Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Mar, 2022

Profit at Itaú Unibanco Holding SA, Banco do Brasil SA and Banco Bradesco SA this year is expected to surpass 2021 levels, which largely recovered to pre-pandemic levels, according to S&P Global Market Intelligence.

Itaú, Latin America's largest bank in terms of assets, is expected to report net income above 30 billion reais for 2022 versus nearly 27 billion reais last year. Bradesco's net income is estimated to exceed 28 billion reais versus 2021's 22 billion reais, while Banco do Brasil, the country's largest listed government-owned lender, should report almost 23 billion reais versus last year's 19.7 billion reais.

Banks saw improved profitability amid government stimulus spending to counter the impact of lockdown measures on the economy. Real GDP growth sank in 2020 shrinking 4.18%, and made a comeback last year, up 4.8%. The consensus for this year is for the country to eke out growth of 0.3%, with inflation slowing slight from 8.3% last year to 7.6% in 2022, according to data compiled by S&P Global Market Intelligence.

In the fourth quarter of 2021, Itaú and Bradesco saw year-on-year decreases in their net profit. Itaú booked 6.23 billion reais, down from 7.59 billion reais a year earlier. Bradesco saw its net income drop to 3.17 billion reais from 5.46 billion reais. Only Banco do Brasil's net income increased, up to 5.35 billion reais from 3.20 billion reais in the fourth quarter of 2021.

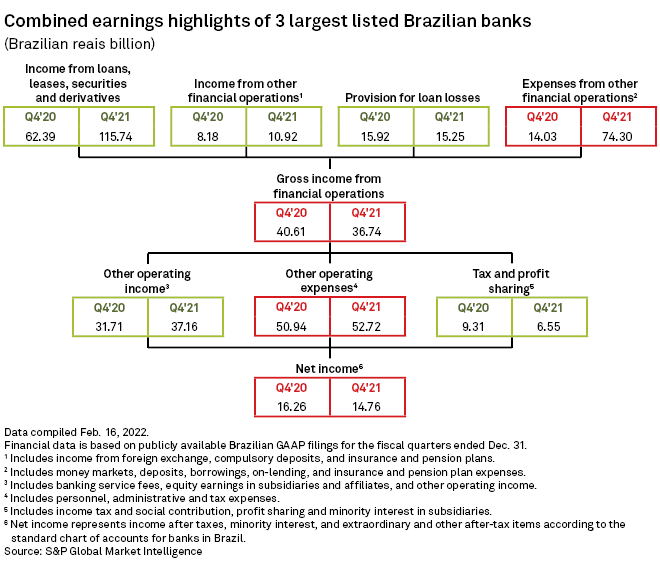

Gross income from financial operations at the three banks decreased about 9% to 36.7 billion reais from 40.6 billion reais a year ago.

Combined expenses from financial operations in the fourth quarter shot up more than fivefold to 74 billion reais from 14 billion reais, led by an increase in money markets and deposits expenses, which rose to nearly 61 billion reais from about 18 billion reais a year earlier.

Income from loans, leases, securities and derivatives jumped 85% to more than 115 billion reais, led by a fourfold increase in income from securities and derivatives at 41.5 billion reais.

Provisions ticked lower to 15 billion reais during the quarter from nearly 16 billion reais a year earlier. Banco do Brasil's provisions decreased 23% year-over-year to 5.15 billion reais, while Itaú and Bradesco's provisions rose to 5.74 billion reais from 4.94 billion reais and to 4.36 billion reais from 4.27 billion reais, respectively.

Bradesco's nonperforming loan ratio was the highest among the three banks at 4.82%. Itaú reported an NPL ratio of 3.93% for the quarter, while Banco do Brasil's NPL ratio was the lowest at 2.94%.

As of March 2, US$1 was equivalent to 5.18 Brazilian reais.