Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Jun, 2022

By Beata Fojcik

Hungary-based OTP Bank Nyrt. underperformed compared to lenders in Poland and the Czech Republic in the first quarter of 2022, with exposure to Ukraine and Russia eroding its earnings.

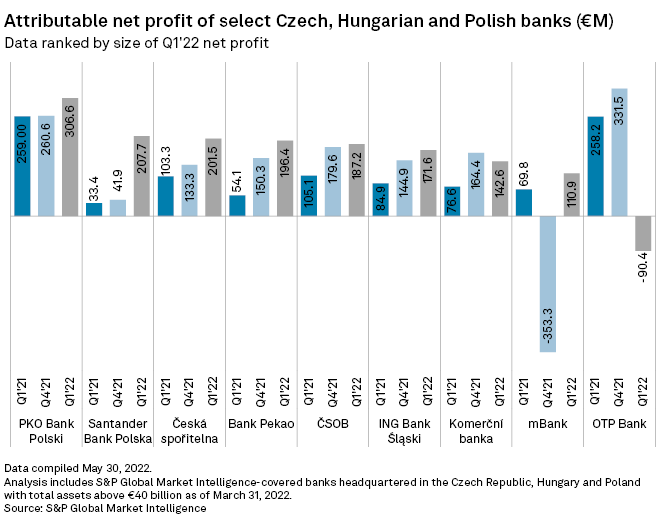

In a sample of the three countries' largest banks, all lenders except OTP Bank reported strong year-on-year increases in net profit amid rising interest rates, releases of COVID 19-related loan loss provisions and a post-pandemic recovery. Most also recorded quarterly improvements, S&P Global Market Intelligence data showed.

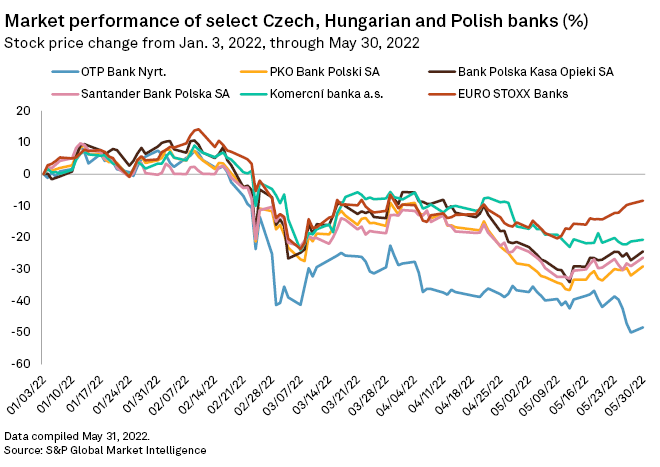

Economic, geopolitical and regulatory uncertainty, particularly in Hungary and Poland, could hit profit prospects for the banks in upcoming quarters. OTP Bank's stock prices dropped 48% year to date, the biggest percentage fall in the sample. Other lenders also underperformed the wider EURO STOXX Banks index, which itself fell by about 8%.

OTP Bank reported a first-quarter net loss of 33.4 billion forints, equivalent to approximately $100.6 million at the end of March, after risk costs jumped on the back of forward-looking provisions made for Russian and Ukrainian operations. OTP Bank's total credit exposure to Russia amounted to €3.25 billion at the end of 2021. Its Russian unit is expected to deliver positive results for the remainder of 2022, the bank said during a recent earnings call. But it warned that additional provisions could be needed depending on developments in Ukraine.

Meanwhile, Banco Santander SA's Polish unit, Santander Bank Polska SA, saw its first-quarter net profit grow by almost 396% quarter on quarter and 522% year on year to €207.7 million, the strongest improvement in the sample in both quarterly and annual terms. Net profits at Polish lenders Bank Polska Kasa Opieki SA, or Bank Pekao, and ING Bank Slaski SA increased year on year by 263% and 102%, respectively. Ceská sporitelna a. s. and Komercní banka a.s., the Czech units of Erste Group Bank AG and Société Générale SA, demonstrated year-on-year profit growth of 95% and 86%, respectively.

Compared to the fourth quarter of 2021, Komerční saw net profit drop by roughly 13%, behind only OTP Bank in terms of growth rate. Commerzbank AG's Polish unit mBank SA increased its net earnings to €110.9 from a fourth-quarter net loss of €353.3 million. Other lenders in the sample demonstrated double-digit net profit growth quarter on quarter, apart from KBC Group NV's Czech unit Ceskoslovenská obchodní banka a. s., or ČSOB, whose earnings improved by roughly 4%.

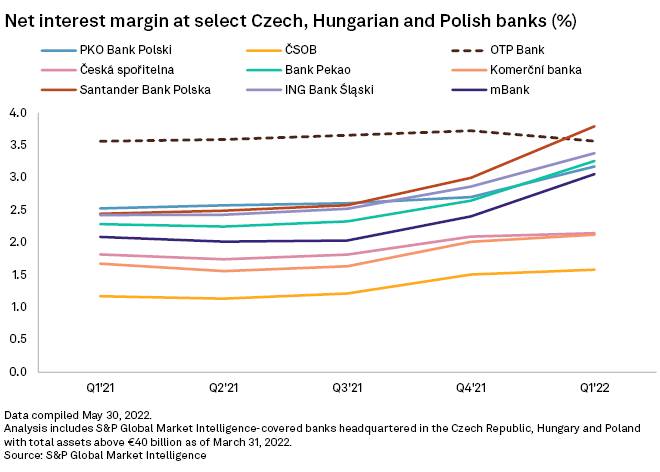

Most banks in the sample also improved their net interest margin, which refers to the difference between the interest income earned by lenders and the interest they pay to creditors, including deposit holders.

Polish lenders showed strong margin gains year on year and quarter on quarter, benefiting from the central bank increasing the key rate 510 basis points in the last eight months, while deposit interest rates remained low during the analyzed period.

Net interest margins, or NIM, increases in the largest Czech banks were more muted amid a lending cool-down and a strongly competitive environment, Tomáš Pfeiler, portfolio manager at Czech broker Cyrrus, told S&P Global Market Intelligence.

OTP Bank was the only bank that registered a quarterly drop and saw no improvements year on year in its net interest margin, although it remained significantly higher than most banks in the sample. The bank said its Russian unit suffered the most significant quarter-on-quarter margin erosion, and the NIM also declined at its core operations in Hungary, as well as Serbia, Slovenia and Croatia, although it is expected to stabilize in the coming quarters.

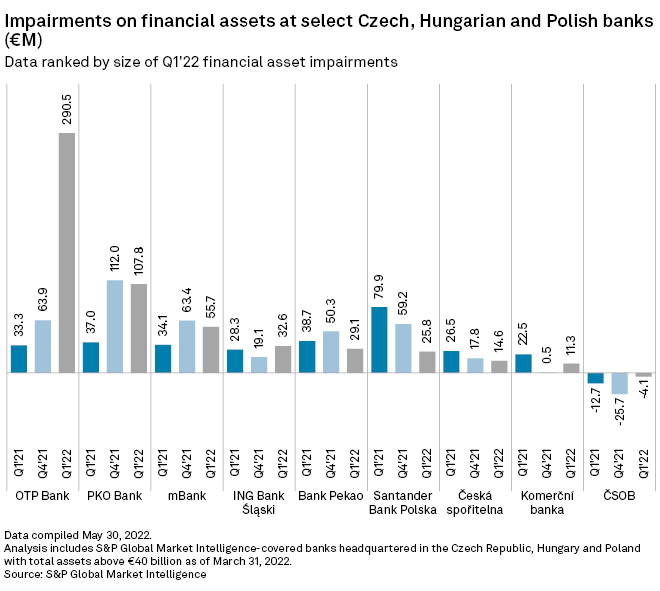

Impairments on financial assets at OTP Bank surged to €290.5 million from €63.9 million in the preceding quarter, and €33.1 million a year ago, due to provisions set aside for Ukrainian and Russian operations. Poland-based PKO Bank Polski SA, which has direct exposure to Ukrainian, set additional provisions against its exposure in Eastern Europe, but its total impairments on financial assets dropped quarter on quarter as it was able to release provisions in other areas.

Bank Pekao and Santander Bank Polska, as well as Czech lender Česká spořitelna, registered a reduction in impairments on financial assets quarter on quarter and year on year. Impairments at ING Groep NV unit ING Bank Śląski increased in quarterly and annual terms. Komerční also saw higher impairments quarter over quarter, while impairments at fellow Czech lender ČSOB remained negative.

Outlook

The 2022 financial performance of Poland-based banks could be heavily affected by government's planned support program for mortgage holders. The program's costs for banks could reach 8.9 billion zlotys this year, according to the government's recent estimations. Poland's bank association estimates that mortgage repayment deferrals, which are part of the planned program, alone could cost the banks 16 billion zlotys in 2022.

Polish banks are also facing higher contributions to the country's bank guarantee fund, as well as growing costs of customer deposits, mBank and Bank Pekao told S&P Global Market Intelligence.

OTP Bank and other Hungarian lenders are facing a profit hit from government's plan to impose a temporary levy on companies operating in the country. The new tax could erase roughly 40% of the banking sector's underlying profits, Raiffeisen Research senior analyst Jovan Sikimic told S&P Global Market Intelligence.

"We calculate the bank tax burden to jump by four to five times versus the current regime. That's why we expect for the next two years a significant decrease of the sector profitability," he said. OTP Bank told S&P Global Market Intelligence it could not comment on the planned Hungary levy until the regulation was announced.

Meanwhile, Czech banks will be challenged by lending cool-down, particularly in the retail mortgage segment, Pfeiler said.

"Another problem will be the impact of weaker [economic] growth on the quality of loan portfolios. The deteriorating macro environment will soon translate into increased provisioning, which will reduce profits," the analyst said.

Banks will also have to deal with higher operating costs caused by surging inflation, Patrik Rožumberský, senior economist at UniCredit's Czech branch, told S&P Global Market Intelligence. The cost concerns were also echoed by Poland's Pekao and mBank.