Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 May, 2022

By Zeeshan Murtaza and Dylan Thomas

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

There is just one word to describe private equity's increasingly competitive fundraising arena: crowded.

Top executives from The Carlyle Group Inc., Blackstone Inc. and TPG Inc. cited the crowded fundraising environment during their earnings calls to explain why some private equity funds actively seeking capital will inevitably take longer to hit their targets. According to Preqin, the 6,282 private equity funds in market as of January represented a 49% increase over the total for the same month a year ago.

Blackstone, Carlyle and TPG have kept their aims high for fundraising. All three are raising private equity funds that rank among the 15 largest currently in market, according to Preqin. Blackstone's Blackstone Capital Partners IX, targeting $30 billion, tops the list.

Executives at the big firms remained generally upbeat about their own prospects for fundraising. As Ares Management Corp. CEO Michael Arougheti explained on his firm's first-quarter earnings call, private equity investors are increasingly focused on re-upping their commitments with familiar managers rather than starting new relationships, "an overarching secular trend" that benefits the largest players.

Read more about the outlook for private equity fundraising.

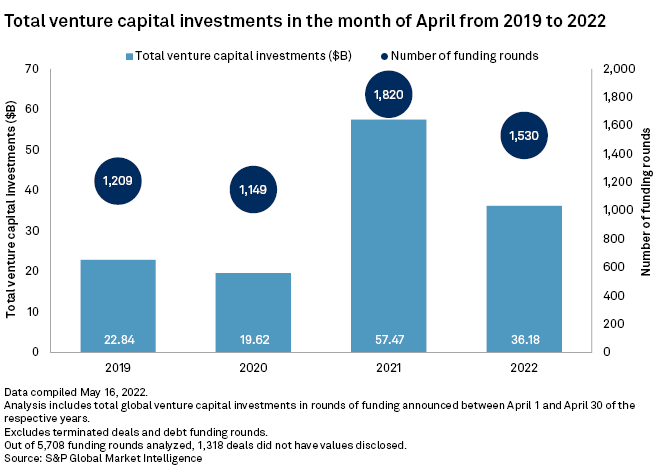

CHART OF THE WEEK: A slowdown in venture capital investment

⮞ Global venture capital investment activity slowed in April, with the aggregate value of all funding rounds declining 15.8% from March and down 37% from April 2021.

⮞ The total number of funding rounds also declined 15.9% year over year to 1,530 in April from 1,820 during the same month a year ago.

⮞ The biggest deal of the month was a $2 billion mature funding round for Epic Games Inc., giving the Fortnite video game developer a $31.5 billion post-money equity valuation.

FUNDRAISING AND DEALS

* Private equity firms Clayton Dubilier & Rice LLC and TPG Global LLC will take animal health company Covetrus Inc. private in a deal worth about $4 billion. Pursuant to the deal, the private equity firms will pay $21 per Covetrus share in cash.

* KKR & Co. Inc. closed KKR Asia Credit Opportunities Fund SCSP with $1.1 billion in commitments. The fund will target privately originated credit investments in the Asian market.

* Blackstone Credit acquired a 49% stake in an entity that owns an LNG export facility near Savannah, Ga. The Blackstone Inc. unit purchased the stake from EIG Global Energy Partners. Separately, a Blackstone fund acquired rights to Justin Timberlake's song catalog in a transaction reportedly valued at just above $100 million, according to Dow Jones Newswires.

* A Thoma Bravo LP affiliate will make a cash offer to acquire Mercell Holding ASA, a Nordic online procurement services provider, at 6.30 Norwegian kroner per share.

ELSEWHERE IN THE INDUSTRY

* Energy Capital Partners LLC will purchase Borrego Solar Systems Inc.'s development business, including its project pipeline of over 8.4 GW of solar and 6.4 GW/25 GWh of energy storage.

* Quad-C Management Inc. closed its latest fund, Quad-C Partners X LP, with commitments totaling about $1.7 billion.

* Tyree & D'Angelo Partners Management LP pulled in $350 million for Tyree & D'angelo Partners Fund III LP.

* Kinnevik AB sold a 7.2% stake in Swedish telco Tele2 AB (publ) to institutional investors through a placement of 50 million class B shares.

FOCUS ON: FOOD

* Brentwood Associates Inc., along with Portfolio Advisors LLC and Pine Mountain Ventures LLC., purchased a majority interest in turnkey sushi solutions franchisor Hissho Sushi Inc.

* Fonds de solidarité FTQ and Caisse de dépôt et placement du Québec are in talks with Bonduelle SCA to buy 65% of canned foods company Bonduelle Americas Long Life.

* Centre Partners Management LLC acquired seafood quick-service restaurant brand Captain D's LLC and its affiliates in a deal with seller Sentinel Capital Partners LLC.