Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Dec, 2022

Heightened regulatory scrutiny of bank M&A and subsequent prolonged closing timelines will persist in 2023 as regulators take a harder look at fair lending and capital and liquidity.

Since a July 2021 executive order from President Joe Biden calling for increased M&A scrutiny, banking regulators have zeroed in on areas such as the Community Reinvestment Act, or CRA, and fair lending when reviewing mergers, according to deal advisers. Going into 2023, intensifying industry headwinds, such as funding pressures, will bring even more scrutiny to bank merger reviews, they said. At the same time, banking regulators are expected to unveil proposed rulemaking regarding bank merger review soon.

That continued focus on CRA and increased focus on liquidity during a time in which regulators are seeking to make the merger review process more rigorous through rulemaking will lead to greater M&A headwinds next year, deal advisers said.

"All of that's going to continue to make the regulators really pay attention to applications," said Kevin Strachan, partner at Fenimore Kay Harrison who advises public and private financial institutions on M&A and more. "We've seen a general skepticism over the last, I'd say, year or two as to M&A applications, and we see no signs of that trend stopping anytime soon."

Capital, liquidity growing in importance

As funding pressures begin to rear their head, regulators are increasingly worried that some banks will have to sell securities and recognize what are currently unrealized losses. As such, capital and liquidity are expected to be a focus of banks' upcoming exams, and regulators will take an even closer look at those metrics when reviewing merger applications, said Frank Sorrentino, a managing director in Stephens' financial institutions group.

"I think both the liquidity and capital are becoming very big issues just in normal examinations. That's probably even more heightened when doing M&A," Sorrentino said. "We're going to continue to have liquidity pressures. We're going to continue to have capital pressures. That's all going to really start to show in M&A."

When preparing their merger applications for regulatory review, banks are spending "a lot more time and attention" on capital planning and pro forma capital ratios, Sorrentino said.

CRA continues to be a focus

Another area that has gained importance in the merger review process, and will continue to be important in 2023, is CRA ratings, advisers said.

"The big holdups have been largely around the whole fair lending, CRA" area, Sorrentino said.

As those ratings have taken more weight in the M&A approval process of late, they have caused hiccups in the process for some banks, according to Strachan. Many times, banks receive passing CRA ratings in exams, but later do not for deal applications, partly because deals involve different examiners and partly because they involve another institution, he said.

"You may not be in as good shape when you have an application in front of them, and that could either be because of just heightened scrutiny on your own practices, or it could be that the target isn't as up to speed as you are," Strachan added.

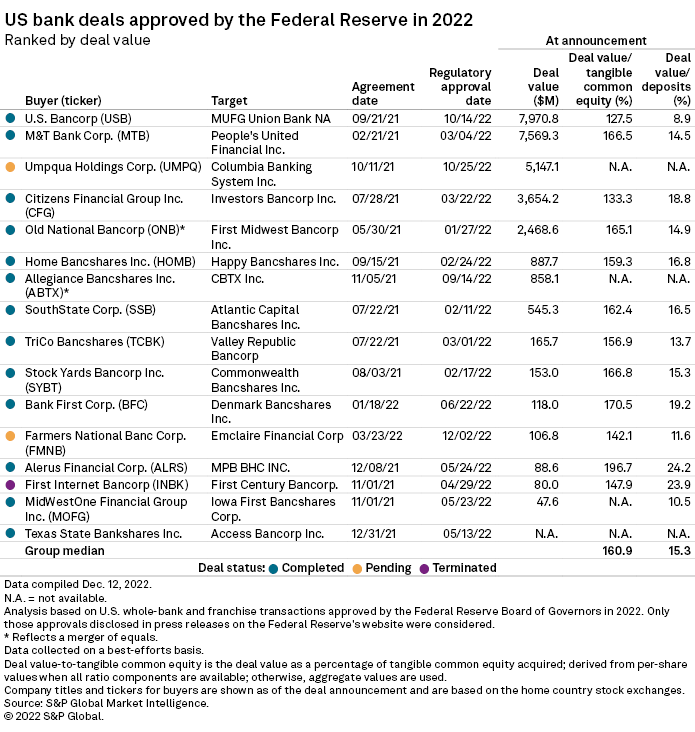

One recent community bank deal — the merger of equals between Allegiance Bancshares and CBTX Inc., which created Stellar Bancorp Inc. — faced criticism regarding the companies' respective CRA ratings. After pending for a little over 10 months, the Federal Reserve eventually approved the deal, but it came with a rare condition from the Federal Deposit Insurance Corp. in which the combined company must increase the number of mortgage applications and approvals among African Americans.

Craig Mueller, a managing director and co-head of the financial institutions group at Oak Ridge Financial, has seen CRA ratings grow more relevant to regulators when reviewing community bank deals. Such snags could push deal approval out six to 12 months from announcement, Mueller said.

Banking regulators are expected to finalize CRA rules in 2023. That rulemaking will have direct applications to the Bank Merger Act and Bank Holding Company Act compliance, according to Chip MacDonald, managing director of MacDonald & Partners LLP.

Merger review revamp ahead

In addition to the impact of CRA rulemaking, the industry can expect even more changes to the Bank Merger Act soon, as regulators embark on an expected overhaul of current merger review guidelines. That impending rulemaking could impact which future deals get approval and how fast.

The timing of that revamp and what it could entail remains unknown, but the Federal Reserve's top bank regulator, Michael Barr, said in September that he would address M&A policy "relatively soon."

Sorrentino believes regulators could seek to codify actions they are already taking. "There's always other things that the regulators ask for maybe unofficially. So maybe this is just going to put a little more clarity on that," he said.

Large bank M&A to remain muted

While some community bank deals have faced prolonged closing timelines, industry experts believe regulators' scrutiny has stayed largely isolated to deals involving or resulting in institutions with more than $100 billion in assets.

Large U.S. bank M&A slowed drastically this year, with the lowest yearly total of megadeals — deals with values above $500 million at announcement — in over a decade as regulators amped up scrutiny of the largest bank deals.

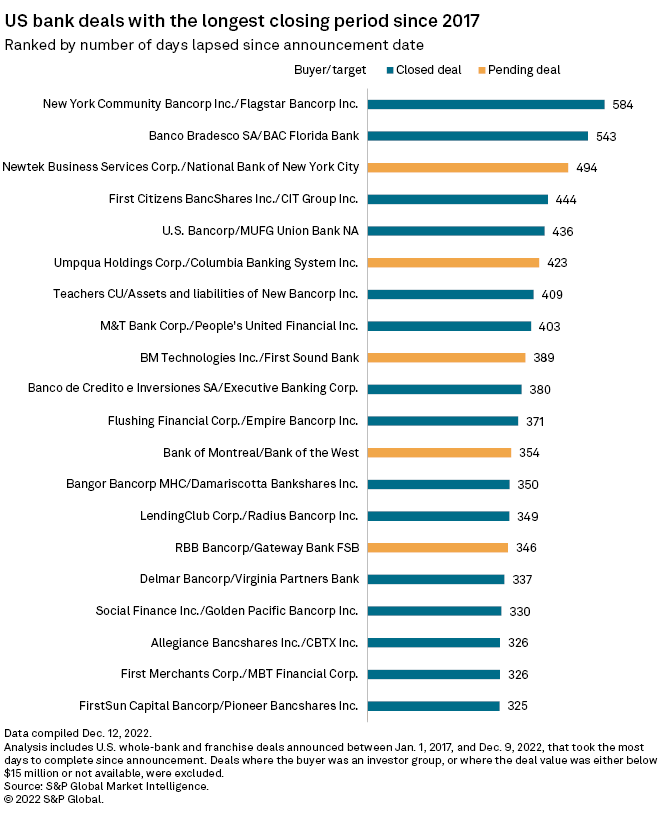

A handful of large deals secured regulatory approval in 2022 after pending for more than a year, including New York Community Bancorp Inc.'s purchase of Flagstar Bancorp Inc., which took 584 days to close, making it the longest-pending U.S. bank deal announced since 2017. New York Community Bancorp said Nov. 7 the Fed had approved its deal

Some banks are heading into 2023 with their mergers still pending for more than a year, including Newtek Business Services Corp.'s acquisition of National Bank of New York City, which has been pending for about 500 days; Umpqua Holdings Corp.'s acquisition of Columbia Banking System Inc., which has been pending for more than 400 days; and BM Technologies Inc.'s purchase of First Sound Bank, pending for almost 400 days.

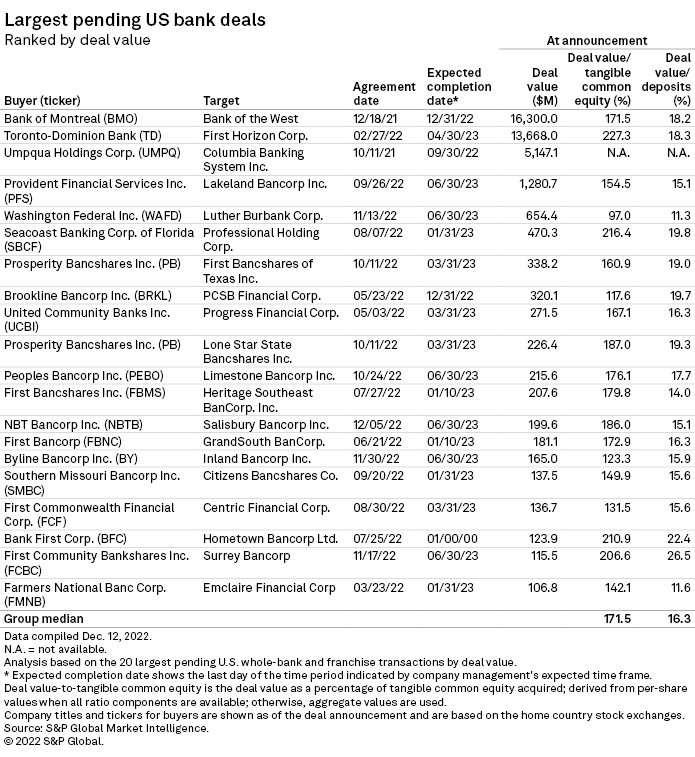

The largest pending bank deals heading into the new year are Bank of Montreal's $16.30 billion acquisition of Bank of the West, followed by Toronto-Dominion Bank's nearly $13.67 billion acquisition of First Horizon Corp.

Prolonged closing timelines as a result of increased scrutiny will continue into next year, and may get more intense as a result of the impending overhaul of current merger review guidelines, deal advisers said. As such, large bank M&A will remain muted in 2023.

"Big bank M&A, I think that's off the table," said Matt Resch, a managing director and co-head of M&A and capital markets with PNC Financial Institutions Advisory Group. "We just couldn't in good conscience recommend a large bank to pull the trigger on a deal knowing that it can sit out there for pushing two years."