Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Feb, 2022

By Hailey Ross

Argo Group International Holdings Ltd.'s stock tanked after the insurer announced an expected reserve charge of between $130 million and $140 million that will negatively impact its fourth-quarter 2021 results.

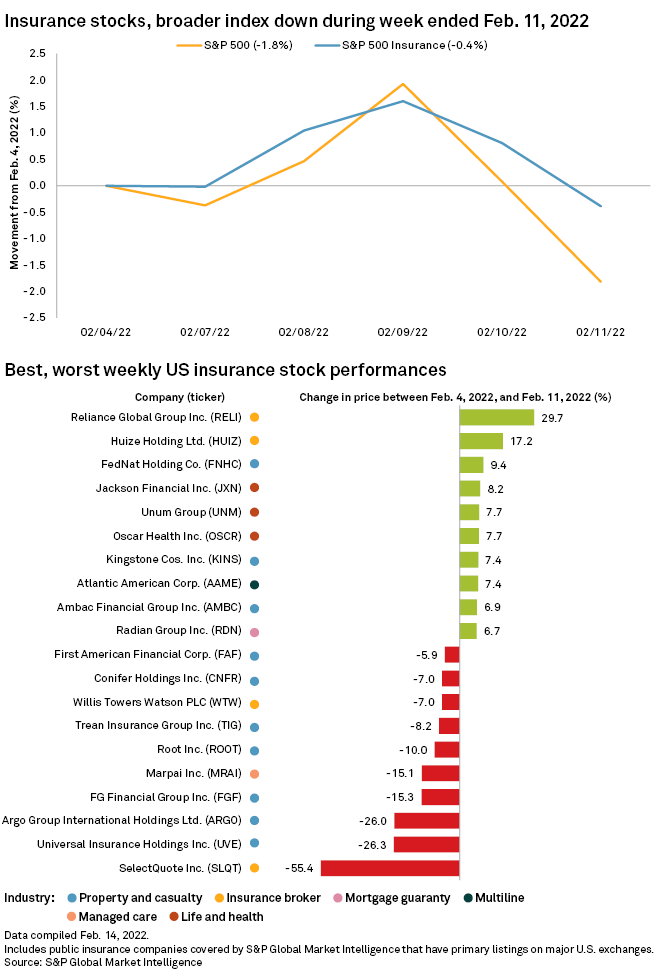

Equity markets suffered modest losses for the week ending Feb. 11, with the S&P 500 declining 1.82% to 4,418.64. The S&P 500 Insurance Index edged down 0.39% to 563.49.

Argo's reserve charge is primarily related to claims within the company's U.S. construction defect business, something Boenning & Scattergood analyst Bob Farnam has not heard much about in the past few years.

"I wasn't really surprised with the market reaction, especially with the size of the reserve charge," Farnam said.

Farnam said investors are worried about social and economic inflation; longer-tail businesses are where much of those concerns come into play.

Argo's stock plunged 26.04% on the week.

It was also a busy week of earnings for the insurance industry across sectors.

In the property and casualty space, Assurant Inc. released results that reflected a jump in year-over-year net operating income, sending its share price to the top of the pack for the week. Executives during an earnings call said inflation has yet to make a significant impact on Assurant's business and expressed satisfaction with the terms negotiated in the reinsurance renewals that took place in January.

Piper Sandler analyst Tom Shimp called it a "strong quarter" for Assurant, with its mobile trade-in business continuing to "fire on all cylinders." Shimp in a research note said investors had previously been concerned that Assurant's investment spending in its global lifestyle business would push earnings expectations down.

"We believe those concerns have been assuaged, explaining the positive stock reaction," he said.

Assurant's shares climbed 5.79% for the week.

Several life insurers this week again reported elevated COVID-19-related mortality in the fourth quarter of 2021.

Sun Life Financial Inc. said mortality was much higher due to the impacts of COVID-19 among the U.S. working-age population. Its earnings for the period included $66 million of COVID-19 related impacts. Executives said they expect the pandemic-related headwinds will persist into the first quarter of 2022.

Principal Financial Group Inc. executives during an earnings call said group and individual life insurance claims continued to be elevated as both the delta and omicron variants had a "greater impact on the working-age population."

Sun Life's stock ended the week in the red with a loss of 4.24%. Principal Financial added 1.70%.

Voya Financial Inc.'s shares finished basically flat as the company released earnings that reflected higher year-over-year net income available to common shareholders for the fourth quarter of 2021.

Brighthouse Financial Inc. reported higher fourth-quarter net income year over year, and its stock moved near record highs this week. Even as it sits at that lofty level, Brighthouse management said they consider the stock undervalued and that they continue to lean toward making repurchases.

The insurer's shares ticked down 0.87% on the week.