Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Jun, 2022

By Sydney Price and Sarah James

Though U.S. consumers and carriers have been slow to adopt eSIM technology, some providers, as well as the U.S. government, see it as a major opportunity for increased wireless competition.

Embedded subscriber identity module cards, also known as eSIM cards, are different from traditional, provider-locked SIM cards in that they are built into the phone's board and cannot be physically removed. Rather, eSIM cards are rewritable and allow users to switch carriers and plans without the help of a sales assistant at a wireless store. Customers can also keep their phone number and device, as well as hold multiple phone numbers on the same device, even when changing providers.

DISH Network Corp. recently touted the technology at its investor day, saying eSIMs would help the company's nascent wireless business take share from incumbents to reach 40 million subscribers by 2040, up from 8.2 million retail wireless subscribers at the end of the first quarter of 2022. But some analysts question whether DISH's wireless subscriber projections are realistic, noting that the company's expectations for eSIM usage may be too bullish.

"eSIM is here, and it will stay, but it's going to take some time to be a significant disrupter," said Lynette Luna, an analyst at Kagan, a media research group within S&P Global Market Intelligence.

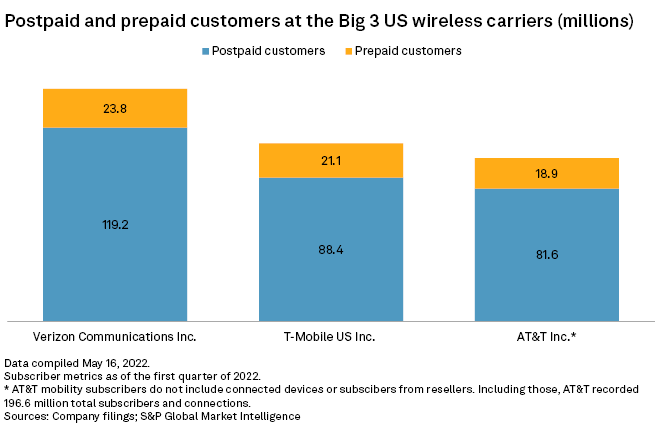

DISH and other smaller providers may be too optimistic about how much they will benefit from increased churn from their larger competitors, Luna said. The three largest U.S. wireless carriers — Verizon Communications Inc., T-Mobile US Inc. and AT&T Inc. — each count over 100 million postpaid and prepaid wireless customers.

All of the top device providers in the U.S. — including Apple Inc., Samsung Electronics Co. Ltd., Alphabet Inc. — offer eSIM compatible devices; However, not all wireless providers are required to support eSIM. AT&T, Verizon, and T-Mobile are among the wireless providers that do.

DISH Executive Vice President of Retail Wireless Stephen Stokols said 60% of shipped devices will be eSIM enabled by 2025.

"Every original equipment manufacturer wants eSIM because it frees up more space in the smartphone for more innovative form factors," Luna said. "Apple is clearly on board and has been doing eSIM for some time in its phones."

Apple's iPhone 12 models, iPhone 11 models, iPhone XS, iPhone XS Max and iPhone XR feature dual SIM technology with both a physical nano-SIM and an eSIM. Later models — including iPhone 13 Pro Max, iPhone 13 Pro, iPhone 13, and iPhone 13 mini — support dual SIM with either two active eSIMs or a nano-SIM and an eSIM.

"Samsung phones with eSIM are finally enabled in the U.S.," Luna said. "They were not for some time, and I suspect that is because the bigger carriers didn't want it enabled."

Apple and Samsung are the No. 1 and No. 2 vendors of smartphones worldwide by both shipments and revenue, according to Kagan data.

But just having a device with an eSIM does not guarantee a customer can seamlessly swap carriers. Incumbents can still lock the phone to their networks if people have financed the phone through them. "That is the majority of postpaid consumers in the U.S.," Luna said.

Additionally, the technology is still in its early days and is not always user-friendly, said Alex Besen, founder and CEO of the mobile data consulting firm The Besen Group LLC.

For some customers, questions may arise as they attempt to use eSIM to switch providers, and they will still need to go to a physical store. This not only defeats the purpose of the technology, but it also preserves the competitive advantage that incumbent carriers have in terms of their larger retail footprint.

"Unless agents at stores are willing to take time to explain eSIM set up to customers, it is going to be a very difficult process for most users," Besen said.

Luna agreed that transitioning providers via eSIM technology is not as painless as some supporters of the technology want customers to believe, and there may still be confusion about phone compatibility.

Proponents of eSIM technology may have an ally in the U.S. government, which could potentially help speed-up widespread adoption of the technology and issue further requirements for wireless companies to ensure network compatibility. The Justice Department has previously endorsed DISH's support for eSIM. As a condition of the T-Mobile/Sprint merger, which closed in 2019, the DOJ required both T-Mobile and DISH to support eSIM as a means of encouraging competition in the wireless market.

"Sadly in the United States, eSIM has not been widely adopted in mobile wireless like it is in Europe and others," the DOJ wrote in a statement. "And that's an area separate of this merger we have looked to. This will revolutionize the use eSIMs in hopefully all carriers, because once consumers have it, they'll benefit from it."

Survey data from 451 Research suggests smartphone users outside the U.S. are more likely to upgrade their devices due to the added benefit of dual or eSIM technologies. While only 6.2% of U.S. survey respondents chose eSIM as a compelling factor for an upgrade, 11.3% of Canadian respondents and 21.7% of respondents outside the U.S. and Canada viewed eSIM as something that might prompt an upgrade sooner than otherwise expected.

In the U.S., survey respondents showed much greater interest in other technologies, like longer battery life and next-generation 5G service.

451 Research is part of S&P Global Market Intelligence.