. insurers full-year 2021 results within the D&O market. |

AXA SA held its place as the largest D&O insurer in the U.S., with roughly 17% of the overall market share. The insurer had $449.17 million in direct premiums written during the first quarter, reflecting a year-over-year premium increase of 9.7%.

Chubb Ltd. controlled 9% of the U.S. D&O market in the first quarter, ranking as the second largest D&O insurer with $249.38 million in direct premiums written.

Tokio Marine Holdings Inc. followed closely behind, taking 8% of the U.S. D&O market in the first quarter. The insurer wrote $209.76 million in direct premiums in the period, representing a year-over-year increase of 32.7%. Tokio Marine's year-over-year increase in premiums was the largest out of the top 10 U.S. D&O underwriters.

Meanwhile, Fairfax Financial Holdings Limited's first-quarter direct written premiums dropped 29.0% from the year-ago period, marking the largest year-over-year decrease in first-quarter premiums among the top 10 U.S. D&O insurers.

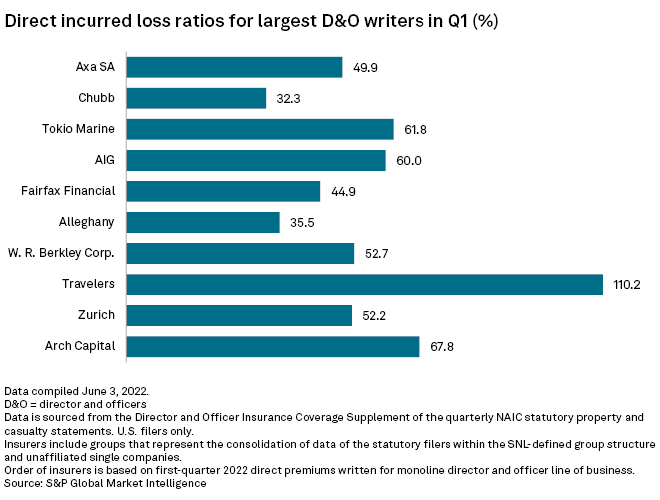

Travelers direct loss ratio tops 100% in Q1

Among the top 10 U.S. D&O insurers, The Travelers Cos. Inc. booked the highest direct incurred loss ratio for the first quarter at 110.2%. The direct incurred loss ratio deteriorated from 76.7% in the first quarter of 2021.

Chubb had the lowest first-quarter direct incurred loss ratio among the top 10 U.S. D&O insurers but also deteriorated year over year. The insurer's loss ratio stood at 32.3% in the first quarter of 2022 versus 27.9% in the year-ago period.

W. R. Berkley Corp. saw the largest improvement among the group of insurers, as its direct incurred loss ratio was 52.7% in during the first three months of 2022, compared to 71.1% in prior year period.