Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Feb, 2022

By Joseph Williams and Darakhshan Nazir

U.S. information technology deal volumes and values reached record highs in 2021, and 2022 is starting off almost as strong.

The first month of the new year clocked 278 sector transaction announcements, down 0.4% year over year. Despite the year-over-year decline, the deal pace through January was nowhere near slow. The 2021 January period marked 35.9% growth over the prior year, which itself was a healthy transaction market before COVID-19 was reported on U.S. shores.

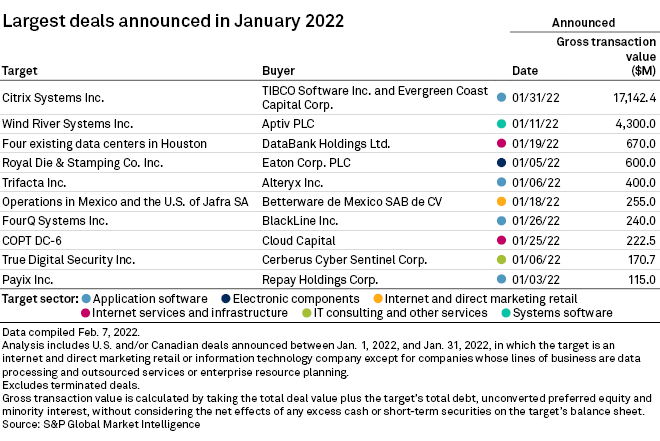

January's top transaction announcement came the last day of the month from a partnership of private equity firms. Vista Equity Partners and Evergreen Capital Corp. intend to take enterprise software company Citrix Systems Inc. private for $17.14 billion and roll the business into Vista's TIBCO Software Inc. in what 451 Research calls the largest privatization of a software vendor ever.

The private equity firms and Citrix have been circling each other for some time. Evergreen's parent company, Elliott Investment Management LP, has owned a stake in the software company and had a seat on the board since 2015, according to 451. Vista acquired TIBCO in 2014, and it began growing the business through acquisition.

Citrix met with Vista in January 2021 to acquired Wrangler Topco LLC for $2.25 billion, plunking down a whopping 16.1x trailing 12-months revenue by enterprise value, according to 451.

Vista is getting back its Wrangler business, which operates work management platform Wrike, at a solid return when bundled with Citrix. Even though the gross value of the transaction is high, it amounts to just 5.2x trailing revenue for the entire Citrix business.

The largest private equity acquisition in the sector in 2021 was Thoma Bravo LP's $11.38 billion bid for Proofpoint Inc., amounting to 9.1x trailing revenue.

The second-largest deal of the month saw a much higher valuation but represented a private equity exit. TPG Capital LP will sell its internet of things business Wind River Systems Inc. to vehicle component developer Aptiv PLC for $4.30 billion, or 10.8x trailing 12-month revenue.

Aptiv was hit hard during the January market correction with its stock dropping precipitously Jan. 6. The Jan. 11 deal announcement did not turn things around, and the company shed over 17% of its market capital through the first month of the year. It rebounded some in February but was still trading at 2.4x enterprise value to trailing revenue as of market close Feb. 8.