Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

4 Mar, 2022

By Bill Holland and Anna Duquiatan

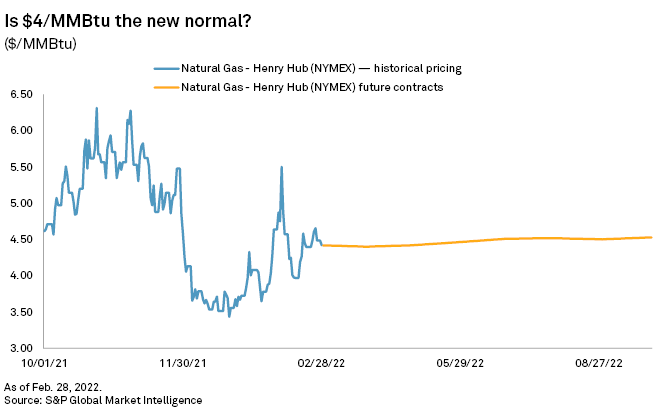

Institutional investors made few entries into pure-play shale gas stocks in the fourth quarter of 2021, despite continued market gains as natural gas prices hit multiyear highs above $6/MMBtu.

The raw numbers showed big new stakes in Permian and Pennsylvania driller Coterra Energy Inc. and Appalachian and Haynesville producer Southwestern Energy Co. But the bulk of these "new" stakes are the result of mergers and acquisitions: Shares exchanged in Cimarex Energy Co.'s $9 billion merger with Cabot Oil & Gas Corp. to create Coterra, and Southwestern shares being distributed to early investors in Indigo Natural Resources LLC, which Southwestern bought for $1.9 billion in September 2021.

Changes in holdings

The information on changes to institutional holdings came from SEC 13F filing data.

Of note in the fourth quarter was investment in the sector by two Ivy League endowment funds. Princeton University Endowment Arm, which manages the New Jersey school's endowment fund, was the largest institutional buyer of shares in EQT Corp., the largest U.S. gas producer by volume, picking up a new 2% stake worth $183.2 million by the end of the quarter.

Yale vs. Princeton

In contrast, Yale University Investments sold three-quarters of its existing stake in EQT and bought a less than 1% stake in rival Antero Resources Corp. in the fourth quarter.

The Princeton fund's investment style is blended, according to S&P Capital IQ data, while the Yale fund focuses on value.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro. The S&P Capital IQ Pro and S&P Capital IQ platforms are owned by S&P Global Market Intelligence.