Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 May, 2022

By Yuzo Yamaguchi and Rehan Ahmad

Green bond sales in Japan are set to dip after several issuers pulled back on planned sales, citing uncertainties amid rising interest rates.

Tohoku Electric Power Co.Inc. put on hold a planned sale of ¥10 billion in 10-year green bonds that were originally scheduled for March to finance its renewable business under its diversification strategy. The Japanese energy conglomerate cited "market circumstances" as the reason. ENEOS Holdings Inc., an oil and natural gas producer, shelved a proposal in March to sell 12-year debt to raise ¥10 billion to refinance its renewable energy projects.

The two energy companies are among several other Japanese businesses, such as electronic-equipment maker Sanken Electric Co. Ltd. and Sekisui House Reit Inc., that have raised concerns about having to pay higher to raise funds from the green debt market as inflationary pressures and high energy prices drive up interest rates. They are likely to stay on the sidelines till borrowing costs stabilize, analysts said.

"The [rising] interest rates are the biggest issue" that would weigh down green bond sales, said Yoshihiro Fujii, executive director at the Research Institute for Environmental Finance. The environment for green bond issuance "is becoming worse," Fujii said.

Russia's invasion of Ukraine and global sanctions on Moscow have exacerbated issuers' problems, pushing energy prices higher and heightening inflationary pressures. This is fueling expectations that the Bank of Japan may take steps to normalize monetary policy after major global central banks, including the U.S. Federal Reserve, made aggressive tightening moves recently.

Grinding lower

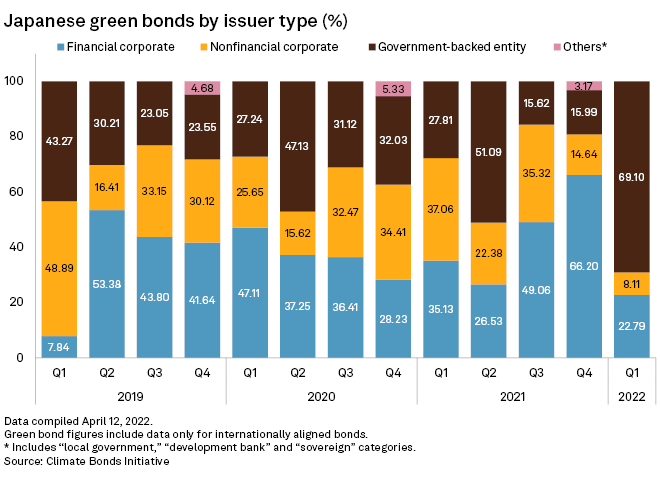

Japanese issuers sold a total of $6.64 billion of green debt in the first quarter of 2022 compared with $3.50 billion in the same period last year, according to data from the Climate Bonds Initiative, a nonprofit U.K. green bond tracker. Still, issuance was down 13.4% from the $7.67 billion in the fourth quarter of last year, the highest quarterly amount in at least three years.

As issuers get into a wait-and-watch mode awaiting greater certainty, the total green bonds issuance in Japan in 2022 may stay flat or even fall short of last year's figure of $16.42 billion, said Mana Nakazora, chief ESG strategist at BNP Paribas in Japan. "The outlook for the interest rates is deeply uncertain," Nakazora said.

Globally, too, green bond sales have been tepid so far this year. In the first quarter, global green debt sold on international standards totaled $83.80 billion, the lowest in seven quarters. Europe, which leads the world green debt market with a $45.80 billion issuance in the January-to-March period, also marked the lowest quarterly sales in the same period.

The overall green bond sales in Japan during the first quarter comprised $2.45 billion of internationally aligned bonds and $4.20 billion sold on domestic standards, based on CBI classification. For a green bond to be internationally aligned, an issuer has to set a numerical decarbonization target for a green project for which the funds would be used, based on CBI taxonomy.