Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Jun, 2022

By Tyler Hammel

Many eyes stayed on Florida this week as property and casualty insurers there sought to lock up reinsurance coverage ahead of the Atlantic hurricane season.

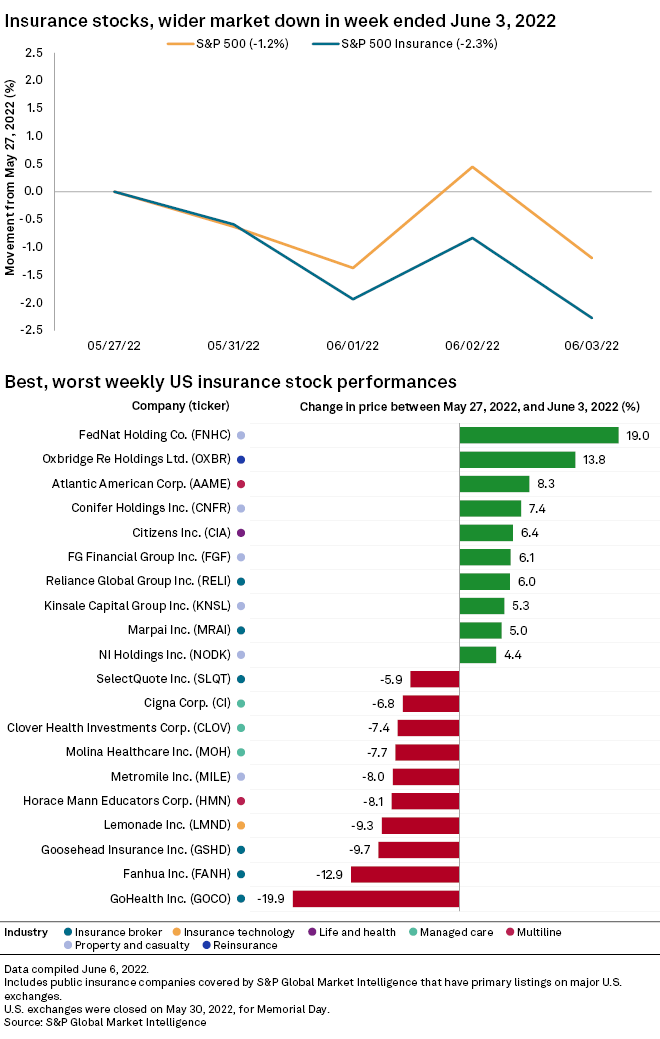

Insurance companies underperformed the broader market during the holiday-shortened week ending June 3, which was modestly negative for stocks. The S&P Insurance 500 index slid 2.27% to 557.96, while the S&P 500 dropped 1.20% to 4,108.54.

The reinsurance renewal market in the Sunshine State has been "extremely challenging, not just for the bottom tier of insurance companies, but for all of them," Edouard von Herberstein, chief underwriting officer for reinsurance strategy at Hudson Structured Capital Management, said during a webinar hosted by Demotech.

Herberstein said even the strongest carriers are struggling to get things done with pricing because reinsurers are concerned about the credit risks and viability of companies operating in Florida.

P&C companies have experienced several years of higher losses from a confluence of factors, including storm damage. Prices in the sector are "generally going up," Piper Sandler analyst Paul Newsome said in an interview.

"There's also less of a supply of reinsurance and so the reinsurance industry is looking at an industry where they're uncertain about making money," Newsome said. "At the same time, the companies are much weaker and it's just a difficult environment overall for Florida writers."

But despite those anxieties, it does seem that most Florida P&C companies were able to able to secure reinsurance for the 2022-2023 season. Universal Insurance Holdings Inc., for instance, announced on May 31 that its subsidiaries closed on $696 million in reinsurance for the next year, reflecting 37.6% of direct premiums, an increase from 36.4% a year ago. The company also locked up additional capacity for future years, including 2024 renewals.

Universal, which is the largest Florida homeowners company by policies in force, saw its stock price tick down 2.98% this week. Heritage Insurance Holdings Inc.'s shares rose 2.25%, while FedNat Holding Co. rose 19.76%.

The Florida P&C market may be put to the test early in the season as National Hurricane Center on June 3 put tropical storm warnings in place across much of the southern half of the state ahead of a storm that was expected to make landfall this weekend.

Inflationary benefits for life

Life insurers tracked alongside the wider market as investors digested persistent inflation and signs that interest rates would continue to rise.

The sector does stand to benefit as interest rates move higher, Moody's reiterated in a report this week. Life insurers have seen bond yields and investment income pick up and experienced further benefits from wage inflation caused by the tight U.S. labor market, as life insurance purchases see a boost with help from pent-up demand, the rating agency said.

Influenced by pandemic-related disruptions and exacerbated by the war in Ukraine, inflation has been increasing since the latter half of 2021. A relatively strong U.S. jobs report on June 3 and continued hot inflation numbers across the globe make it more likely that the Federal Reserve will stay the course and repeatedly raise interest rates in the coming months.

Lael Brainard, vice chair of the Federal Reserve, in a CNBC interview this week said it was unlikely the central bank would pause its plan for continued interest rate hikes by September. If inflation were to slow, the Fed might consider quarter-point increases, but if not, it is likely to continue with hikes of 50 basis points, Brainard said.

MetLife Inc. finished the week down 2.26%, while Prudential Financial Inc. slipped 2.17%. Primerica Inc. edged down 1.38%, Lincoln National Corp. lost 4.54% and CNO Financial Group Inc. dipped 2.57%.