Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Apr, 2022

By Hailey Ross and Tom Jacobs

First-quarter earnings results dominated the headlines this week, with stocks up marginally until a brutal final session left most names in the red.

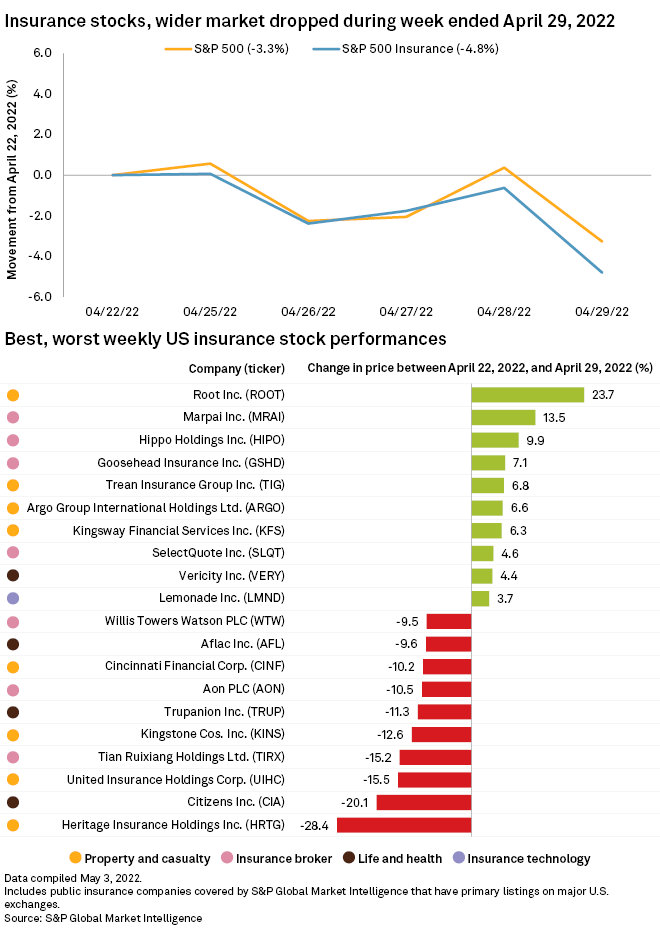

The insurance industry underperformed the broader markets and both took significant tumbles. The S&P 500 Insurance index dropped 4.81% to 556.87 for the week ending April 29, while the S&P 500 slid 3.27% to 4,131.93.

Chubb Ltd. released first-quarter earnings that reflected a significant spike in core operating income to $1.64 billion, or $3.82 per share, a 43.6% increase from $1.14 billion, or $2.52 per share, a year earlier. However, net income dropped 14.2% year over year.

CEO Evan Greenberg during an earnings call said the insurer's actual incurred losses to date from the war between Russia and Ukraine will not be a meaningful event for the company. Greenberg also said he expects elevated levels of risk in the market will dampen M&A activity across the insurance industry.

Chubb's shares ended the week up 0.17%.

In the brokerage space, Willis Towers Watson PLC executives said the company expects lost profits related to its exit from Russia to generate "modest margin headwinds" for 2022 and beyond.

Willis Towers Watson's revenues slipped 3% to $2.16 billion in the first quarter of 2022 from $2.23 billion a year earlier, but organic revenue growth was 2%. The broking group's stock tumbled 9.39% on the week.

Insurtech Root Inc. this week reported a narrower year-over-year net loss in the first quarter. CEO Alex Timm revealed that Root plans to launch a brokerage product later in the second quarter and is in talks with a number of carriers as potential participants.

Wells Fargo analyst Elyse Greenspan said Root's profitability figures were better than expected but noted that the company was still hurt by higher inflation levels, which will continue to pressure margins and push topline growth down.

Root's shares rose 23.71% for the week.

In the reinsurance sector, Everest Re Group Ltd. reported a spike in net operating income of $405.8 million, or $10.31 per share, compared to $260.2 million, or $6.49 per share, in the first quarter of 2021. COO Jim Williamson during a conference call said that while there has been much speculation about the prospect for potential aviation losses related to the war in Ukraine, that line is a "relatively small part" of the company's book.

"There is significant uncertainty around the extent of potential loss in terms of actual units of aircraft exposed, and that number has been changing," Williamson said. "I think there are real questions related to which coverage will apply to what amount."

Williamson added that the reinsurer has taken "significant actions" in its own aviation book in the last couple of years to help it handle "shock losses."

Everest Re saw its shares fall 4.01% for the week.

Two major managed care insurers also released their financial results this week.

Centene Corp. reported first-quarter earnings that reflected 24% growth in revenue year over year from the prior period and raised its full-year outlook to expect adjusted earnings between $5.40 and $5.55 a share, up from its previous per-share guidance of $5.30 and $5.50.

Centene's stock dropped 5.08%.

During Humana Inc.'s earnings call, CFO Susan Diamond said the insurer managed to avoid COVID-related headwinds for the first quarter, even though the company also experienced its highest level of hospital admissions related to the virus in January. Admissions rapidly dropped throughout the quarter and were at a nadir by March.

The health insurer booked higher first-quarter adjusted earnings year over year and also raised its full-year 2022 adjusted EPS guidance by 50 cents.

Humana's shares were basically flat on the week.