Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 May, 2022

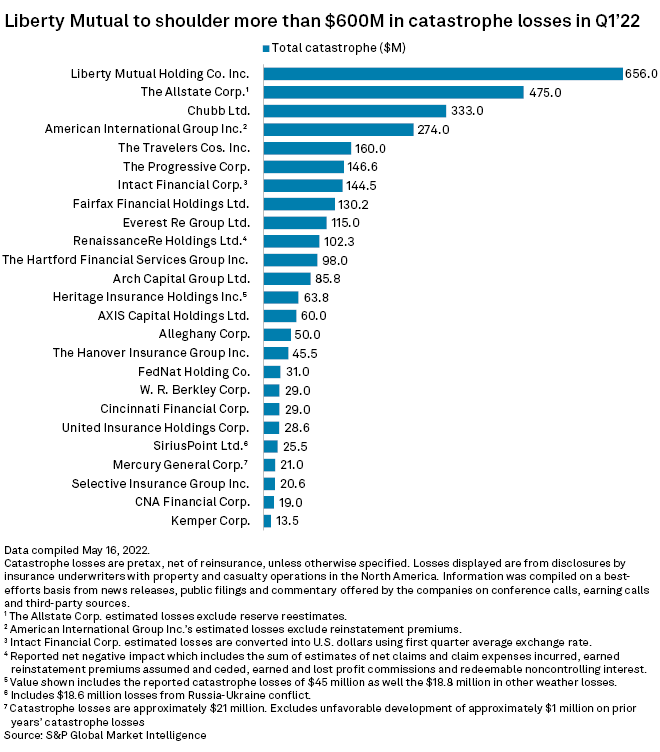

North American property and casualty and multiline insurers, as well as reinsurers, saw catastrophe losses decline year over year in the first quarter, according to an analysis by S&P Global Market Intelligence.

Liberty Mutual sees biggest catastrophe bill

Liberty Mutual Holding Co. Inc. reported the largest amount of losses during the quarter at $656 million, though that was down from $1 billion in the first quarter of 2021.

The Allstate Corp. followed with a bill of $475 million, comprised of $91 million from tornadoes, $365 million from wind and hail and $19 million for winter-related and other events. The insurer reported $833 million of catastrophe losses, excluding reserve reestimates, in the prior-year period.

Chubb Ltd. experienced the third-largest amount of catastrophe losses at $333 million, comprised of $138 million for storms in Australia, $65 million for wildfires in Colorado and $130 million for other global weather-related events. Those losses were less than half of what it experienced a year earlier, when it recorded $700 million in catastrophe losses in the first quarter of 2021.

American International Group Inc.'s first-quarter catastrophe losses stood at $274 million, including $106 million for flooding, rainstorms and other events and $38 million for windstorms and hailstorms. AIG logged $422 million of total catastrophe losses, excluding reinstatement premiums, a year ago.

AIG, Arch Capital take losses from Russia-Ukraine war

AIG reported $85 million of catastrophe losses in the first quarter related to the war between Russia and Ukraine.

CEO Peter Zaffino during an earnings call said AIG does not expect material effects from the conflict but also does not anticipate a rapid resolution for war-related, as it is still unclear whether actual losses have occurred or what their extent might be.

Arch Capital Group Ltd. did not provide an exact number for losses related to the war but did disclose that two-thirds of its $85.8 million total catastrophe losses in the first quarter were attributable to the conflict.