Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Feb, 2022

By Cathal McElroy and Marissa Ramos

A successful bid by Crédit Agricole Italia for Carige would have given it a large presence in Genoa, a port city in northwest Italy and capital of the Liguria region.

Source: Pier Marco Tacca/Getty Images Entertainment via Getty Images

Crédit Agricole SA's hunt for M&A opportunities in northern Italy is expected to continue despite its failed bid to buy Banca Carige S.p.A. - Cassa di Risparmio di Genova e Imperia.

In early January, the French banking giant's Italian arm, Crédit Agricole Italia SpA, reportedly offered the symbolic sum of €1 for troubled Carige. Italy's BPER Banca SpA stepped in with an improved offer and has since entered exclusive negotiations with Carige's owners.

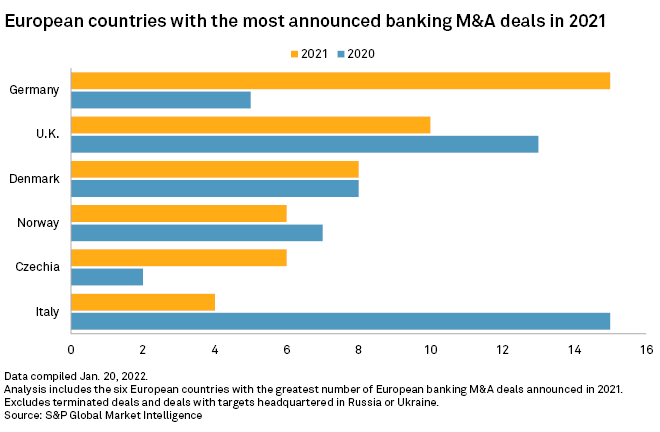

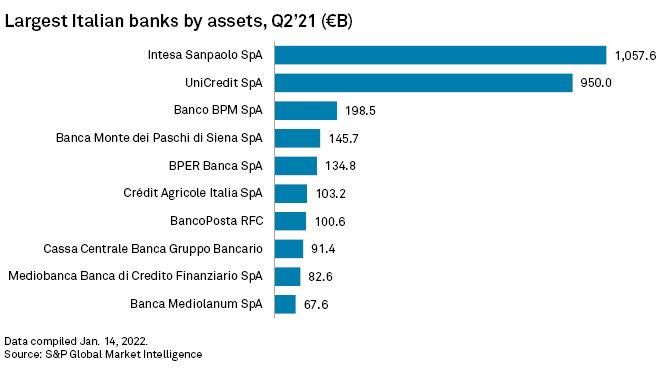

Crédit Agricole is already Italy's sixth-largest lender and said it is aiming to develop a universal bank in northern Italy. The lender's rejected bid for Carige follows its near-€900 million takeover of northern Italian bank Credito Valtellinese SpA in April 2021. Crédit Agricole's increased activity in the market comes amid a wave of M&A in the Italian banking sector over the last two years, which has been encouraged by a push for consolidation to strengthen lenders' balance sheets.

Another look

"It makes sense for [Crédit Agricole Italia] to look at other possible transactions in northern Italy because banks get good synergies from domestic transactions," Jon Peace, head of European banks research at Credit Suisse said in an interview. "To the extent that something comes along in the future, and there's a good overlap and it's of moderate size, I would expect them to look again."

Crédit Agricole declined to comment on Italian press reports of its bid for Carige. "There is no change in our strategy," a spokesperson told S&P Global Market Intelligence in an emailed statement. "In Italy, our strategy consists of creating a universal bank in the north of the country. … Organic growth remains our priority. We can seize opportunities if they allow us to develop our business lines and to generate cost and revenue synergies."

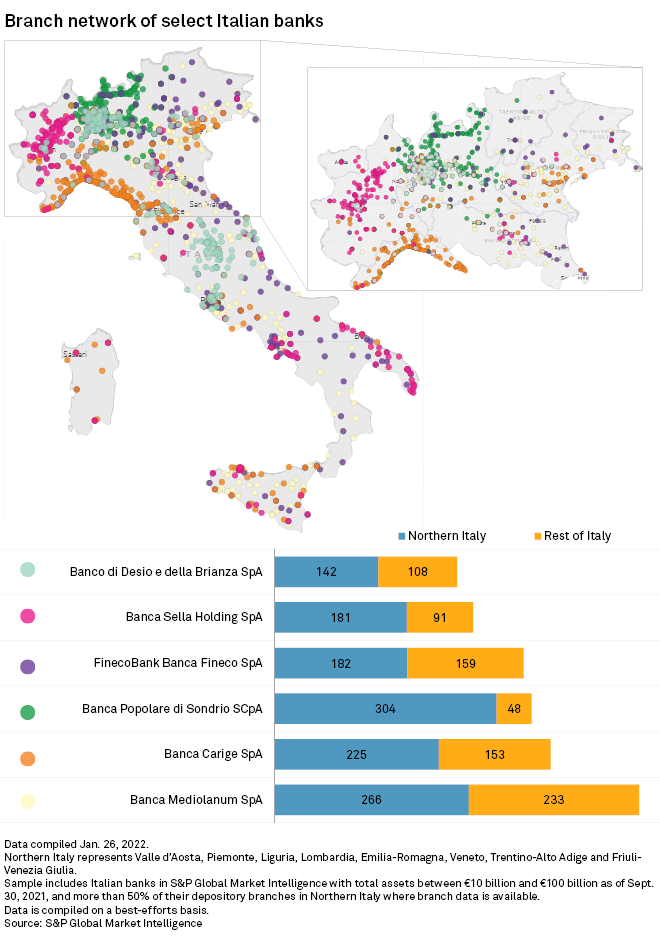

A successful bid for Carige would have grown Crédit Agricole's branch network in northern Italy by around 35.7% to 1,436, Market Intelligence data shows. Carige has 378 branches in Italy, of which 225, or 59.5%, are located in the eight regions considered to comprise northern Italy: Valle d'Aosta, Piedmont, Liguria, Lombardy, Emilia-Romagna, Veneto, Trentino-Alto Adige and Fruili Venezia Giulia. Of the 10 "midsize" Italian banks with total assets of between €10 billion and €100 billion, Banca Popolare di Sondrio S.C.p.A. has the highest proportion of its branches located in Northern Italy at 86.4%, Market Intelligence data shows. Banca Sella Holding SpA has the second-highest percentage of branches in the region at 66.5%.

"Sella Group maintains its independence and does not consider these kinds of operations," Sella Group said in an emailed statement.

Banca Popolare di Sondrio did not respond to a request for comment.

Italy's government has encouraged greater consolidation in the market by offering tax incentives to buyers. The scheme was extended to run until mid-2022, having previously been due to finish at the end of 2021. The decision to extend the scheme allowed BPER to improve its offer for Carige, according to a Jan. 11 report by Scope Ratings.

"The consolidation process in Italy still has some ground to run," with deals among midsized, regionally focused popolari, or mutual banks, still a prospect, the report said.

"The opportunities from synergies and strengthening market share are present in the market," said Azzurra Guelfi, a bank equity analyst at Citigroup Global Markets. "We expect more midsize banks to be looking at some form of consolidation. We don't expect anything to happen in the short term, but it's something that remains an area of focus for the investor."

'Second domestic market'

Crédit Agricole entered the Italian retail banking market in 2006 with its purchase of local lenders Cariparma, Friuladria and more than 200 Banca Intesa branches. Further acquisitions followed in 2011 and 2017, with the group rebranding as Crédit Agricole Italia in 2016. Crédit Agricole describes Italy as its "second domestic market."

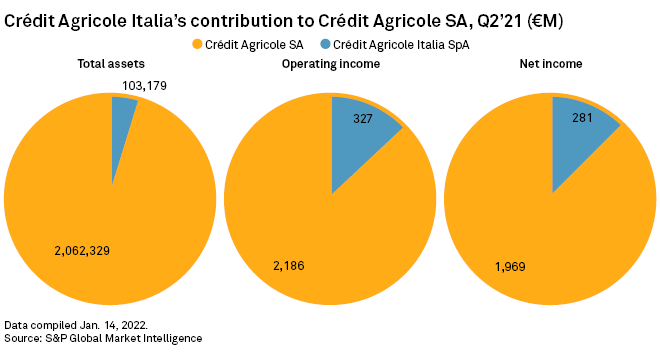

The purchase of Credito Valtellinese, or Creval, in 2021 moved the bank from the eighth-largest to the sixth-largest lender by total assets in Italy. The deal also helped boost Crédit Agricole Italia's total assets by 34.96% to €103.18 billion by the end of the second quarter of 2021, the most recent period for which data is available, from 2020-end, according to S&P Global Market Intelligence. By comparison, Crédit Agricole Italia's total assets had grown 35.51% since the end of 2011.

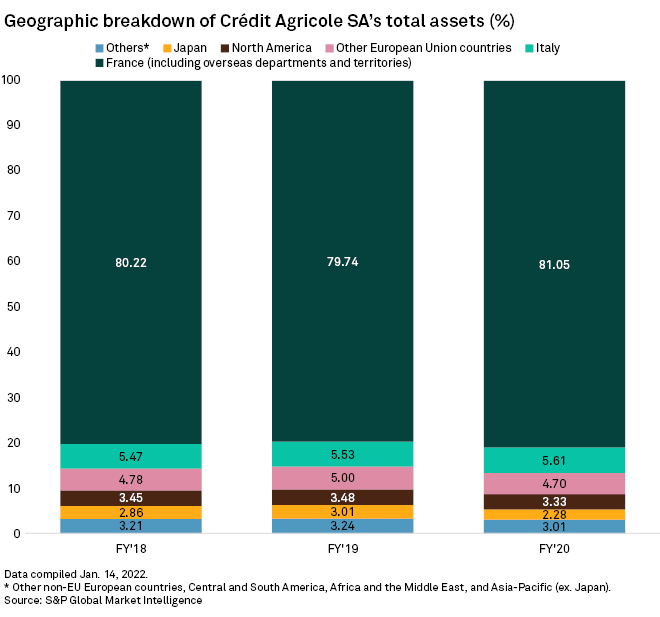

Following the Creval deal, Crédit Agricole Italia comprised 5.00% of parent company Crédit Agricole SA's total assets as of the end of the second quarter of 2021. Italy is the bank's second-largest market by assets, with France accounting for around 80% of the total.

Crédit Agricole's reported move for Carige is "opportunistic" rather than part of its core strategy, said Arnaud Journois, vice president at global credit rating agency DBRS Morningstar. Carige's branches are predominantly located in Liguria, a region in the northwest of Italy that borders France and in which Crédit Agricole has a limited presence, Journois added.

While Crédit Agricole's appetite for growth in Italy is welcome, the lender might be better advised to focus on the evolution of its retail banking operation in its home market of France, said Sam Theodore, senior consultant at Scope Insights.

"If I were Crédit Agricole, I would be focused mostly on digital transformation in France," Theodore said. "It seems to me the group is slightly behind some peers in this process."

'Execution is important'

Crédit Agricole should also be careful about its pace of growth in Italy, said Nicolas Hardy, executive director of financial institutions at Scope Ratings. Until now, the bank's expansion in the country has been "well executed" and its track record of integration is good, Hardy said.

"Execution is an important consideration," added Hardy. "A too-aggressive expansion strategy would raise questions on ability to deliver and risk appetite."

Segment